Ethereum has been increasingly inflationary for over a month as fees hit all-time low

Ethereum has been extra and additional inflationary for over a month as charges hit all-time low

Ethereum has been extra and additional inflationary for over a month as charges hit all-time low Ethereum has been extra and additional inflationary for over a month as charges hit all-time low

Ethereum transitions abet to inflationary station as decreased network task and lower transaction payment burns contribute to a in discovering present broaden.

Duvet art/illustration through CryptoSlate. Image involves blended verbalize which could encompass AI-generated verbalize.

Since Ethereum moved from proof-of-work to proof-of-stake in 2022, it has turn correct into a deflationary asset. The complete circulating present of Ethereum (ETH) on the moment stands at 120,105,358 ETH, representing a 415,680 ETH lower from the provision ranges observed sooner than The Merge.

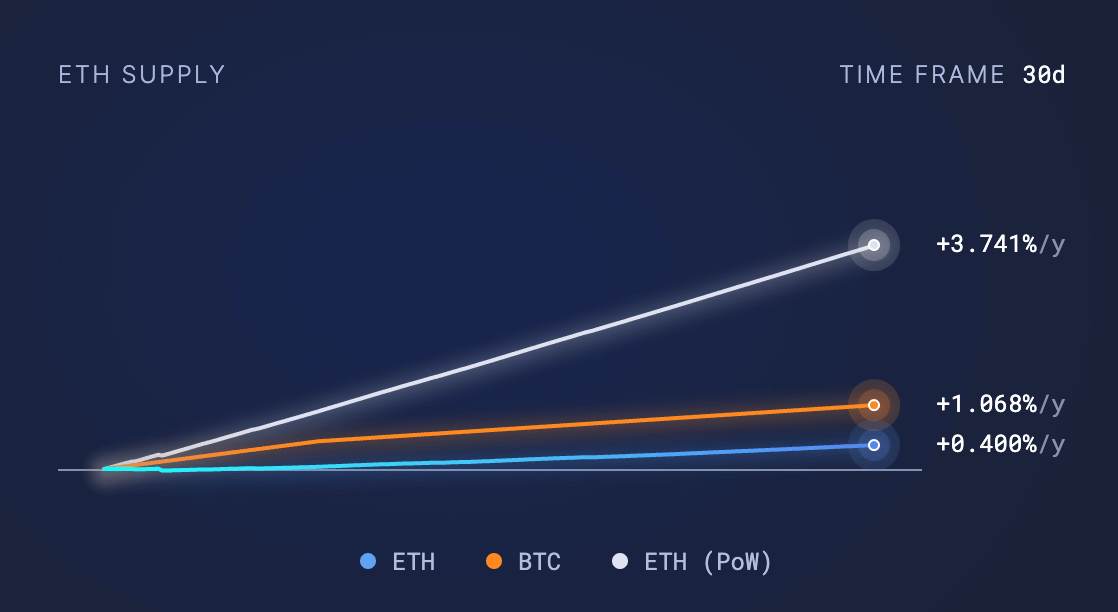

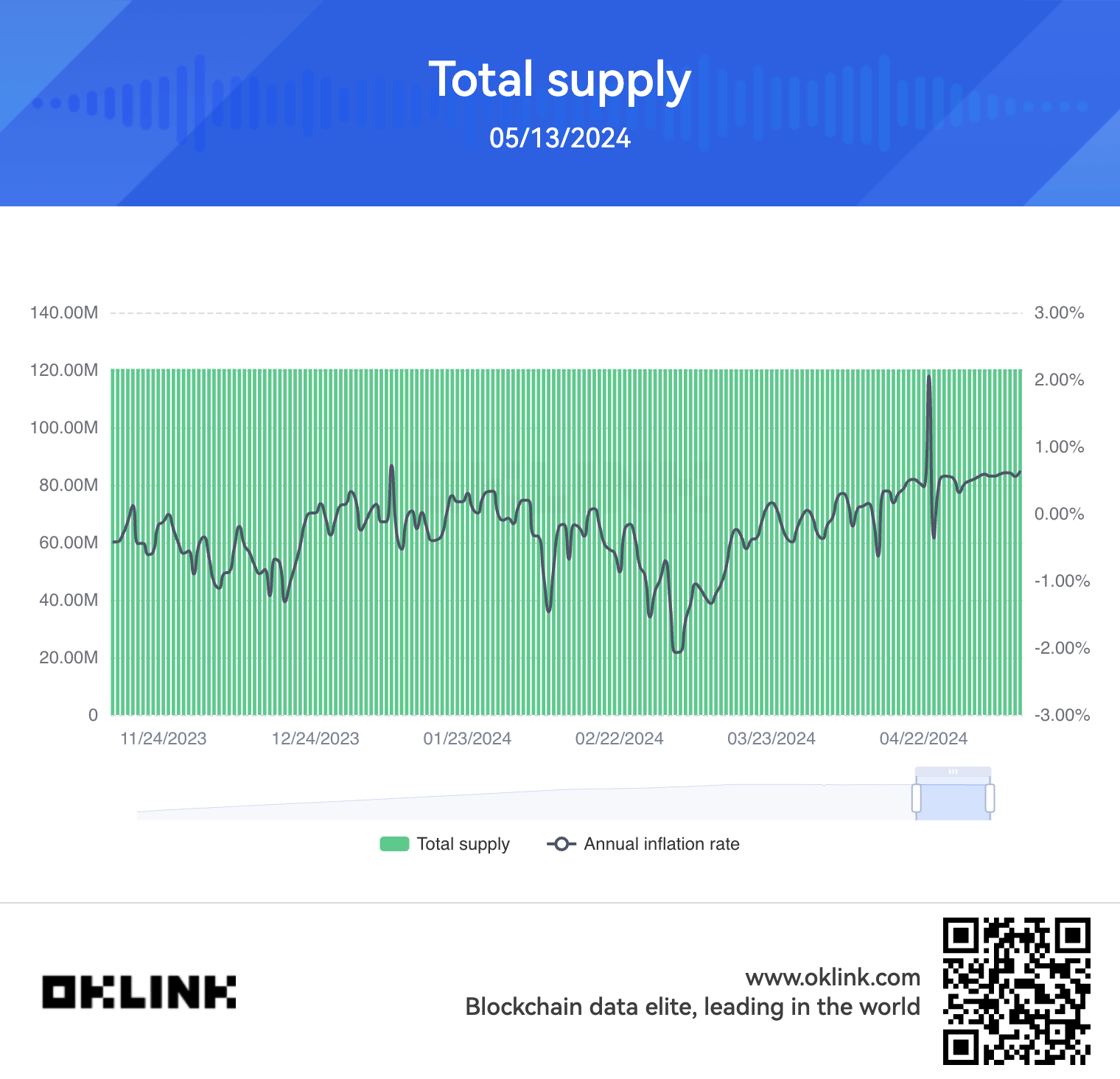

Nonetheless, at some stage within the last 30 days, Ethereum’s present dynamics believe shifted, with 35,548.72 ETH being burned (a long way from circulation) and 75,072.43 ETH being issued as block rewards to validators. The in discovering end result is a present broaden of 39,523.71 ETH at some stage in this period. Data from Ultrasound Money level to that, in step with the provision trade at some stage within the last 30 days, Ethereum’s most well-liked annualized inflation rate is roughly 0.4%.

When in contrast, Bitcoin’s inflation rate stands at 1.068%, while Ethereum’s Proof-of-Work (pre-merge) inflation rate would had been enormously greater at 3.74%. If essentially the most well-liked 30-day rate persists, projections for the following year recent that round 433,000 ETH will be burned, and 914,000 ETH will be issued, rising a in discovering originate of 481,000 ETH.

