Crypto investments soar with $2 billion inflow amid US macroeconomic shifts

Crypto investments drag with $2 billion inflow amid US macroeconomic shifts

Crypto investments drag with $2 billion inflow amid US macroeconomic shifts Crypto investments drag with $2 billion inflow amid US macroeconomic shifts

Crypto trading quantity jumps 55% as inflows hit 2d-longest recede since SEC approval.

Duvet artwork/illustration by strategy of CryptoSlate. Image entails mixed enlighten material that will perhaps well consist of AI-generated enlighten material.

Investor self perception in crypto-linked funding merchandise surged last week, buoyed by the US macroeconomic narrate of affairs.

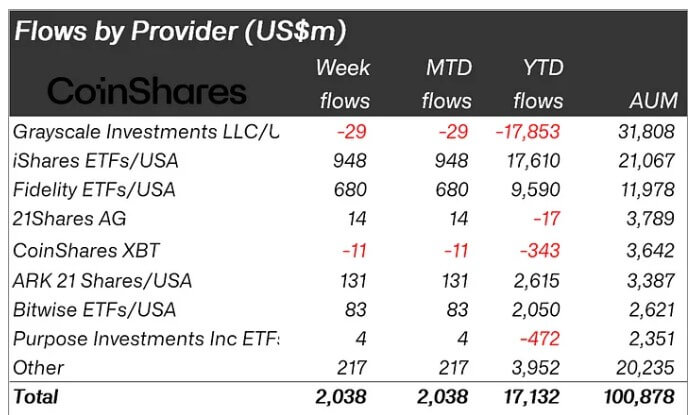

In its most up-to-date weekly document, CoinShares noticed that these monetary instruments saw safe inflows of $2 billion last week, matching the whole inflows recorded for Can even merely.

Additionally, this marks the fifth consecutive week of sure inflows, with the resources drawing round $4.3 billion worth of investments throughout the interval. Notably, here's the 2d-longest recede of inflows for the reason that US Securities and Substitute Price (SEC) popular space Bitcoin exchange-traded funds (ETF) in January.

James Butterfill, CoinShares’ head of compare, accepted that inflows were frequent across providers like BlackRock, Constancy, Proshares, Bitwise, and Reason, with a necessary discount in outflows from Grayscale.

Butterfill explained that the inflows shall be attributed to the “weaker-than-expected US macro recordsdata,” which has raised expectations for monetary coverage rate cuts. He added:

“[The] sure payment hotfoot saw whole resources below administration (AuM) rise above the $100 billion impress for the indispensable time since March this twelve months.”

Meanwhile, trading job for these funding merchandise surged after weeks of subdued actions. Last week, trading quantity became boosted by 55% to $12.8 billion, tremendously exceeding the $8 billion recorded within the prior week.

Bitcoin, Ethereum drive flows

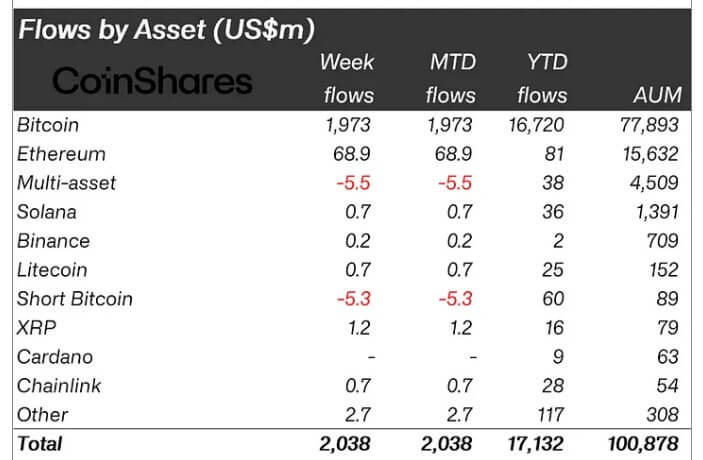

Bitcoin (BTC) remains a needed passion for patrons, registering $1.9 billion in inflows. Meanwhile, short BTC merchandise experienced outflows for the third consecutive week, totaling $5.3 million.

Ethereum (ETH) saw a indispensable resurgence, with $69 million in inflows, marking its completely week since March. This pushed ETH’s twelve months-to-date flows to $81 million, getting greater from earlier losses before the SEC popular several space Ethereum ETF 19b-4 filings.

Assorted well-known altcoins had minor actions, with inflows below $1 million. On the different hand, Fantom and XRP stood out, recording inflows of $1.4 million and $1.2 million, respectively.

Talked about listed here

Source credit : cryptoslate.com