Calls dominate Bitcoin options despite price drop and ETF outflows

Calls dominate Bitcoin alternate strategies despite mark tumble and ETF outflows

Calls dominate Bitcoin alternate strategies despite mark tumble and ETF outflows Calls dominate Bitcoin alternate strategies despite mark tumble and ETF outflows

Market sentiment remains complex as ETF inflows and outflows force refined shifts in Bitcoin derivatives.

Quilt art/illustration via CryptoSlate. Image contains blended teach material that would possibly perhaps presumably encompass AI-generated teach material.

While the regular volatility has been absent from the derivatives market, the small fluctuations seen previously few days level-headed managed to squawk refined market trends.

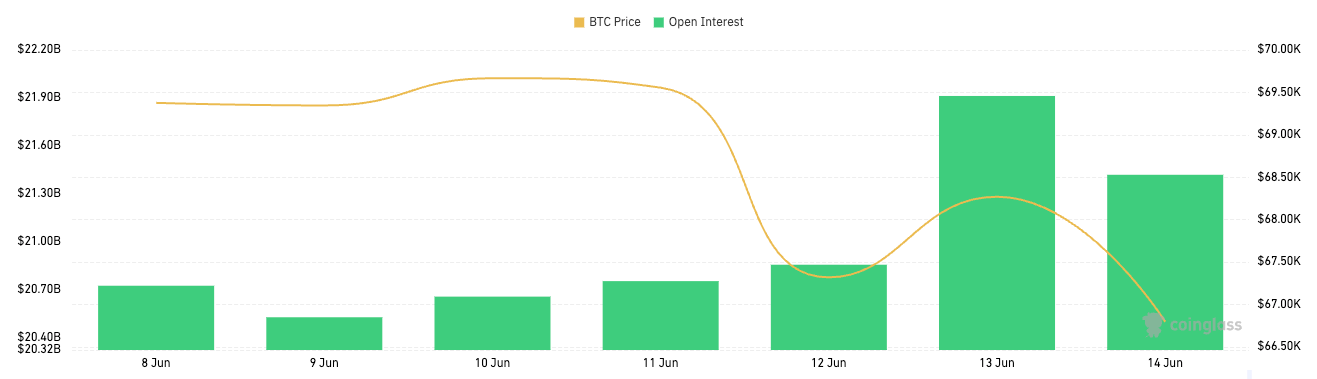

Between June 12 and June 14, Bitcoin alternate strategies delivery curiosity increased $20.85 billion on June 12 to $21.91 billion on June 13, earlier than lowering to $21.42 billion on June 14.

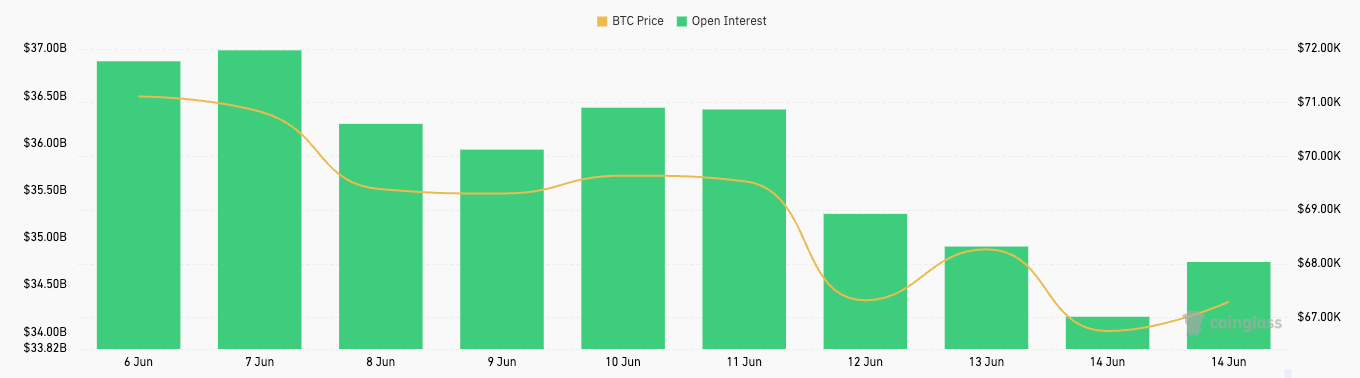

Inaugurate curiosity in Bitcoin futures also rather declined all over the length, falling from $35.25 billion on June 12 to $34.17 billion on June 14.