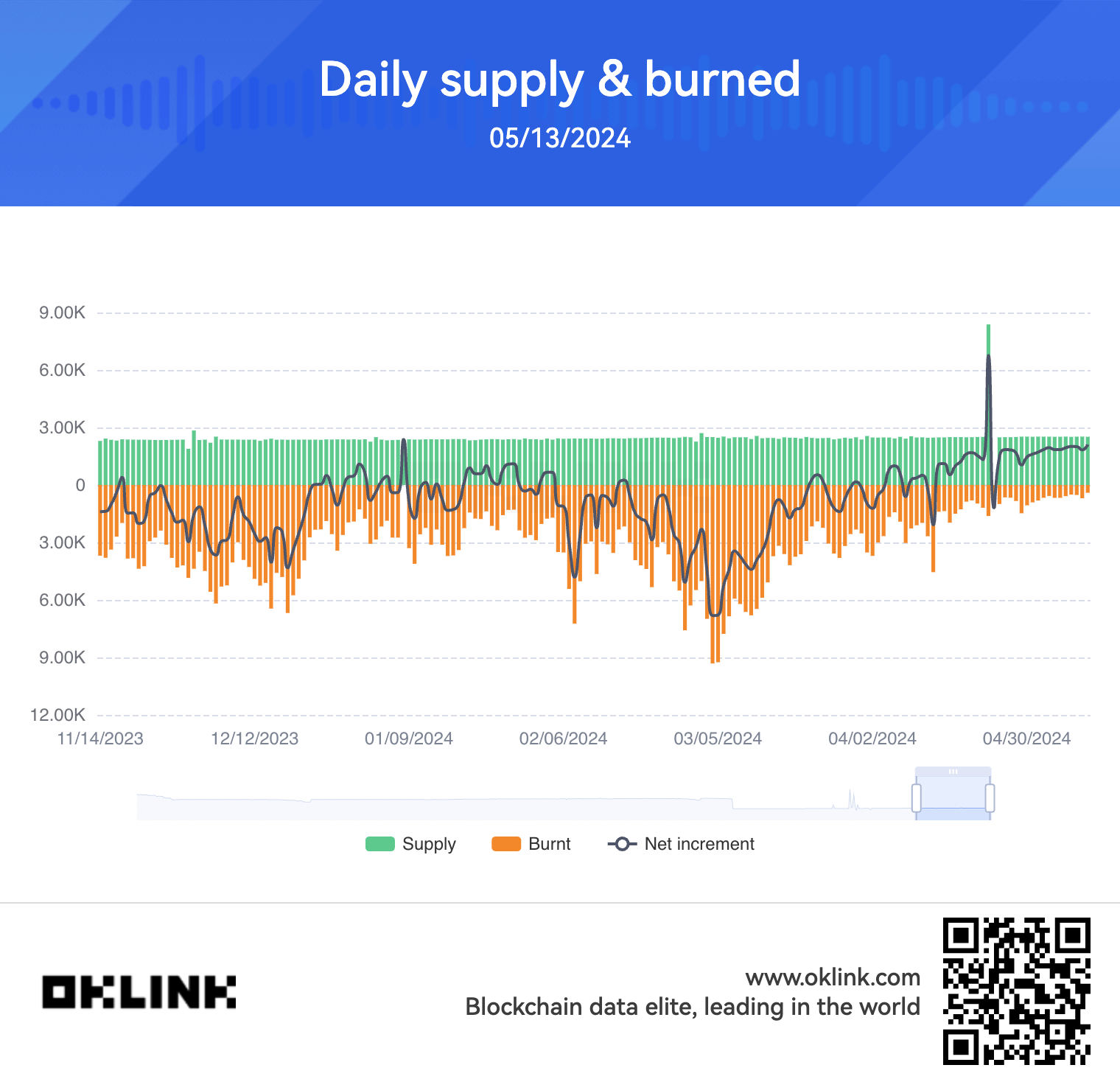

Data from OKLink reveals a persevered lower in ETH burned since March, when a median of round 6,000 ETH became burned day-to-day. For the explanation that start of Could simply, most effective round 900 ETH has been burned day-to-day, the lowest life like ranges since The Merge.

The most well-liked Dencun upgrade on the Ethereum network has had a distinguished impact on the ecosystem. The upgrade has led to a lower in layer-2 transaction charges and total network task. In consequence, this has seemingly resulted in a lower burn rate, pushing Ethereum’s present abet into an inflationary mutter.

