78% of crypto industry expect new Bitcoin all-time high within 12 months

Finder’s most modern peek of 40 crypto founders, executives, and educators finds a bullish outlook for Bitcoin, projecting its price to make bigger very much through 2030. The consensus amongst the panel suggests a particular trajectory for Bitcoin, predicting its price to upward thrust to $77,423 by the quit of 2024, $122,688 by 2025, and $366,935 by 2030. These projections mark a critical uptick in optimism in contrast with previous surveys, indicating the rising bullish sentiment within the field.

In accordance with the typical prediction, Bitcoin is anticipated to attain $77,423 by the end of 2024, with projections varying very much amongst panelists. Some defend up for a surge to over six figures within the year, while extra conservative estimates counsel a possible decline from its present mark of around $44,000.

Consultants highlight plenty of crucial factors underpinning their optimistic outlook. Kadan Stadelmann, CTO of Komodo, attributes the aptitude for Bitcoin to hit $80,000 in 2024 to increasing passion from critical firms and institutional investors, the approval of deliver ETFs bettering market accessibility, and the anticipated halving event reducing Bitcoin’s unique present rate. Daniel Polotsky, founder and chairman of CoinFlip, facets to possible passion rate cuts by the Federal Reserve and geopolitical instability as further catalysts for Bitcoin’s mark make bigger.

Despite the overarching bullish sentiment, some panelists, fancy John Hawkins of the University of Canberra, dwell skeptical, viewing Bitcoin as a speculative bubble that can trip solely temporary beneficial properties from unique deliver ETFs.

“If the unique deliver Bitcoin ETFs are accepted, there will most definitely be temporary mark make bigger. But in the medium to longer-term, I restful regard Bitcoin as a speculative bubble…

And recall, in 2021, same claims were made in regards to the BTC futures ETFs as for the time being are being made about BTC deliver ETFs. Then the Bitcoin mark went up for a while but later crashed.”

The panel anticipates Bitcoin’s mark would possibly presumably well presumably height at $87,875 by the quit of 2024, with some even suggesting a possible high of $200,000. Conversely, the lowest predicted price stands at $35,734, with projections of a tumble to as miniature as $20,000. But, voices fancy Henry Robinson of Decimal Digital Foreign money and Shubham Munde of Market Be taught Future predict a surge to around $115,000 to $120,000, pushed by miniature present and extending ask, amongst different factors.

Opinions on the most easy route of action for Bitcoin investors are mixed, with a majority advocating for buying Bitcoin at its present mark. Jason Lau of OKX emphasizes the importance of ETF approval and rising adoption, suggesting a shiny long-term outlook for Bitcoin.

“The elevated access for retail investors, coupled with alignment from monetary establishments to adopt and promote bitcoin, is going to kick off a brand unique wave of inflows over time.

While non everlasting volatility is anticipated as firms and sizzling cash reposition, the longer-term potentialities are shiny.”

In distinction, Jeremy Cheah of Nottingham Trent University advises caution, predicting a modest correction.

When assessing Bitcoin’s present valuation, over half of the panelists be taught about it as underpriced, indicating a undeniable searching out opportunity. The panel additionally explores the factors in the succor of Bitcoin’s present mark make bigger, attributing it to ETF approvals, halving anticipation, and rising institutional funding. Taking a see ahead, over 50% of specialists imagine the 2024 halving would possibly presumably well presumably situation off the next critical crypto bull urge, supported by a mixture of regulatory approvals, macroeconomic factors, and evolving market narratives.

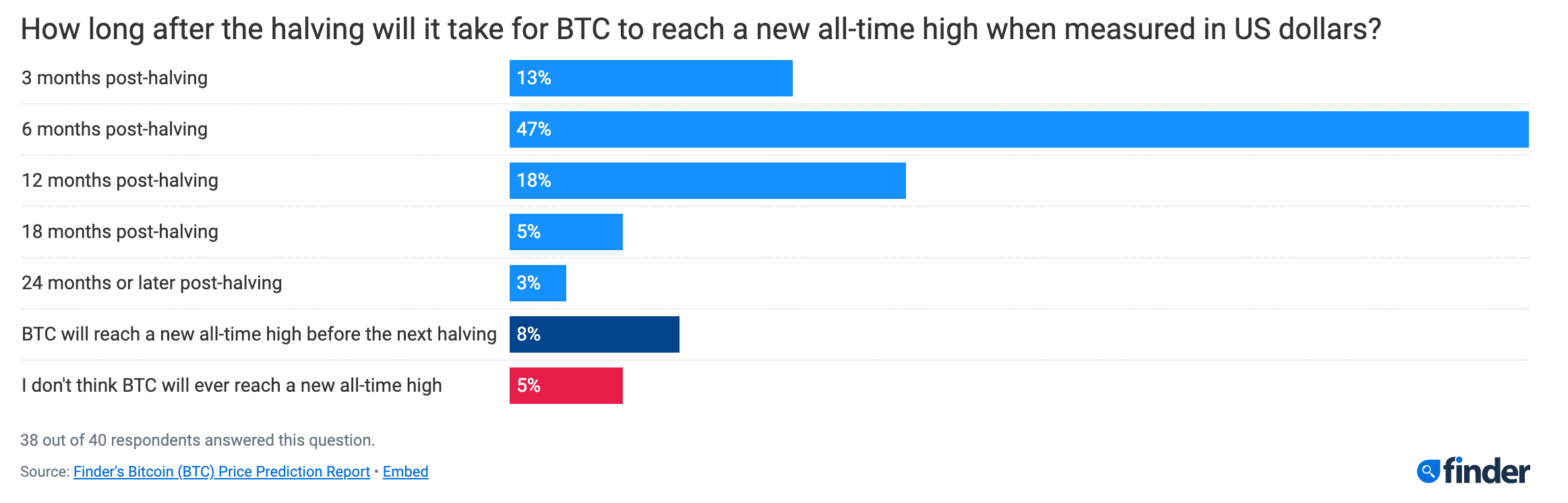

Consensus on a brand unique all-time high timeline settled around October 2024. Ultimate 5% of respondents say Bitcoin will fail to breach $69,000 again. 78% ask a brand unique all-time high within twelve months.

Evidently, Finder’s panel gifts a predominantly optimistic be taught about of Bitcoin’s future, forecasting sizable divulge through 2030. While opinions on the timing and extent of this divulge fluctuate, the consensus leans in opposition to a bullish outlook underpinned by regulatory trends, market dynamics, and the cyclical nature of Bitcoin’s halving occasions.

Bitcoin Market Info

On the time of press 12:00 pm UTC on Feb. 8, 2024, Bitcoin is ranked #1 by market cap and the price is up 4.26% over the previous 24 hours. Bitcoin has a market capitalization of $877.34 billion with a 24-hour buying and selling volume of $25.27 billion. Be taught extra about Bitcoin ›

Bitcoin

12:00 pm UTC on Feb. 8, 2024

$44,712.33

4.26%

Crypto Market Summary

On the time of press 12:00 pm UTC on Feb. 8, 2024, the total crypto market is valued at at $1.71 trillion with a 24-hour volume of $56.89 billion. Bitcoin dominance is currently at 51.36%. Be taught extra in regards to the crypto market ›

Source credit : cryptoslate.com