Exploring BlackRock’s BUIDL fund: Bridging traditional finance and DeFi

Exploring BlackRock’s BUIDL fund: Bridging archaic finance and DeFi

Exploring BlackRock’s BUIDL fund: Bridging archaic finance and DeFi Exploring BlackRock’s BUIDL fund: Bridging archaic finance and DeFi

BlackRock, the worldâs largest asset supervisor, launched its Ethereum-essentially based entirely mostly tokenized fund in March of this year, marking a historic 2d for the commerce. This pass highlights the rising acceptance and integration of blockchain know-how within archaic finance by bringing exact-world belongings on-chain, enabling enhanced transparency and rapid settlement.

Camouflage art work/illustration by capacity of CryptoSlate. Image involves combined instruct material that might perhaps well presumably consist of AI-generated instruct material.

The next is a customer article from Vincent Maliepaard, Advertising and marketing and marketing Director at IntoTheBlock

What is BlackRock’s BUIDL Fund?

The BUIDL fund, formally is named the BlackRock USD Institutional Digital Liquidity Fund, represents BlackRock‘s venture into tokenized belongings on a public blockchain. Utilizing the Ethereum network, BUIDL invests in cash, short-interval of time debt securities, and U.S. Treasury bonds.

The initiate of BlackRock’s BUIDL fund excited many within the commerce for that reason of it showcases how archaic financial instruments can combine with the revolutionary capabilities of DeFi.

On the opposite hand, BlackRock is no longer the major to stumble on this know-how. A range of valuable companies salvage also made major strides in this location. Shall we embrace, Abrdn, a first-rate UK asset supervisor, launched a tokenized model of its £15 billion Lux Sterling money market fund on the Hedera Hashgraph DLT in June 2023 (Ledger Insights)â.

In an identical procedure, Hamilton Lane, one more funding supervisor, opened a tokenized feeder fund on the Polygon blockchain in early 2023. This fund lets in particular person investors to entry non-public equity with drastically reduced minimal funding requirements in comparison with archaic variations (markets.businessinsider.com)â.

A immense number of examples from the blockchain commerce salvage contributed to a rising enviornment of interest ecosystem within the greater blockchain commerce known as âValid-world Sources,â or RWAs.

Valid-World Sources in Crypto

Valid-world Sources (RWA) salvage emerged as one in every of basically the most major areas of focus within the blockchain commerce this year. Projects in this house contrivance to channel yield and belongings from the archaic financial system into the digital house. This integration leverages the inherent interoperability of DeFi, enabling original types of asset utilization and yield generation.

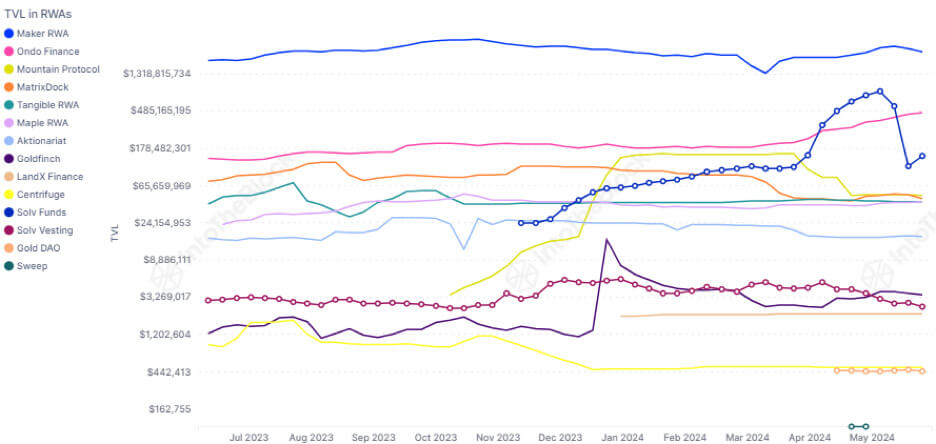

In 2023, major strides salvage been made in this sector, marked by successfully incorporating U.S. Treasury bond yields into DeFi through protocols be pleased Mountain Protocol. As a end result, the total payment locked (TVL) in RWA protocols soared to over $2.9 billion. Top protocols within the RWA ecosystem now depend over 194,000 RWA protocol token holders between them, reflecting its rapid adoption and rising impact.