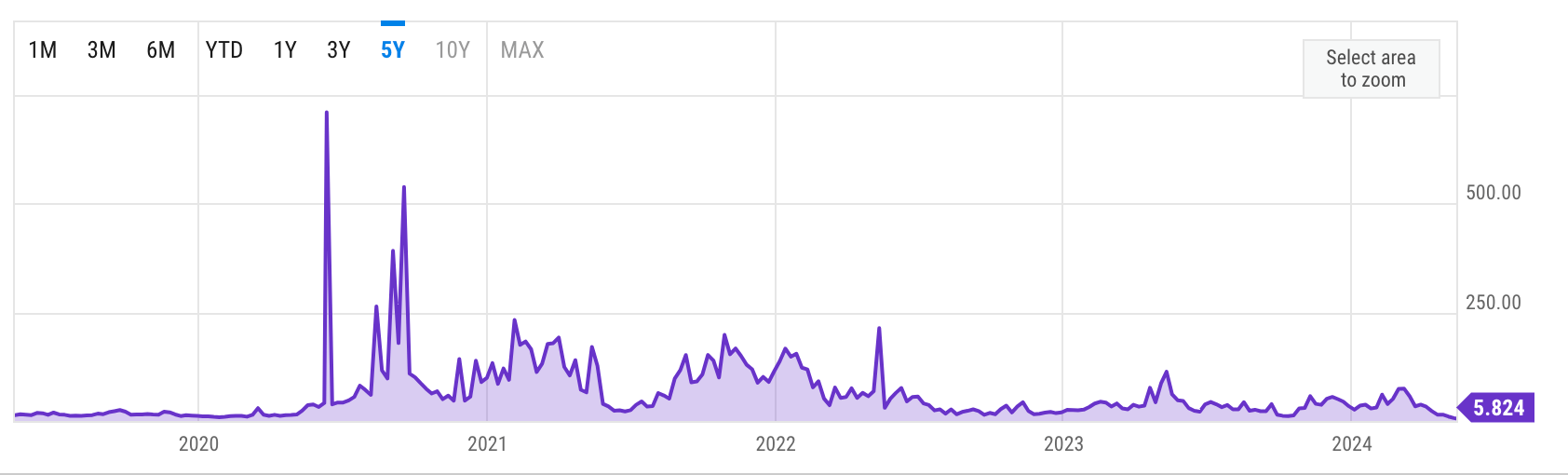

Data from Etherscan and Ycharts reveals that gasoline charges believe also plummeted to round 5 gwei, the lowest on story.

Curiously, Ethereum’s inflation rate has drawn closer to that of Bitcoin, especially within the aftermath of Bitcoin’s halving event closing month. As per records from the previous 7 days, Ethereum’s inflation rate for the previous week stands at 0.54%, correct 0.29 share factors greater than Bitcoin’s put up-halving rate of 0.83%.

Ethereum’s inflation rate has been gradually rising since February when it reached a neighborhood low of -2%.

While Ethereum’s present has turn correct into a tiny bit inflationary within the short term consequently of decreased network task and burn rate, its total present is smooth lowering on a in discovering basis. That is also attributed to EIP-1559, which offered a burn mechanism for a share of transaction charges.

Taking a gaze forward, Ethereum’s inflation rate and present dynamics is typically influenced by future network upgrades and adoption trends. If transaction charges and burn rate dwell low, Ethereum could proceed to journey inflationary stress within the end to term. Nonetheless, the long-term trajectory depends on the success of upcoming upgrades and the total growth of the Ethereum ecosystem.

The adoption of layer-2 networks and essentially the most well-liked broaden in layer-3 network task reduces load from the Ethereum mainnet, yet it does so at a trace. Nonetheless, essentially the most well-liked broaden in L2 and L3 task is now not at a level to develop ample L1 transactions to retain Ethereum deflationary. Finest time will pronounce whether or now not the extremely-sound cash understanding for Ethereum will be retained in a world dominated by L2 and L3s.

Source credit : cryptoslate.com