Crypto ETPs trading volume plummets 50% as BlackRock surpasses Grayscale

Crypto ETPs shopping and selling quantity plummets 50% as BlackRock surpasses Grayscale

Crypto ETPs shopping and selling quantity plummets 50% as BlackRock surpasses Grayscale Crypto ETPs shopping and selling quantity plummets 50% as BlackRock surpasses Grayscale

Crypto ETPs seen modest inflows of $30 million final week.

Quilt art work/illustration by strategy of CryptoSlate. Describe comprises mixed swear that will comprise AI-generated swear.

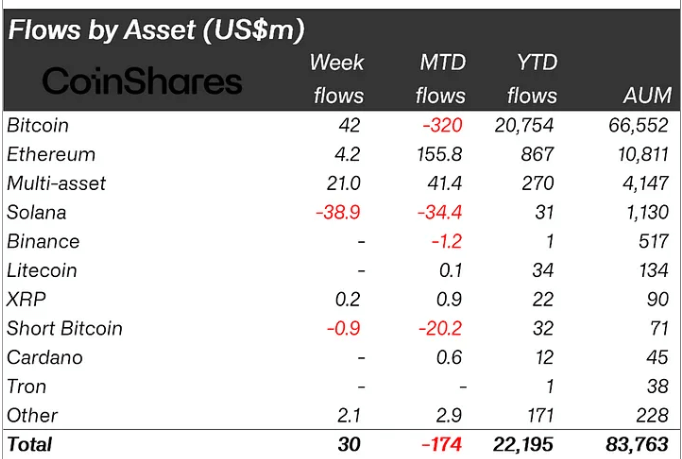

Crypto investment merchandise skilled a lukewarm efficiency final week, with modest inflows of $30 million, in step with CoinShares weekly memoir.

The weekly shopping and selling quantity for these merchandise also plummeted merely about 50% from the previous week, shedding to $7.6 billion.

James Butterfill, CoinShares‘ head of compare, defined that these numbers possess been the market’s reaction to contemporary macroeconomic files that implied the Fed became as soon as much less at wretchedness of decrease hobby charges by 50 foundation aspects in September.

Solana sees memoir outflows

Bitcoin regained its dominance, attracting $42 million in inflows. On the different hand, its month-to-date drift remains unfavourable, with a deficit of $320 million.

Equally, Ethereum persisted its multi-week sprint of inflows, drawing in a modest $4.2 million, bringing its full monthly flows to merely about $166 million.

Moreover, Multi-asset merchandise also seen particular momentum, with $21 million in inflows. Varied altcoins, along side XRP, reported positive aspects as nicely.

Solana, on the different hand, confronted important outflows, with traders pulling a memoir $39 million from the asset. This became as soon as largely because of declining community fundamentals and a spirited fall in memecoin shopping and selling. Solana’s label mirrored this bearish pattern, falling 6% over the previous week to $141.

Meanwhile, Brief Bitcoin merchandise recorded merely about $1 million in outflows, marking their second consecutive week of decline. This signifies that traders dwell optimistic about Bitcoin’s non permanent label ability.

BlackRock usurps Grayscale

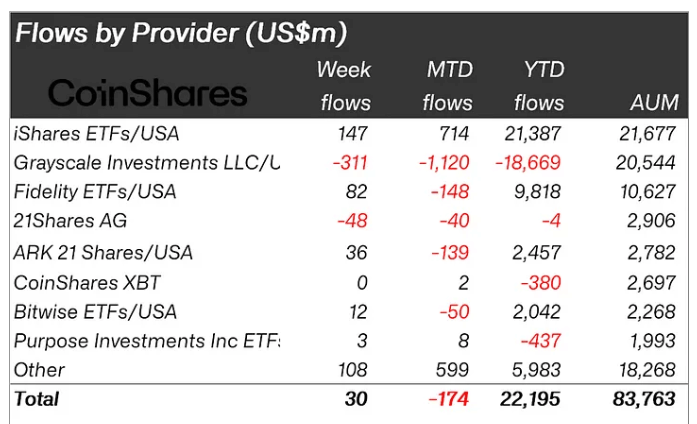

Butterfill also defined that the modest inflow figures hid the real fact that established ETP suppliers like Grayscale possess been shedding market fragment to issuers of newer investment merchandise like BlackRock.

A more in-depth learn about at issue suppliers finds a extra nuanced image. Grayscale, a nicely-established supplier of Bitcoin and Ethereum ETFs, seen persisted outflows final week, with over $300 million exiting its merchandise. This brought its month-to-date flows to a unfavourable of extra than $1 billion and dragged the full label of assets below its management to $20.5 billion.

In distinction, contemporary entrants like BlackRock iShares and Fidelity’s FBTC reported solid inflows. Particularly, BlackRock’s ETF seen inflows of $147 million final week, and its AUM has now risen to $21.677 billion, the most reasonable within the field.

Talked about on this article

Source credit : cryptoslate.com