CEXs saw record-breaking trading volume as Bitcoin touched ATH

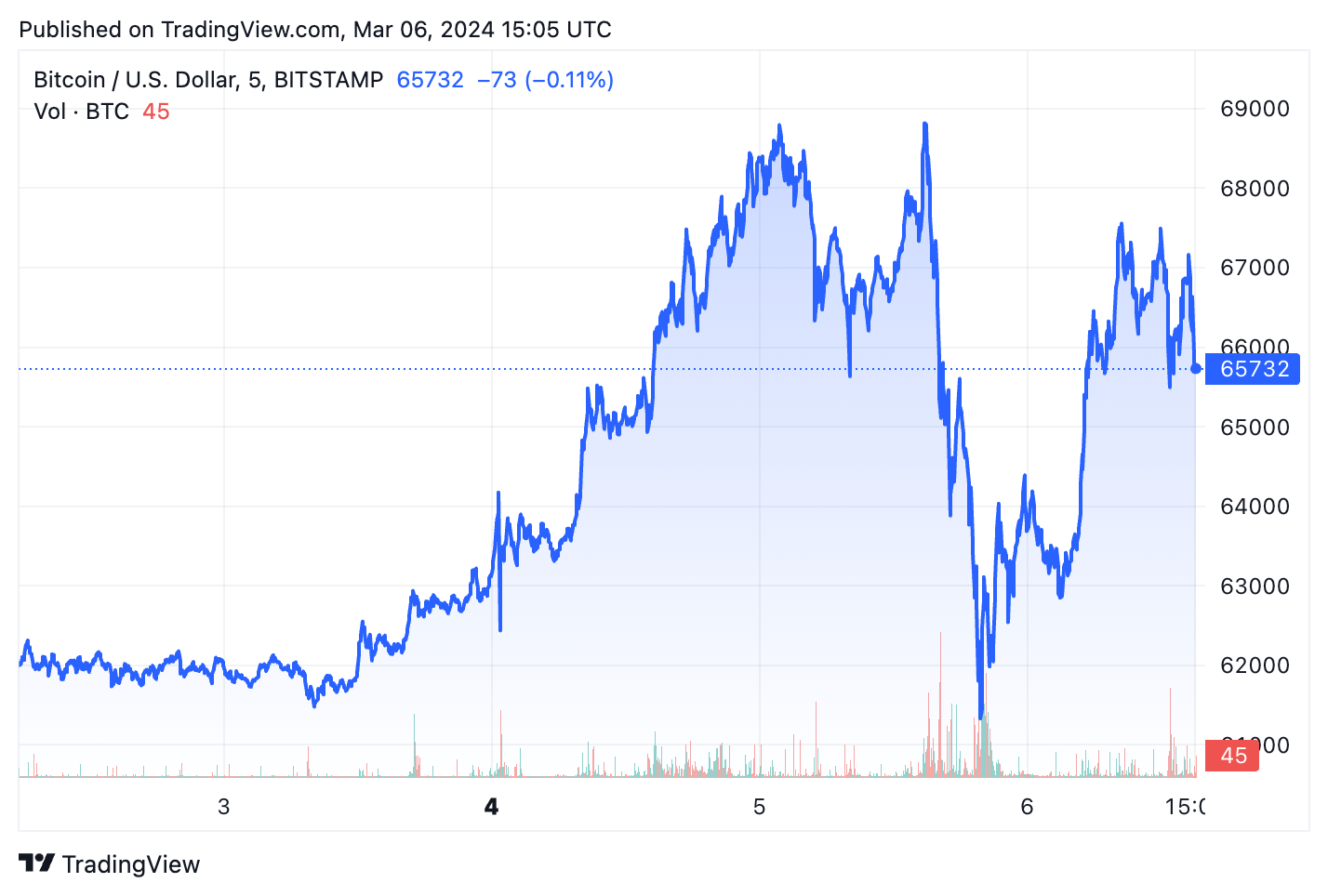

On Mar. 5, Bitcoin reached the all-time high it posted in November 2021, breaking by $69,000 within the unhurried afternoon UTC. On the opposite hand, Bitcoin’s stint at its ATH changed into extraordinarily short and changed into rapidly adopted by a nice looking 14% correction that pushed its heed down to $59,300. Within the early morning of Mar. 6, BTC regained some of its misplaced footing but struggled to stabilize at $66,000.

