Digital assets see record $17.8 billion YTD inflows as Bitcoin and Ethereum lead the charge

Digital resources check file $17.8 billion YTD inflows as Bitcoin and Ethereum lead the charge

Digital resources check file $17.8 billion YTD inflows as Bitcoin and Ethereum lead the charge Digital resources check file $17.8 billion YTD inflows as Bitcoin and Ethereum lead the charge

Bitcoin sees fifth-biggest influx amid switch in investor sentiments.

Duvet art work/illustration by CryptoSlate. Portray entails mixed mutter that will perhaps perhaps also embrace AI-generated mutter.

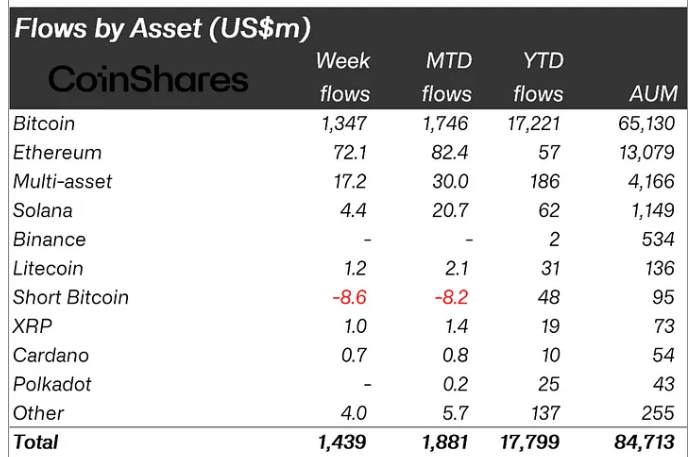

Digital asset investment products skilled consecutive inflows this month, with $1.44 billion recorded splendid week, per CoinShares‘ most up-to-date weekly fund float report.

This most up-to-date influx raised the year-to-date total to a file $17.8 billion, surpassing the $10.6 billion inflows of 2021.

On the assorted hand, buying and selling volumes stayed low at spherical $8.9 billion, when put next to the seven-day common of $21 billion.

Bitcoin sees the fifth-biggest influx.

A breakdown of the flows showed that Bitcoin noticed its fifth-biggest weekly inflows on file splendid week, totaling $1.5 billion. Conversely, rapid-Bitcoin skilled its biggest weekly outflow since April 2024, amounting to $8.6 million.

This skedaddle suggests a shift in market sentiment for the crypto industry. The critical Bitcoin inflows indicate investors’ growing self perception within the asset’s doable for worthy relate, with many investors taking relieve of the most up-to-date tag decline to enter the market.

James Butterfill, head of research at CoinShares, acknowledged:

“We predict about tag weakness due to the the German Government bitcoin gross sales and a turnaround in sentiment because of decrease than quiz CPI within the US led to investor to be able to add to positions.”

Meanwhile, Ethereum-associated crypto products attracted $72 million in inflows in anticipation of its achieve switch-traded funds (ETF) originate. This marks its biggest influx since March, bringing its year-to-date flows to $57 million.

Nate Geraci, President of ETF Retailer, predicted the SEC would approve ETH ETF products for purchasing and selling this week for the reason that monetary regulator “has no right explanation for from now on extend at this level.”

Furthermore, enormous-cap quite quite loads of digital currencies bask in Solana, Chainlink, Avalanche, and XRP noticed bigger than $8 million in cumulative inflows.

Locally, the united states led with $1.3 billion in inflows splendid week, reflecting a gigantic sure sentiment. Switzerland achieve a yearly file with $58 million in inflows, while Hong Kong and Canada noticed $55 million and $24 million, respectively.

Mentioned on this article

Source credit : cryptoslate.com