Building and Direct of the BUIDL Fund

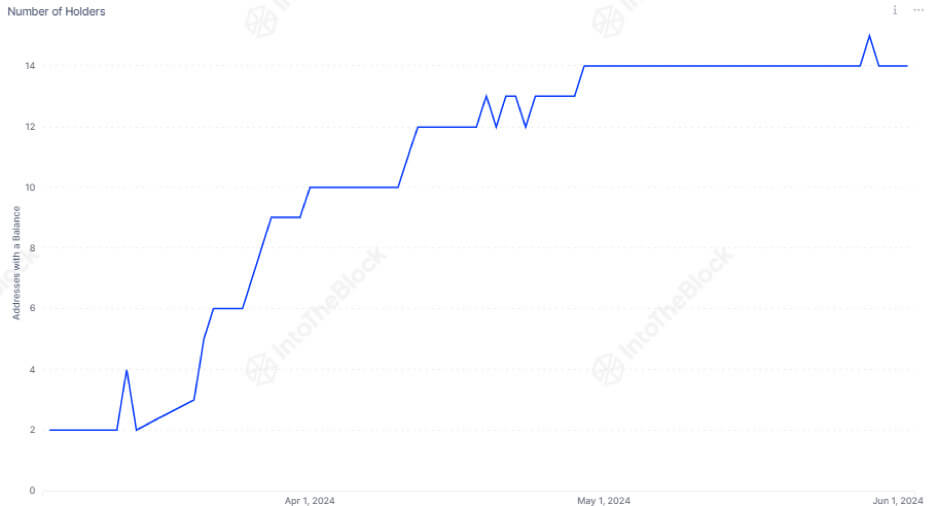

The pattern of BlackRock’s BUIDL fund is designed to cater to institutional investors, requiring a minimal funding of $5 million per entity. The fund has 14 holders and has showcased dumb nevertheless valuable order since its initiate.

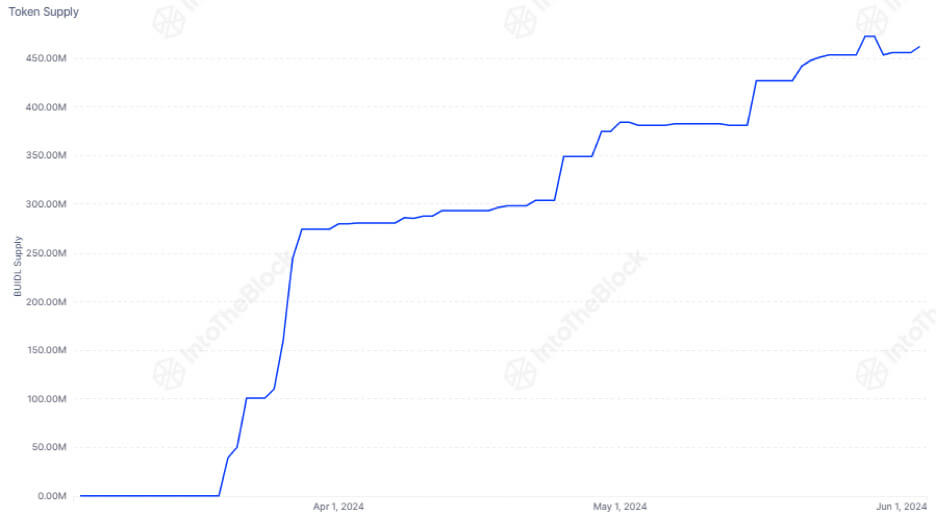

Whereas the number of holders might perhaps well presumably develop step by step, each and every original investor drastically boosts the fund’s total holdings. Fresh information shows there are 462,542,901 circulating tokens, each and every representing roughly $1, bringing the total fund payment to $462 million.

The Scheme forward for BlackRock’s BUIDL Fund and RWA in DeFi

Because the DeFi sector continues attracting attention from archaic financial gamers, integrating RWAs be pleased these within the BUIDL fund is anticipated to scamper. This vogue is pushed by the inherent advantages of tokenization, alongside side increased transparency, liquidity, and entry to a broader fluctuate of investors. This evolution extends previous the blockchain commerce and items the stage for a extra interconnected and efficient world financial machine.

Talked about in this text

Source credit : cryptoslate.com