Coinbase market share dips as smaller exchanges gain ground – Kaiko

Coinbase market share dips as smaller exchanges agree with ground â Kaiko

Coinbase market share dips as smaller exchanges agree with ground â Kaiko Coinbase market share dips as smaller exchanges agree with ground â Kaiko

Despite the decline, the highest three US crypto exchanges by volume now serve an eye on simply about 90% of the market.

Duvet artwork/illustration by potential of CryptoSlate. Image entails combined boom material which can additionally include AI-generated boom material.

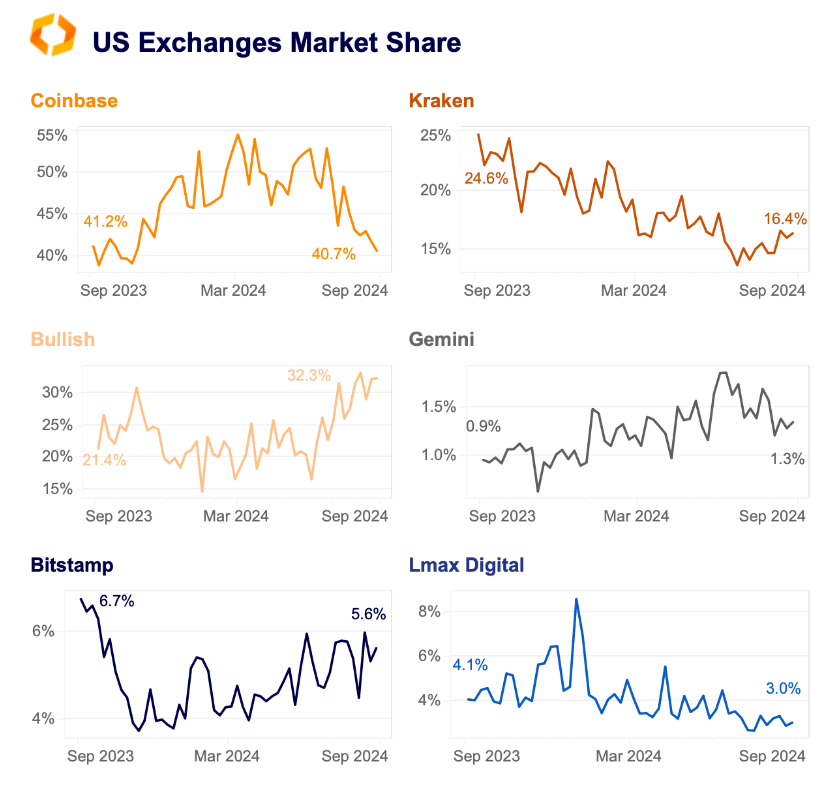

Coinbase has considered a sharp decline in market share as smaller exchanges won ground most contemporary months, per a Sept. 9 report by analysis agency Kaiko.

Coinbase dominated higher than half of of the US crypto market share earlier this year, peaking at practically 55% in March. Nonetheless, its market share has since fallen to 41% in early September, down from Fifty three% in June.

The excellent beneficiary of this shift has been Bullish, whose market share simply about doubled from 17% to 33% over the identical duration. Unlike Coinbase, which basically serves retail investors, Bullish basically targets institutional clients and trading.

Founded in 2021 as a subsidiary of blockchain agency Block.one, Bullish is backed by PayPal co-founder Peter Thiel. The agency lately made headlines for its agree with of crypto-focused media outlet Coindesk.

Top 3 exchanges dominate

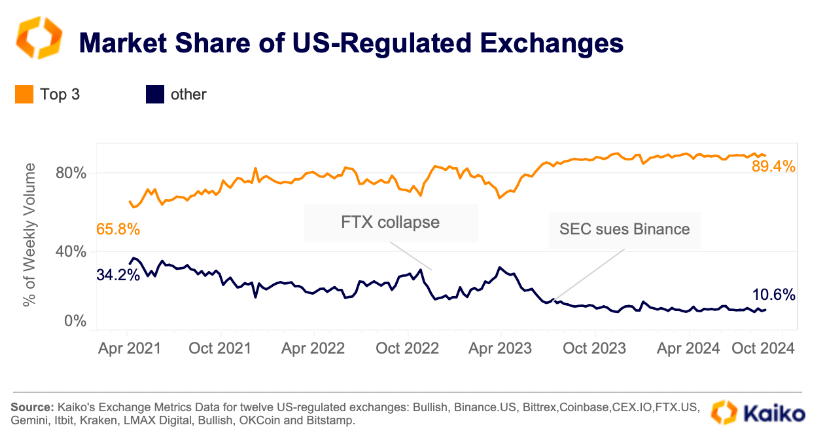

Meanwhile, top US exchanges agree with a great deal expanded their market share since 2021. According to Kaiko, the three excellent exchanges by volume now serve an eye on simply about 90% of the market, up from 66% in April 2021.

In distinction, smaller exchanges agree with considered their share shrink from 34% to 11%.

Kaiko explained that this used to be resulting from several factors, in conjunction with stricter regulations, lowered trading project at some level of the 2022-2023 agree with market, and the dominance of major avid gamers delight in Coinbase and Kraken in institutional crypto trading.

As effectively as, their dominance may perhaps well even be attributed to the surprising give contrivance of FTX in 2022 and the regulatory action against Binance.US, which all however led to the agency’s market share give contrivance.

Shares efficiency

Coinbase’s declining market share comes as British monetary institution Barclays upgraded its stock COIN from underweight to equal weight.

The monetary huge analyst Benjamin Budish renowned that Coinbase has matured thru product expansion and improved financial possibilities.

Budish also pointed out that Coinbase will income from a extra favorable regulatory ambiance. With market observers looking out forward to the two US presidential candidates to display conceal increased toughen for the crypto commerce, the Brian Armstrong-led swap may perhaps well emerge as a winner on this regulatory shift.

Nonetheless, the analyst cautioned that uncertainty remains, in particular across the broader financial ambiance and ongoing regulatory challenges. Seriously, the swap’s unresolved Securities and Replace Price (SEC) lawsuit casts a shadow over its operations.

Despite these challenges, Coinbase’s stock has risen by about 5% in early trading this day, per TradingView recordsdata. But, the corporate’s year-to-date efficiency has fallen, with its stock down 10%.

Talked about listed here

Source credit : cryptoslate.com