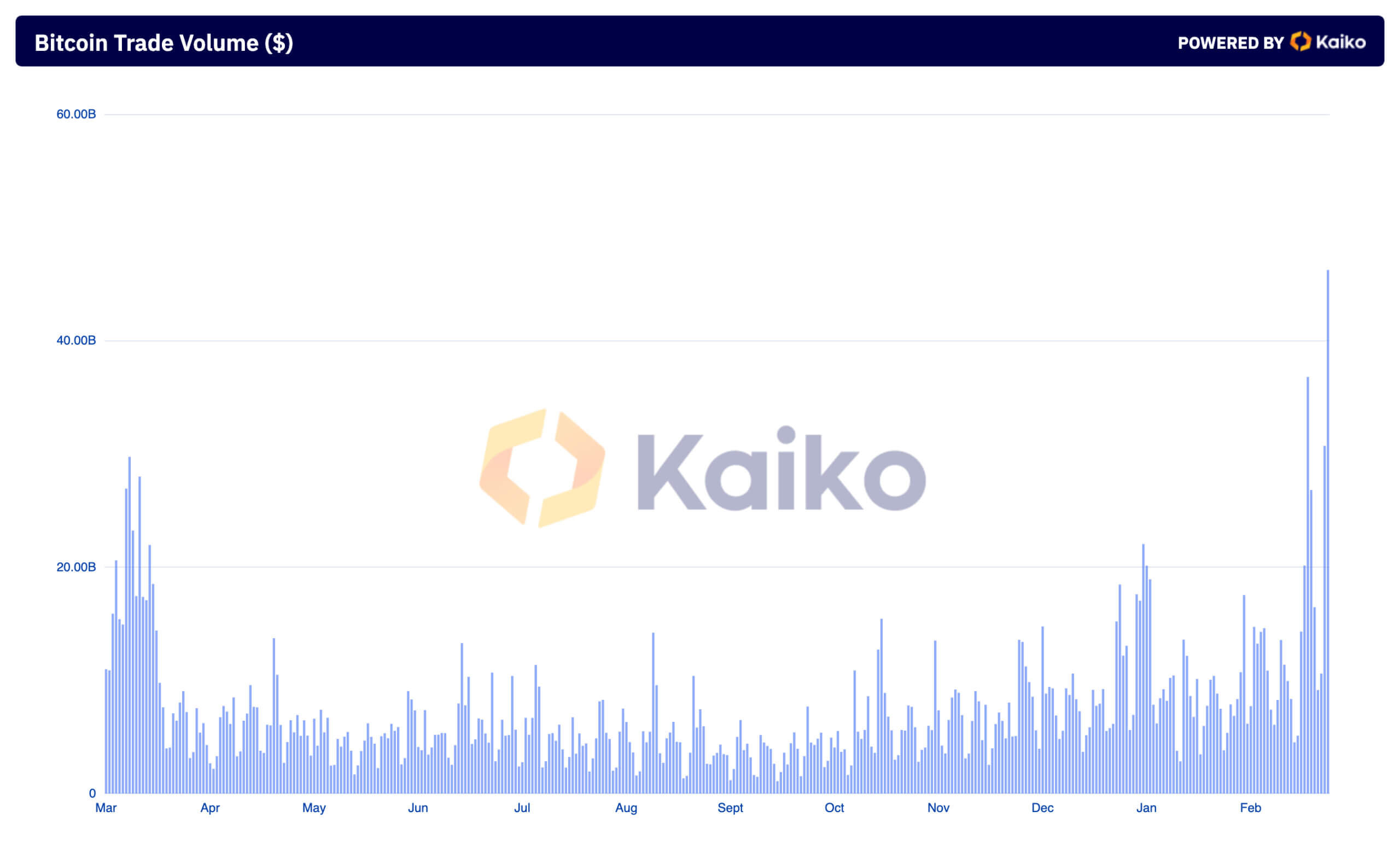

The market’s intense heed volatility on Tuesday, Mar. 5, translated to file-breaking trading volumes across centralized exchanges. With diminutive records on the volume viewed on OTC desks and a walk in records availability from set up ETFs, CEX volume serves as essentially the most attention-grabbing barometer for market instruct with regards to Bitcoin.

The diagnosis of Kaiko records by CryptoSlate revealed a 405% amplify in trading volume in trading volume between Mar. 2 and Mar. 5 — rising from $9.15 billion to $46.25 billion. This surge adopted Bitcoin’s unstable heed hasten, exhibiting an aggressive response from traders to cost fluctuations.

The amplify in trading volume changed into mirrored by a development in alternate count, which escalated from 10.12 million to 32.79 million over the identical period. This shows elevated engagement available within the market and presumably a greater influx of retail and institutional traders.

The changes viewed within the frequent alternate size additional corroborate this. Between Mar. 2 and Mar. 5, the frequent alternate size elevated by over 55%, leaping from $904 to $1,410, exhibiting bigger capital actions contained available within the market as traders rushed to capitalize on the value volatility.

