Digital asset products globally see $147 million outflow but trading surges 15%

Digital asset merchandise globally analysis $147 million outflow but trading surges 15%

Digital asset merchandise globally analysis $147 million outflow but trading surges 15% Digital asset merchandise globally analysis $147 million outflow but trading surges 15%

Multi-asset funds shine with 16th week of inflows despite broader market outflows.

Quilt art/illustration by plot of CryptoSlate. Image involves mixed swear material that could comprise AI-generated swear material.

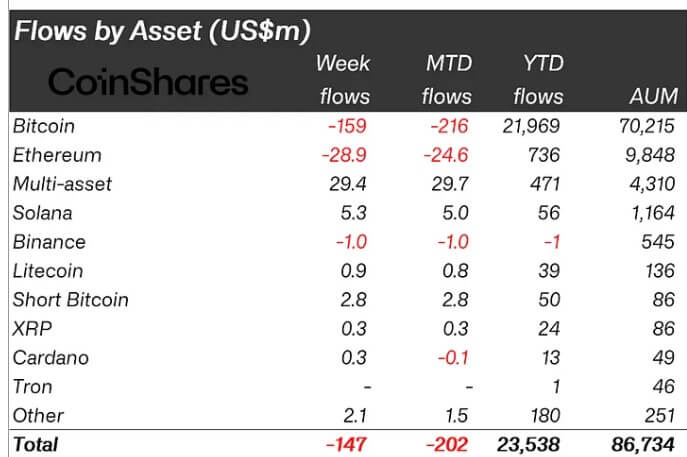

Digital asset investment merchandise globally faced $147 million in ranking outflows perfect week, in response to the most fresh weekly CoinShares list.

This marks the principle ranking outflow week in the previous four weeks after a duration of consistent inflows.

Despite the outflows, digital asset merchandise skilled a 15% magnify in trading volumes, even because the broader crypto market noticed lowered disclose.

James Butterfill, CoinShares’ Head of Examine, attributed the outflow to stronger-than-anticipated economic files launched in the USA. He worthy:

“Greater than anticipated economic files perfect week, lowering the possibilities for primary charge cuts are the seemingly motive for the weaker sentiment amongst traders.”

Domestically, Canada and Switzerland maintained a bullish pattern, recording inflows of $43 million and $35 million, respectively. Conversely, the US, Germany, and Hong Kong skilled primary outflows, with $209 million, $8.3 million, and $7.3 million, respectively.

Investors sort out Bitcoin and Ethereum

The list worthy that Bitcoin remained a key focus, with outflows of $159 million for Bitcoin-related merchandise, coinciding with most recent label fluctuations.

On the opposite hand, brief-Bitcoin merchandise noticed inflows of $2.8 million, reflecting bearish sentiment toward Bitcoin’s label movement.

Per CryptoSlate’s files, Bitcoin is trading at round $63,000, a 2% magnify genuine by plot of the final 24 hours. Last week, the main digital asset dropped to a low of lower than $60,000 before rebounding to its fresh cost.

Ethereum, which had correct ended a five-week outflow breeze, returned to outflows totaling $29 million perfect week. Butterfill commented that investor hobby in Ethereum remained subdued. In distinction, Solana became the utterly altcoin to attract principal inflows, reaching $5.3 million for the week.

Within the period in-between, multi-asset investment merchandise, offering publicity to multiple digital resources, defied the final pattern with ranking inflows of $29.4 million.

This marks their 16th consecutive week of sure flows, bringing their complete to $431 million. Butterfill added that multi-asset merchandise comprise turn into a current among traders since June, representing 10% of resources below management at global crypto fund managers.

Talked about listed here

Source credit : cryptoslate.com