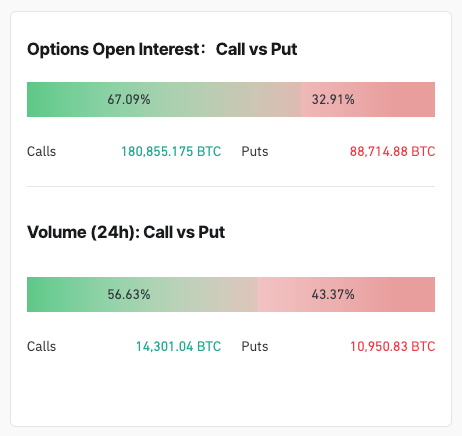

The initial amplify in alternate strategies delivery curiosity, adopted by a subsequent decline, suggests a elaborate market sentiment when analyzed alongside mark. Bitcoin dropped from $69,555 on June 11 to $66,780 on June 14, after a short recovery on June 13. The predominance of name alternate strategies (67.17%) over put apart alternate strategies (32.83%) as of June 14 signifies an general bullish sentiment despite the worth tumble. The 24-hour volume for alternate strategies on June 14 also leaned in direction of calls (59.88%), reinforcing this bullish outlook even in a declining mark atmosphere.

These refined adjustments in OI were a consequence of a combination of so much of factors influencing the broader crypto market. Bitcoin ETFs web experienced blended inflows and outflows previously so much of days. The rebound of Bitcoin ETFs with $100 million in inflows, juxtaposed with a pointy $226 million outflow amid Ethereum ETF news, reveals staunch how immense of a success the market took. This outflow likely contributed to the decreased search files from of for Bitcoin futures, as evidenced by the declining delivery curiosity in futures.

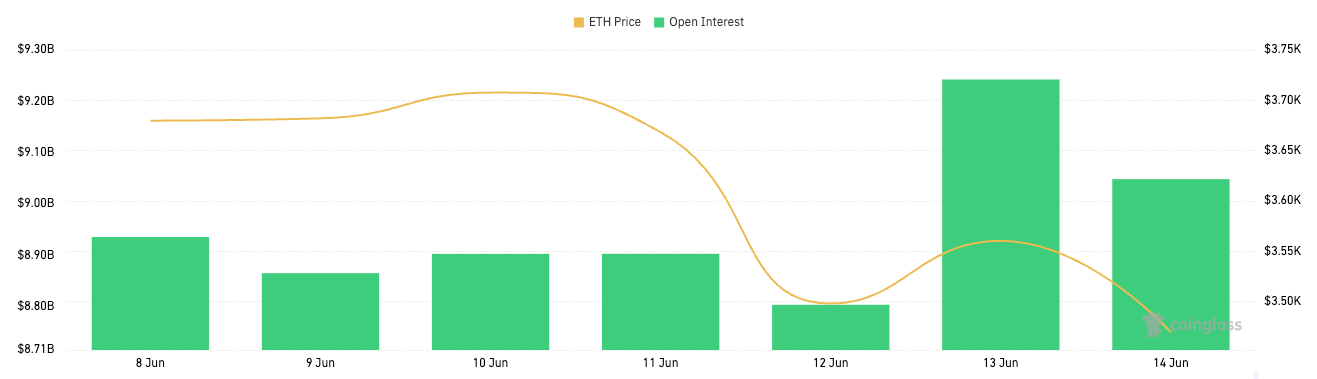

The decisive words from SEC’s Chair Gary Gensler that Ethereum ETFs will likely be authorized this summer likely diverted investor consideration and capital in direction of Ethereum, impacting Bitcoin’s derivatives market. This shift is evident in Ethereum’s future and alternate strategies market, the place delivery curiosity will increase previously few days mirror this alternate in sentiment.

MicroStrategy’s convertible gift issuance to aquire more BTC also fashioned investor sentiment. Michael Saylor’s most modern traipse demonstrates the company’s unwavering self assurance in Bitcoin, which is in a position to indubitably impact shoppers taking part in the derivatives market. This impact is seen in their means to withhold and amplify bullish positions despite a flat mark, as seen in the dominance of name alternate strategies.

ETF outflows web a straight away impact on Bitcoin futures and alternate strategies markets. Outflows from Bitcoin ETFs can lead to reduced liquidity and search files from of in the futures market, inflicting a decrease in delivery curiosity. This connection is evident from the guidelines, the place we scrutinize a decline in futures delivery curiosity following most well-known ETF outflows. The connection between ETF flows and futures delivery curiosity reveals how crucial institutional participation and sentiment are in using the market.

Bitcoin’s sideways circulate and absence of noteworthy volatility all over this era web a dampening raise out on delivery curiosity. When the worth remains comparatively exact, merchants would possibly perhaps presumably receive fewer alternatives for earnings, ensuing in reduced buying and selling job and decrease delivery curiosity in futures. The exact mark vary of Bitcoin from June 10 to June 14, with minor fluctuations, suggests a length of market consolidation, contributing to the seen decline in futures delivery curiosity.

Talked about in this text

Source credit : cryptoslate.com