Crypto funds see $2.2 billion inflow, pushing 2024 total to $33.5 billion

Crypto funds witness $2.2 billion influx, pushing 2024 total to $33.5 billion

Crypto funds witness $2.2 billion influx, pushing 2024 total to $33.5 billion Crypto funds witness $2.2 billion influx, pushing 2024 total to $33.5 billion

Surging Twelve months-to-date inflows highlight increasing investor self perception in digital property put up-US elections.

Masks art work/illustration via CryptoSlate. Image contains blended allege which can perchance well encompass AI-generated allege.

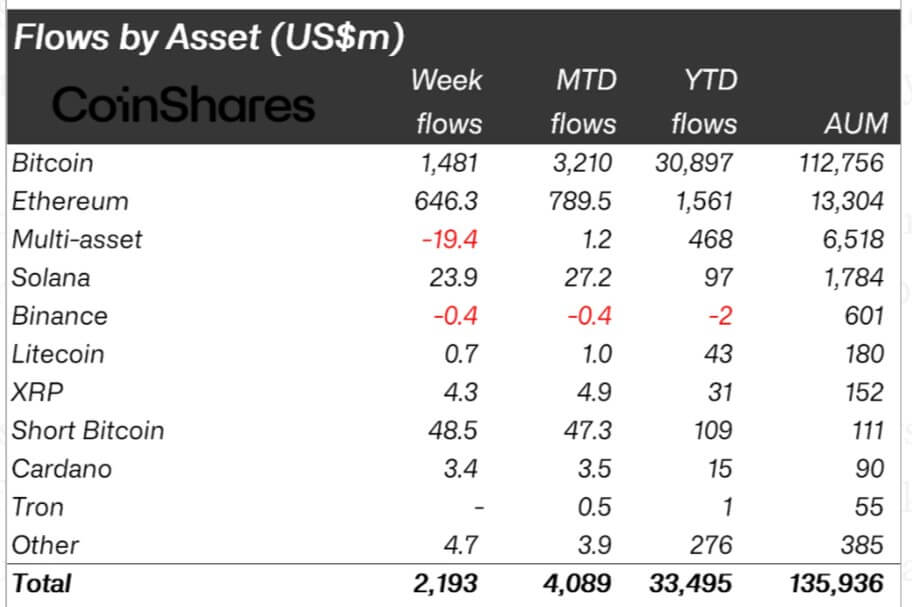

Closing week, digital asset funding products saw $2.2 billion in inflows, reflecting a broader market uptrend driven by Donald Trump’s contemporary victory on the swish-concluded US presidential election.

Within the first half of of the week, inflows peaked at $3 billion, lifting total property below management (AUM) to an all-time high of $138 billion. Alternatively, Bitcoin’s file brand performance all around the period brought about an outflow of round $866 million, ensuing in a gain influx of $2.2 billion.

In retaining with CoinShares, this influx pushed the totals since the September passion fee slash to $11.7 billion, bringing the Twelve months-to-date total to $33.5 billion.

James Butterfill, Head of Analysis at CoinShares, explained that:

“This contemporary surge in job appears to be like to be driven by a aggregate of looser monetary policy and the Republican partyâs tidy sweep in the contemporary US elections.”

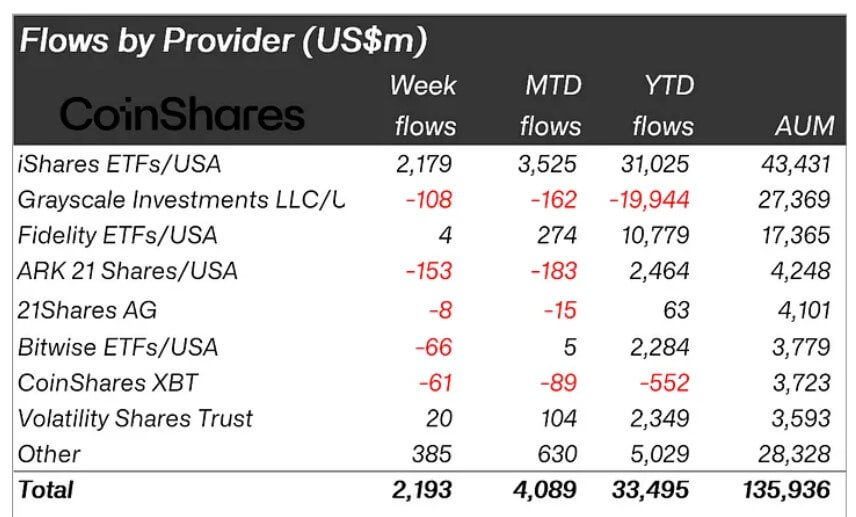

US-Bitcoin ETFs proceed to dominate

Bitcoin’s dominance remained strong, with $1.48 billion in inflows. The substantial flows shall be linked to the spectacular performance of the US-essentially based catch 22 situation alternate-traded fund (ETF) products, which proceed to blueprint necessary consideration from retail and institutional merchants.

In retaining with CoinShares data, BlackRock’s IBIT and Constancy’s FBTC saw inflows of $2.1 billion and $4 million, respectively. Alternatively, outflows of $153 million from the Ark 21 Shares fund outstripped those of Grayscale, which stood at $108 million for the week.

Within the meantime, Bitcoin’s file-breaking brand performance above the $90,000 brand has attracted bearish merchants, who invested $49 million in quick Bitcoin products.

Moreover, the bullish market sentiment looked to impact passion in Ethereum, which furthermore attracted necessary inflows of $646 million (same to 5% of its AUM). Butterfill linked this influx to election outcomes and a proposed Beam Chain community upgrade.

Varied property, alongside side Solana, XRP, and Cardano, saw more modest inflows of $24 million, $4.3 million, and $3.4 million, respectively.

Mentioned listed here

Bitcoin

Bitcoin  Ethereum

Ethereum  Solana

Solana  XRP

XRP  BlackRock

BlackRock  Constancy Investments

Constancy Investments  CoinShares

CoinShares  Ark Make investments

Ark Make investments  iShares Bitcoin Have confidence

iShares Bitcoin Have confidence  ARK 21Shares Bitcoin ETF

ARK 21Shares Bitcoin ETF  Grayscale Bitcoin Have confidence

Grayscale Bitcoin Have confidence  Constancy Smart Foundation Bitcoin Have confidence

Constancy Smart Foundation Bitcoin Have confidence

Source credit : cryptoslate.com

CryptoQuant

CryptoQuant

Farside Traders

Farside Traders