Fidelity inflows smash Grayscale outflows as $255 million Bitcoin enters US market

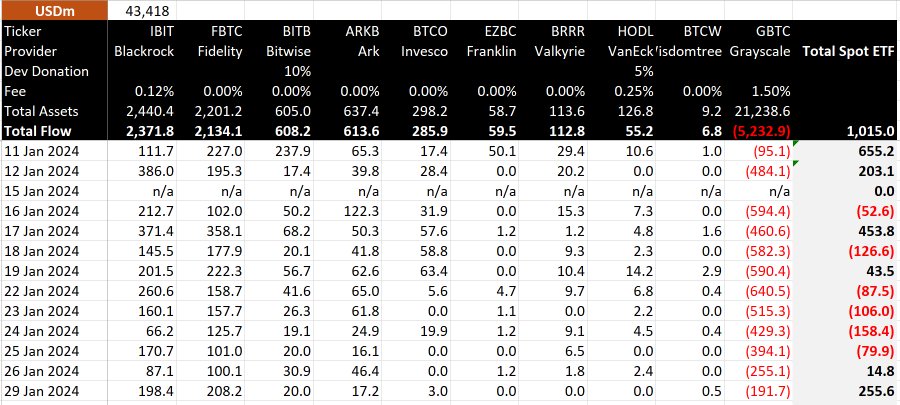

Grayscale’s Bitcoin Belief (GBTC) is experiencing a slowdown in outflows, with staunch under $200 million withdrawn from the fund on Jan. 29.

Files from BitMEX Research indicates an total outflow of around $192 million within the course of this reporting duration. Seriously, this marks the bottom outflows for the explanation that fund’s inception, surpassing only the preliminary day of shopping and selling when withdrawals amounted to $95 million.

In the interim, a peep at the novel child nine shows that the inflows into the funds preserve offsetting that of Grayscale.

The Fidelity Wise Starting up build Bitcoin Fund (FBTC) emerged as a standout, concluding the twelfth shopping and selling day with the ultimate inflow at $208 million. In comparability, varied funds, alongside with BlackRock’s IBIT, experienced a $198 million inflow. ETFs equivalent to BITB, ARKB, and BTCO recorded inflows of $20 million, $17 million, and $3 million, respectively, while others reported zero inflows.

The robust shopping and selling activities contributed a fetch inflow of $255.6 million within the course of the twelfth shopping and selling day.

GBTC maintains ‘liquidity crown’

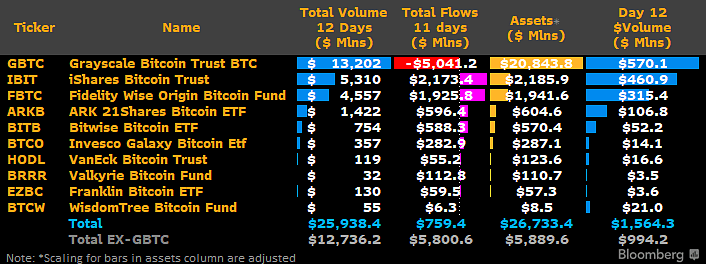

Alternatively, Grayscale’s GBTC stays the tip cryptocurrency ETF in liquidity, as Bloomberg Intelligence analyst James Seyffart observed.

Without reference to most well-liked outflows, GBTC’s shopping and selling quantity reached $570 million on Jan. 29, surpassing BlackRock’s IBIT by $110 million and reaffirming its market dominance.

Following its most well-liked conversion, Grayscale’s ETF has experienced colossal outflows totaling extra than $5 billion. Analysts attribute the outflows to advantage-taking maneuvers by merchants exposed to its old fetch asset label prick label.

Furthermore, the fund’s rather high 1.5% management price is cited as a aspect that has led some merchants to shift in the direction of competing ETF services equivalent to BlackRock and Fidelity, who payment a lower price of 0.25%.

As of Jan. 29, the outflows derive resulted in Grayscale’s ETF’s Property Beneath Management (AUM) dropping to approximately $21.431 billion (a connected to 496,573 BTC) from its year-to-date top of simply about $29 billion (623,390 BTC), as reported by the fund’s official web field. This info indicates that fund users derive divested over 100,000 items of the leading cryptocurrency for the explanation that approval of the ETF conversion.

Source credit : cryptoslate.com