Even crypto friendly UK banks freeze accounts in fear of crypto transactions

Even crypto friendly UK banks freeze accounts in difficulty of crypto transactions

Even crypto friendly UK banks freeze accounts in difficulty of crypto transactions Even crypto friendly UK banks freeze accounts in difficulty of crypto transactions

Person ride of crypto apps is declining attributable to poorly implemented and written guidelines.

Duvet artwork/illustration by the narrate of CryptoSlate. Checklist comprises blended hiss that will encompass AI-generated hiss.

There turned into an enlarge in monetary institution accounts belonging to crypto professionals being frozen or restricted across the UK, US, and EU over the past few months. They are saying you in most cases don’t care about one thing till it occurs to you; smartly, this week, it did. To my right shock, it came from the one put I least anticipated it.

Revolut has prolonged been regarded as because the most crypto-friendly monetary institution within the UK, providing in-app crypto purchases and, in 2023, in a roundabout plan adding the capacity to send and get crypto, albeit with particular obstacles. On the other hand, present events have called into ask the monetary institution’s commitment to providing a seamless ride for its cryptocurrency-the utilization of clients.

Despite the UK now not being section of the European Union, below which MiCA EU guidelines apply, the newly implemented Skedaddle Rule requires same disclosures. This implies that users are if truth be told required to existing and establish the house owners of any unhosted wallets that are the recipients of withdrawals from Revolut.

On the other hand, UK crypto companies are allowed to apply a risk-based capacity to resolve after they must peaceable procure files on unhosted wallets. They simply will need to have the functionality to establish the build their clients are transacting with unhosted wallets and assess the riskiness of those transactions.

How the UK’s most crypto-friendly monetary institution iced over my story of 0.23ETH

Two days ago, I bought a modest 0.23 ETH (£550) via the Revolut app and attempted to switch the funds to my personal Ethereum pockets, which is linked to a valuable ENS domain. To my shock, Revolut blocked the transaction and took payments from the story. Furthermore, my whole checking story, along with a joint story with my accomplice, turned into frozen.

After quite loads of hours of frustration and confusion, the story turned into in a roundabout plan unfrozen, and payments had been refunded after a extra quiz. On the other hand, the convey pockets deal with remains blocked, stopping me from sending funds to that story. This ride has left me questioning the coolest nature of Revolut’s supposed crypto-friendliness. Given the decisions within the UK, Revolut remains the very most suitable choice for those unsatisfied with broken-down banks, nonetheless it is a low bar. I deem that incidents such as these have less to get with Revolut being ‘anti-crypto’ and extra to get with a difficulty of regulatory retribution.

