Coinbase cuts ties with law firms hiring ex-regulators linked to crypto crackdown

Coinbase cuts ties with law companies hiring ex-regulators linked to crypto crackdown

Coinbase cuts ties with law companies hiring ex-regulators linked to crypto crackdown Coinbase cuts ties with law companies hiring ex-regulators linked to crypto crackdown

Armstrong vows to decrease ties with law companies the usage of veteran regulators all for anti-crypto actions.

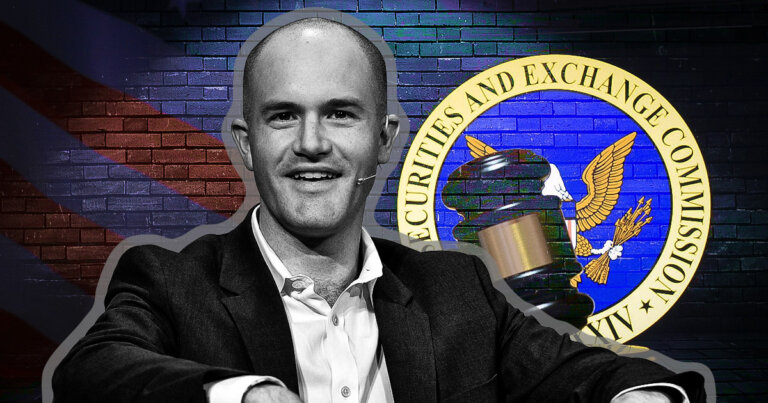

Duvet art work/illustration through CryptoSlate. Portray contains mixed direct that will contain AI-generated direct.

Coinbase CEO Brian Armstrong announced the alternate would nick ties with law companies that hire veteran regulatory officials linked to what he describes as “illegal” actions against the crypto commerce.

Armstrong’s feedback, made in a social media publish on Dec. 3, discover news that veteran SEC Division of Enforcement Director Gurbir S. Grewal joined Milbank’s Litigation & Arbitration Community â prompting the Coinbase CEO to single out the company as one the alternate would now not engage with.

Armstrong said:

“We’ve let the entire law companies we work with know that, in the occasion that they hire somebody who committed these circulation deeds in the (soon to be) prior administration, we are succesful of now not be a consumer of theirs.”

Armstrong criticized senior partners at law companies for being “ignorant of the crypto commerce’s space” on the realm. He specifically referenced Grewal, accusing him of contributing to regulatory actions that he known as “an ethics violation.”

The Coinbase CEO claimed the prior SEC administration under Gary Gensler had “unlawfully” focused the crypto commerce whereas refusing to give clear guidance on compliance.

Armstrong wrote:

“This used to be now not a customary SEC tenure. If you had been a senior there, you must likely't squawk you had been perfect following orders. They'd the strategy to switch away the SEC, and heaps perfect folks did.”

Armstrong emphasised that whereas he would now not judge in “completely canceling folks,” the crypto commerce must preserve away from financially supporting contributors he alleges had been all for harming the field.

He acknowledged:

“Let your law companies know that hiring these folks draw losing you as a consumer.”

Milbank did now not suddenly answer to requests for observation.

The switch highlights the deep-rooted tensions between the crypto commerce and regulators. Coinbase has been on the forefront of fine and policy battles, with Armstrong normally calling for clearer guidelines to foster innovation in digital property.

Grewal’s tenure on the SEC coincided with increased enforcement actions focusing on crypto platforms, at the side of high-profile lawsuits against Coinbase and other companies. His switch to non-public discover shows a broader pattern of regulators transitioning to perfect advisory roles in the industries they as soon as oversaw.

Talked about listed right here

Source credit : cryptoslate.com

CryptoQuant

CryptoQuant

CoinGlass

CoinGlass