CFTC ‘happy’ to become primary regulator for digital assets, reducing SEC role – Chair Behnam

CFTC ‘chuffed’ to change into main regulator for digital property, lowering SEC role â Chair Behnam

CFTC ‘chuffed’ to change into main regulator for digital property, lowering SEC role â Chair Behnam CFTC ‘chuffed’ to change into main regulator for digital property, lowering SEC role â Chair Behnam

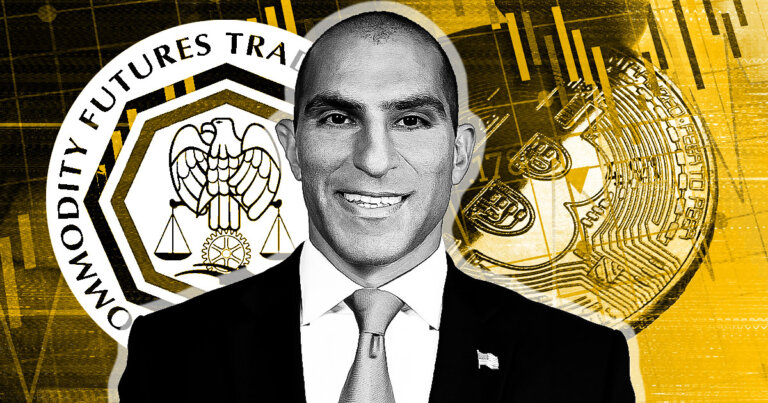

CFTC chair Rostin Behnam stated the businesses must cooperate on the different hand.

Quilt artwork/illustration by process of CryptoSlate. Image entails combined drawl which can also consist of AI-generated drawl.

CFTC chair Rostin Behnam stated the agency is originate to serving as a major regulator for crypto all over a Senate Agriculture Committee hearing on digital commodities oversight.

The hearing, held on July 10, broadly enthusiastic the CFTC’s question for more regulatory authority.

Senator Roger Marshall asked Behnam whether or no longer it would possibly well maybe perhaps be “more like a flash-witted” to assemble the CFTC a major regulator for digital property while leaving a miniature quantity of “offshoots” for the SEC to tackle.

Behnam responded:

“I discuss for myself, [we] would be chuffed to assemble that. I ponder we have the skill to assemble that the experience and the experience.”

Nonetheless, Behnam stated modifications to definitions of securities and commodities would be wanted if the CFTC assumes main authority.

Cooperation with SEC truly helpful

Earlier, Marshall asked Behnam whether or no longer he supports the SEC having the flexibility to resolve which property fall below the CFTC’s jurisdiction.

Behnam stated he does no longer make stronger the SEC making such choices alone however added that the two businesses own labored together to define property in gray areas for about 50 years.

Marshall additionally asked whether or no longer the CFTC is anxious it must also face lawsuits over conflicting asset designations. Behnam stated he “can’t allege that it’s no longer going to occur,” however cooperation between the SEC and CFTC will again address new correct questions.

Behnam acknowledged Marshall’s concerns that lawmakers would possibly well maybe perhaps well enable such lawsuits however stressed the necessity for a contract itemizing machine that suits the CFTC’s unusual powers and enables cooperation with the SEC. Behnam stated:

“I ponder there’s a arrangement to compose a machine of itemizing contracts that doesn’t lengthen or extend the itemizing of contracts in a regulated market.”

Behnam stated the CFTC wants to introduce tokens and contracts to regulated markets “as soon as conceivable” to slice aid or gather rid of investor dangers.

Most

Behnam believes that a major share of the crypto market must fall below the CFTC’s purview as it could not be classified as securities. At some level of the hearing, Behnam stated that more than 70% to 80% of the crypto market does no longer fall below the class of securities, leaving the house without a recount federal oversight.

He stated the CFTC wants as a minimal $30 million within the first year and as a minimal $50 within the 2nd year to place a regulatory regime. The funding would proceed toward staffing, administration, and IT spending. User costs submitted by registrants would offset requested funds.

Behnam additionally affirmed Senator Cory Booker’s concerns spherical urgency, declaring that if the CFTC does no longer safe authority, fraud and manipulation will continue to affect folk across the US.

Mentioned listed here

Source credit : cryptoslate.com