Ethereum inflation soars amid Dencun changes—less than 100k ETH away from pre-Merge levels

Ethereum inflation soars amid Dencun changesânow not up to 100k ETH faraway from pre-Merge phases

Ethereum inflation soars amid Dencun changesânow not up to 100k ETH faraway from pre-Merge phases Ethereum inflation soars amid Dencun changesânow not up to 100k ETH faraway from pre-Merge phases

Dencun enhance and staking growth reshape Ethereum's supply dynamics, driving inflationary trend.

Quilt art/illustration via CryptoSlate. Image contains blended impart material that might well moreover simply consist of AI-generated impart material.

Ethereum is undergoing its most prolonged inflationary length, with over 350,000 ETH (price around $1.1 billion) added to its supply since the March Dencun enhance, in step with Ultrasound.money records. Ethereum’s present inflation price is 0.35%.

The elevate has introduced the total supply to 120.4 million ETH, leaving staunch below 95,000 ETH to match the phases considered at the Ethereum Merge in Sept. 2022.

ETH’s almost two years of supply reduction had been worn out in honest seven months since EIP-4844, commonly identified as Dencun or Proto-Danksharding.

How Dencun altered Ethereum’s supply dynamics

The Dencun change introduced important adjustments that diminished Ethereum’s low fee burn price.

By allocating explicit block home for layer-2 networks to job bundled transactions, identified as blobs, rivals for mainnet block home used to be diminished. Moreover, the proto-danksharding mechanism made records availability more ambiance pleasant, inflicting low expenses to fall sharply.

These events maintain severely impacted the blockchain community transaction expenses, leading to Ethereum issuing more ETH than it burns in most blocks.

For context, Ethereum burned Forty five,022 ETH while issuing 78,676 ETH all the map in which by the final 30 days. This resulted in a catch supply elevate of over 30,000 ETH, underlining the inflationary affect of the diminished low fee ambiance.

Staking affect

The elevate in Ethereum’s inflationary tension is also linked to the rising ETH staking ratio. Coinbase analyst David Han illustrious that while the Dencun enhance has enormously impacted Ethereum’s ecosystem, the inflation price adjustments seem linked to broader components, in conjunction with the rising ETH staking ratio, which is accelerating all token issuance.

Ethereum’s pass to Proof of Stake (PoS) has bolstered community security and boosted participation, nonetheless it absolutely has also resulted in more ETH being issued. Validators who lock up their ETH to trusty the community map rewards in newly minted tokens.

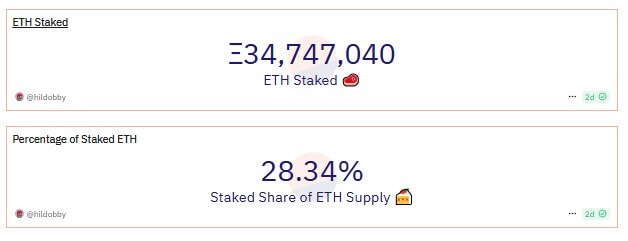

In response to Dune Analytics records, roughly 34.7 million ETHâabout 28% of the total supplyâis currently staked. This staked ETH helps trusty the community and generates rewards, extra growing Ethereum’s supply.

Moreover, the rising trend of restaking, in particular with protocols admire EigenLayer, amplifies this form. Customers reinvesting their staking rewards generate rather more ETH, compounding the inflationary affect.

Talked about listed here

Source credit : cryptoslate.com

Farside Consumers

Farside Consumers

CoinGlass

CoinGlass