Chainlink debuts privacy tech, triggering LINK’s rise to multi-week high

Chainlink debuts privacy tech, triggering LINK’s upward thrust to multi-week high

Chainlink debuts privacy tech, triggering LINK’s upward thrust to multi-week high Chainlink debuts privacy tech, triggering LINK’s upward thrust to multi-week high

Australia and Unique Zealand Banking Team (ANZ) is the first financial establishment to embody Chainlink's CCIP Private Transactions.

Duvet art work/illustration by project of CryptoSlate. Image involves blended mumble that would possibly possibly possibly doubtless possibly contain AI-generated mumble.

Chainlink’s LINK token has surged to its perfect point since leisurely September, driven by the Oracle network’s introduction of a privacy-centered abilities that helps financial institutions.

Following the news, files from CryptoSlate displays that LINK’s mark peaked at $12.16 sooner than a tiny dipping to $12.01 on the time of writing. This marks a continuation of the upward pattern, with the token rising by roughly 6% this month and 4% all over the previous seven days.

LINK presently ranks amongst the high 15 digital resources, with a market capitalization of around $7.5 billion.

CCIP Private Transactions

On Oct. 22, Chainlink launched Unsuitable-Chain Interoperability Protocol (CCIP) Private Transactions, a recent resolution enabling financial institutions to hyperlink their non-public blockchains with different chains.

The platform targets to unravel the continued device of true tainted-chain privacy, which has been a barrier to regulatory-compliant blockchain interactions for financial institutions.

Chainlink published that Australia and Unique Zealand Banking Team (ANZ) is with out a doubt one of the necessary first institutions to undertake the platform. This would possibly possibly occasionally doubtless allow tainted-chain tokenized precise-world resources (RWAs) settlements beneath Singapore’s Project Guardian, led by the Monetary Authority of Singapore (MAS).

Chainlink’s Blockchain Privateness Manager is planned to energy the contemporary abilities. The Manager enables non-public blockchains to make exercise of CCIP to join with different networks, collectively with public and non-public blockchains, exterior files sources, and frail financial programs, whereas putting forward transaction privacy.

Institutions the utilization of the Blockchain Privateness Manager can situation particular privacy parameters for every transaction. They'll veil nonetheless files, a lot like non-public files, token amounts, and counterparties, whereas selectively revealing different on-chain minute print.

Nigel Dobson, ANZ’s Banking Services Lead, authorized that the platform addresses the long-standing privacy challenges in institutional blockchain transactions. He added that this model would possibly possibly possibly doubtless well dash blockchain adoption amongst financial institutions.

Sergey Nazarov, Chainlink Co-founder, said:

“So a ways, the blockchain industry has no longer equipped the stage of privacy necessary for these institutional transactions to switch forward efficiently, limiting the command of the total industry. Now that non-public transactions all over chains are that you just would possibly possibly possibly doubtless possibly narrate of, we ask an even bigger inflow of institutional adoption of blockchains, CCIP, and the Chainlink fashioned in total.”

As effectively as to the Privateness Manager, Chainlink has introduced a Sandbox for DECO, a privacy-conserving files verification diagram.

DECO makes exercise of zero-files proofs (ZKPs) and existing web infrastructure to make certain that the privacy of blockchain contributors. While DECO is silent being tested, Chainlink plans to manufacture the platform accessible publicly.

Chainlink Market Records

On the time of press 11:58 am UTC on Oct. 22, 2024, Chainlink is ranked #14 by market cap and the price is up 2.8% all over the final 24 hours. Chainlink has a market capitalization of $7.59 billion with a 24-hour shopping and selling quantity of $261.14 million. Be taught more about Chainlink ›

Crypto Market Summary

On the time of press 11:58 am UTC on Oct. 22, 2024, the total crypto market is valued at at $2.32 trillion with a 24-hour quantity of $83.85 billion. Bitcoin dominance is presently at 57.20%. Be taught more relating to the crypto market ›

Mentioned listed right here

Source credit : cryptoslate.com

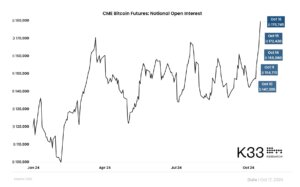

CoinGlass

CoinGlass

Dune Analytics

Dune Analytics

CryptoQuant

CryptoQuant