DEX market share reaches ATH as CEXs face shrinking volume

DEX market share reaches ATH as CEXs face skittish volume

DEX market share reaches ATH as CEXs face skittish volume DEX market share reaches ATH as CEXs face skittish volume

DEXs hit file market share amid Uniswapâs dominance and rising memecoins.

Quilt art/illustration by CryptoSlate. Image involves mixed relate material that could just encompass AI-generated relate material.

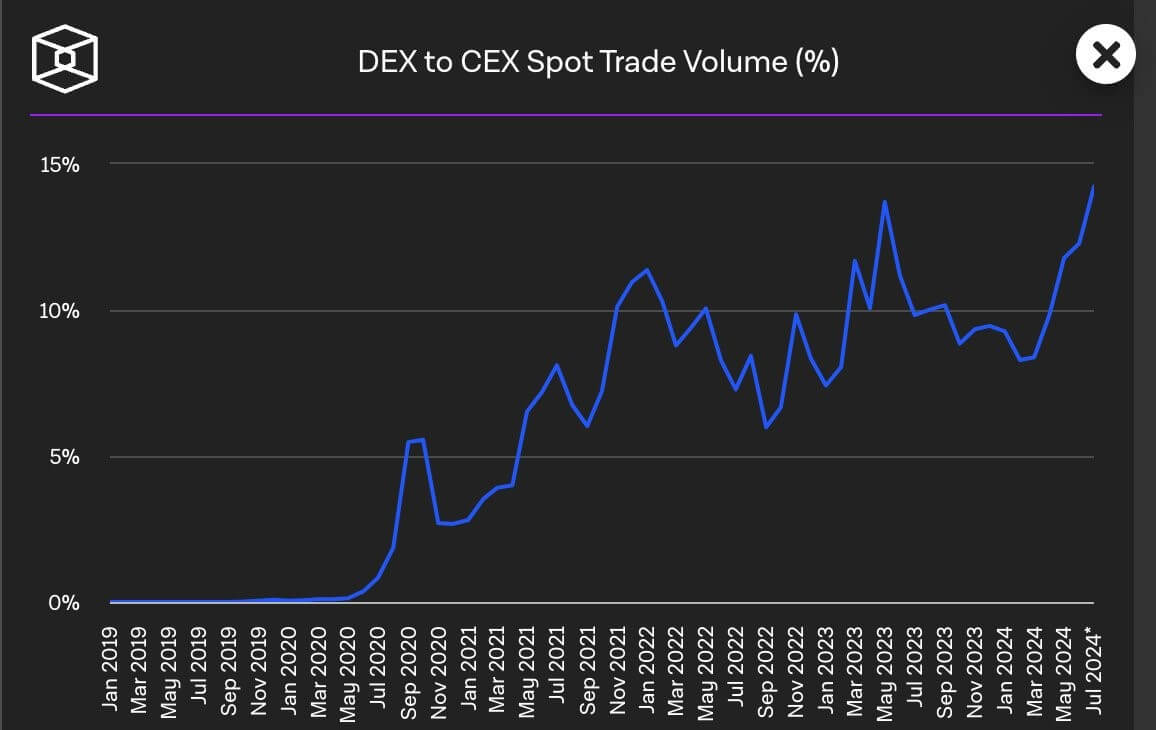

Decentralized exchanges (DEXs) now have their very best-ever trading volume ratio when in comparison with centralized exchanges (CEXs).

On July 29, Uniswap founder Hayden Adams highlighted this achievement, noting that “DEX market share is at an all-time high relative to CEX.”

Adams referenced a chart from The Block displaying that DEX trading volumes have been rising since the originate of this 300 and sixty five days.

This increase correlates with a broader bullish market, pushed by the US Securities and Alternate Price’s (SEC) approval of utter change-traded funds (ETFs) for major digital resources, alongside side Bitcoin and Ethereum.

Notably, the increase in DEX activity also comes all the blueprint by elevated institutional and political interest in the crypto market, in particular as the US election approaches.

DEX volume rising

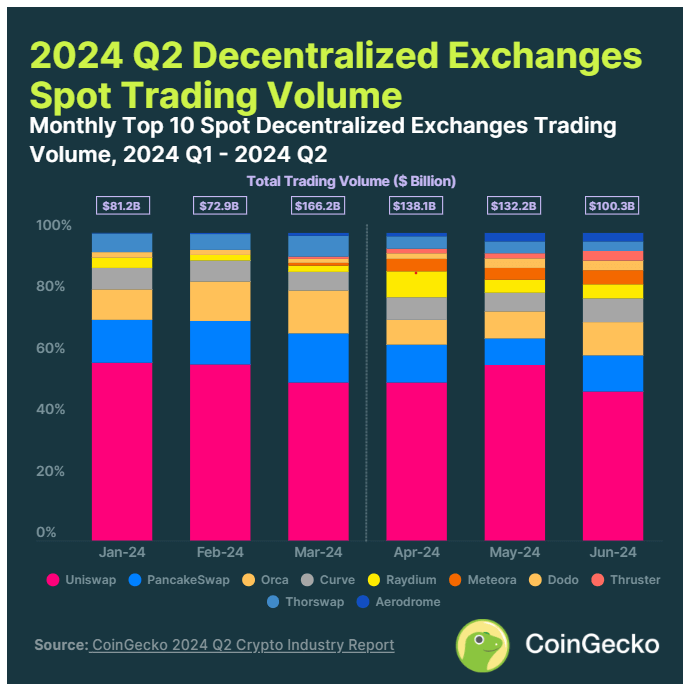

The above confirms findings from CoinGecko’s currently launched 2nd-quarter file, which reveals a first-rate shift in crypto trading patterns. The information signifies a decline in utter trading volume on centralized exchanges, whereas DEXs have experienced a essential build bigger.

At some level of the 2nd quarter, trading volume on the tip 10 DEXs surged 15.7% from the outdated quarter, reaching $370.7 billion. This increase is basically attributed to a rise in memecoins and a flurry of airdrops all the blueprint by this period.

Uniswap remained the main DEX, commanding forty eight% of the market share by the live of June. Contemporary entrants like Thruster and Aerodrome also seen huge increase, unparalleled established players in the decrease tier of the DEX market.

Conversely, centralized exchanges seen a 12.2% tumble in utter trading volume, totaling $3.4 trillion for the quarter. Despite this decline, Binance persisted to lead the market with a forty five% share, whereas numerous exchanges akin to Bybit, Gate.io, Bitget, and HTX conducted neatly.

Mentioned listed here

Source credit : cryptoslate.com