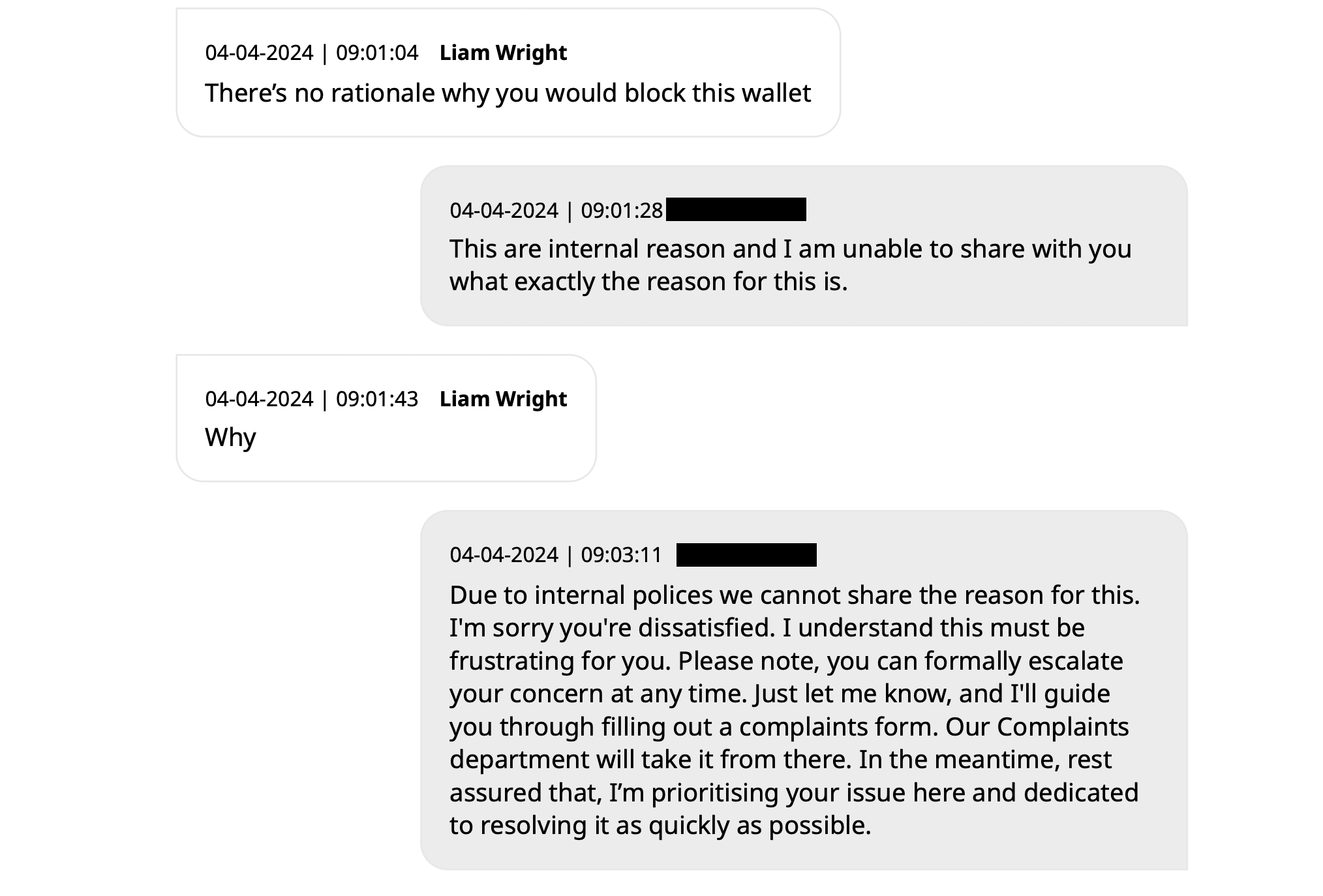

Still, the chat transcript between Revolut’s make stronger team and me reveals an absence of transparency relating to the explanations unhurried the story freeze and the pockets deal with block. The make stronger representatives may possibly now not provide a determined explanation, citing inside insurance policies that finish them from sharing the convey reasons for these actions.

This incident raises concerns relating to the autonomy and retain watch over that Revolut users have over their very possess funds, in particular relating to digital resources transactions. Blockading a personal pockets deal with without a passable explanation undermines belief within the monetary institution’s capacity to facilitate soft crypto transactions.

As the UK navigates the put up-Brexit monetary panorama, banks like Revolut must strike a steadiness between compliance with guidelines and providing a client-friendly ride for his or her clients. The strict application of criminal solutions and the dearth of transparency in addressing story and pockets disorders risk alienating crypto users who rely on these companies. That is extraordinary provided that the firm is having a investigate cross-check to originate an actual crypto alternate providing.

Debanking crypto users within the USA

Within the USA, even crypto users who were prolonged-time clients of broken-down banks face story closures attributable to their involvement with digital resources. John Paller, co-founding father of ETH Denver, unprejudiced these days shared his ride on Twitter, revealing that Wells Fargo had debanked him after 26 years of patronage and millions paid in payments. Paller’s checking, savings, credit card, personal line, non-profit, and commerce accounts had been all shut down without explanation, despite him now not the utilization of his personal accounts for crypto purchases in present times.

Caitlin Prolonged, Founder and CEO of Custodia Financial institution, spoke back to Paller’s tweet, noting a major enlarge in inquiries from crypto companies urgently searching out out to replace monetary institution accounts closed by their banks. She referred to this building as one other wave of “Operation Choke Point 2.0,” suggesting a corpulent-on witch hunt in opposition to crypto-connected companies.

Bob Summerwill, Director of the Ethereum Traditional Cooperative, echoed the sentiment, emphasizing the need for banks like Custodia. He shared his possess ride with PayPal, which closed the Ethereum Traditional Cooperative’s story without providing explicit reasons, handiest declaring that the decision turned into everlasting and may possibly now not be overturned.

These incidents highlight a growing subject within the crypto community: even those who've established relationships with broken-down banks and have a compliance historical past are at risk of losing entry to banking companies. The inability of transparency and the abrupt nature of these story closures elevate questions relating to the underlying motivations unhurried these actions and the aptitude affect on the enlargement and adoption of cryptocurrencies within the USA.

Certain friction if truth be told ideal plot a terrible client ride

Anecdotally, I have also heard from now not decrease than 5 completely different folks who work in crypto and continually switch extensive sums of FIAT currency via broken-down banks which have had accounts frozen. I'm now not advocating for a Wild West; current sense law is all I quiz.

The UK’s capacity to law also comprises what it considers ‘determined friction.’ The view that refers to a build of residing of regulatory measures designed to introduce particular boundaries or assessments that slack down the technique of investing in digital resources. These measures are supposed to counteract the social and emotional pressures that will lead folks to make quick or in dejected health-urged funding choices. The Financial Conduct Authority (FCA) has launched these ‘determined frictions’ as section of its monetary promotions regulations, aiming to improve client protection within the crypto market.

Specific examples of “determined friction” encompass customized risk warnings and a 24-hour cooling-off duration for first-time investors with a firm. These measures are designed to make particular that participants are adequately urged relating to the risks connected to crypto investments and have passable time to think again their funding choices without the affect of on the spot emotional or social pressures.

The fact is a collection of questions designed to alarm off unique investors, adopted by an unsightly banner warning across the tip of every crypto app that reputedly never goes away even after that you just may have passed all necessities.

I want to know when the govtmight be implementing a check on fractional reserve banking for all broken-down finance clients? Now we need to know relating to the nuances of govt law on crypto, such as who the FCA oversees and whether or now not a whitepaper is required. Dispute we had been to quiz ten folks on the boulevard what occurs in case you deposit funds into their checking accounts. I wonder how many would pass the check?

How many know US and UK banks’ reserve necessities are 0%? Outdated limits of 5 – 10% had been dropped in 2020, and now it is at a monetary institution’s possess discretion how grand of its clients’ funds are if truth be told held in money. Therefore, it is fully lawful for a monetary institution to take a £1,000 deposit and loan the general amount out to one other salvage collectively.

Of course, broken-down finance is regulated, and money is ‘guaranteed’ by govt insurance protection, so we don’t must difficulty. Let’s ideal now not investigate cross-check assist to 2008 when we had to rely on such tools, lets? It took decrease than 10% of clients to withdraw funds from Northern Rock for it to collapse.

Banks don’t have all of you money; smartly-hasten crypto exchanges and self-custody wallets get, nonetheless guidelines counsel we has to be bothered of crypto?

I hang it’s the banks that are bothered.

I asked Revolut’s make stronger and X teams if the PR division want to touch upon my difficulty earlier than this op-ed, nonetheless the ask turned into repeatedly disregarded.Â

Talked about on this text

Source credit : cryptoslate.com