Fidelity’s Bitcoin ETF joins the $1 billion club in alongside BlackRock

Constancy’s plan Bitcoin (BTC) alternate-traded fund (ETF) rapid secured its web page as the 2nd ETF provider to surpass $1 billion in property underneath management (AUM) within a week of its start.

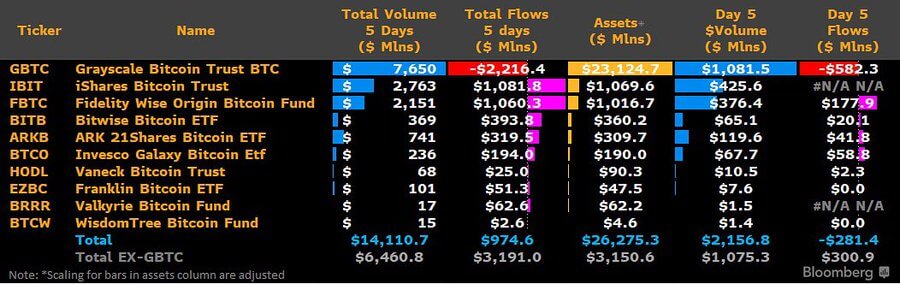

Data from Bloomberg reveals that Constancy’s Clever Initiating Bitcoin Have faith done this milestone on its fifth day of buying and selling, recording flows that reached $1.01 billion in AUM. BlackRock’s iShares Bitcoin Have faith (IBIT) had reached the same milestone a day earlier, and its AUM at the present stands at $1.06 billion.

This fulfillment is grand given the brief interval since the ETF’s start, highlighting a rapidly ascent among the no longer too prolonged ago accredited issuers. The expedited pronounce displays the grand investor hobby in these products no topic the ETF’s outdated challenges in securing approval from the U.S. Securities and Replace Rate (SEC).

Market observers emphasize the importance of reaching $1 billion in AUM within a brief timeframe, noting that this accomplishment is necessary for any ETF. Furthermore, the inflows into these ETFs within appropriate one week signify a sturdy search records from from traders for publicity to Bitcoin by regulated investment autos.

Critically, a CryptoSlate Insight famed that the grand inflows into these ETFs hang elevated BTC to the rep web site of the 2nd-greatest commodity within the U.S. by AUM, surpassing silver. This shift reveals cryptocurrency products’ rising acceptance and integration into conventional investment portfolios.

GBTC outflows unhealthy $2B

Meanwhile, the total outflow from Grayscale’s GBTC has now reached a genuinely wide $2 billion.

This valuable outflow continues a consistent construction since the fund’s start, with a necessary $582 million outflow recorded on its fifth day within the market.

GBTC’s discount has elevated to roughly 96 foundation aspects alongside the outflow. Analysts counsel that this discount adjustment would possibly maybe well moreover acknowledge to the market’s recent promoting stress.

Trading task remains stable.

No topic their brief one-week existence, Bloomberg ETF analyst Eric Balchunas highlighted the outstanding pronounce in buying and selling actions for the “Unusual child Nine” ETFs.

Critically, the buying and selling quantity for these ETFs surged by 34% between the fourth and fifth buying and selling days, defying the same old post-start decline observed in hyped-up launches.

“On the whole with a hyped-up start, you watch quantity step by step decrease day after day post-start; [it’s] uncommon to be conscious it reverse help up. All nevertheless one observed a soar too, nevertheless GBTC [remained] flat, so it wasn’t a volatility thing,” Balchunas added.

Source credit : cryptoslate.com