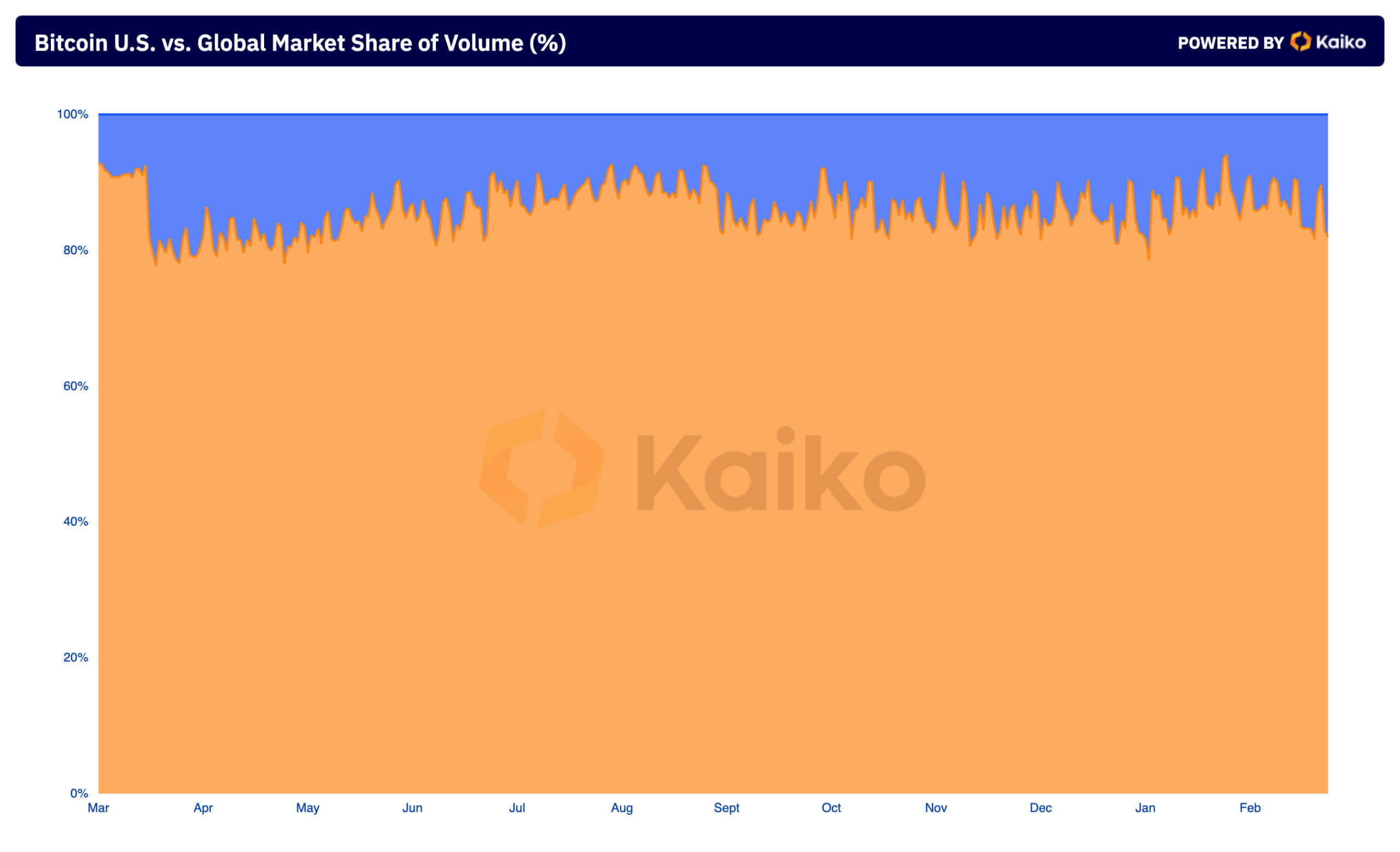

Inspecting the distribution of trading volume between US and world markets shows where most of this volume changed into coming from. The world market has constantly dominated Bitcoin trading volume, as previously covered by CryptoSlate. On the opposite hand, the US market’s allotment of the volume elevated from 11.6% on Mar. 2 to 18.05% by Mar. 5, exhibiting a necessary amplify in interest from US-essentially based traders all the top doubtless device by this unstable period.

Maintaining up with the long-time period model, Binance commanded a necessary majority of the world trading volume with 51.54%, while Coinbase led the US alternate market with a 57.89% allotment. Binance and Coinbase’s dominance over the crypto market has been illustrious for years, and the two exchanges constantly fable for a appreciable section of world trading instruct. The high focus of trading on the two exchanges, in particular all the top doubtless device by this week’s high volatility, shows traders favor to follow platforms with high liquidity and a mountainous determine.

Coinbase’s most modern points with fable balances impacted the series of trades completed by the platform, main to a necessary outflow of BTC from the alternate. On the opposite hand, the affect on the total trading volume on the alternate seems to beget been minimal, as evidenced by Coinbase’s dominance within the US market.

The unprecedented heed volatility experienced all the top doubtless device by the week attracted necessary trading instruct, drawing in both existing and original market contributors. The surge in volume, alternate count, and alternate sizes shows traders beget been aggressively partaking with the market, responding to Bitcoin’s spike with bigger alternate sizes. This hasten shows centralized exchanges’ serious role in facilitating liquidity and providing heed discovery, in particular all the top doubtless device by necessary market actions.

Source credit : cryptoslate.com