Crypto investment products near all-time high with $1.84 billion weekly net inflow

Crypto-linked investment products seen critical inflows last week, totaling $1.84 billion—this yr’s 2d-most provocative weekly inflows—per CoinShares’ most modern weekly document.

This critical influx used to be also matched by a legend trading quantity of more than $30 billion throughout the an identical duration, which at cases represented 50% of world Bitcoin day-to-day trading volumes on trusted exchanges.

James Butterfill, CoinShares head of examine, added:

“The total assets below administration [of crypto ETPs], after recent label rises, are undoubtedly very finish to the all-time high at $82.6 billion, lawful anxious of the $86 billion peak snarl in early November 2021.”

US dominance continues

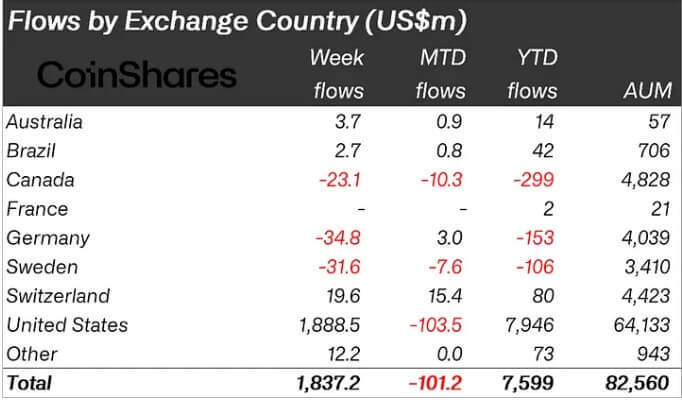

The US maintains its dominance in crypto investment product flows, persevering with to be buoyed by the introduction of Bitcoin ETFs, with the wide majority of digital asset in finding inflows reported last week at $1.88 billion.

Whereas the US leads the worth, world responses fluctuate. Switzerland recorded $20 million in inflows, contrasting with outflows from Sweden, Germany, and Canada, amounting to $32 million, $35 million, and $23 million, respectively.

Bitcoin products dwell at the forefront all over assets, witnessing an influx of $1.72 billion, representing 94% of entire inflows recorded last week.

Particularly, CryptoSlate Insight reported that Bitcoin held in world ETPs crossed the 1,000,000 label. These ETPs contain experienced a serious influx of 133,000 BTC throughout the previous 90 days, primarily attributed to the success of US space Bitcoin ETFs.

On the unreal, traders making a bet against Bitcoin’s upward label hurry allotted $22 million to short-linked investment products regardless of the ongoing market rally.

Ethereum experienced wide inflows amidst the crypto market surge in tandem with Bitcoin. Ethereum products seen inflows totaling $85 million last week, marking their predominant weekly influx since mid-July 2022. No matter this, ETH products AuM stand at $14.6 billion, down from the height of $23.7 billion.

In an identical blueprint, Polygon, XRP, and Chainlink witnessed inflows totaling $7.6 million, $2.5 million, and $1.6 million, respectively. On the unreal hand, Solana continues its third consecutive week of outflows, totaling $12 million.

Source credit : cryptoslate.com