BlackRock’s spot BTC ETF tops $720M in daily volume, marking highest level to date

BlackRock’s location Bitcoin ETF — the iShares Bitcoin Belief (IBIT) — surpassed a document excessive of $720 million in each day volume on Feb. 14 to steal the no 1 location with regards to volume, per recordsdata from Coinglass.

Commenting on IBIT’s more than $700 million in volume on Feb. 14, Bloomberg ETF analyst Eric Balchunas described the pattern as a “more unfamiliar second wind strength” for the fund. He defined:

“[The] reason here’s appealing and unfamiliar is [because] early on IBIT’s volume used to be correllated [with] GBTC outflows and perhaps to any ‘lined up’ cash [BlackRock] had. View all that could wind down a small in unison, and it began too, but then IBIT broke the [f—] unfastened.”

IBIT cements lead

Balchunas smartly-known that volume for the “Newborn 9” infrequently signifies inflows as there aren’t many present merchants looking out for to promote, when compared with a fund cherish GBTC that used to be converted into an ETF and had pre-present holders.

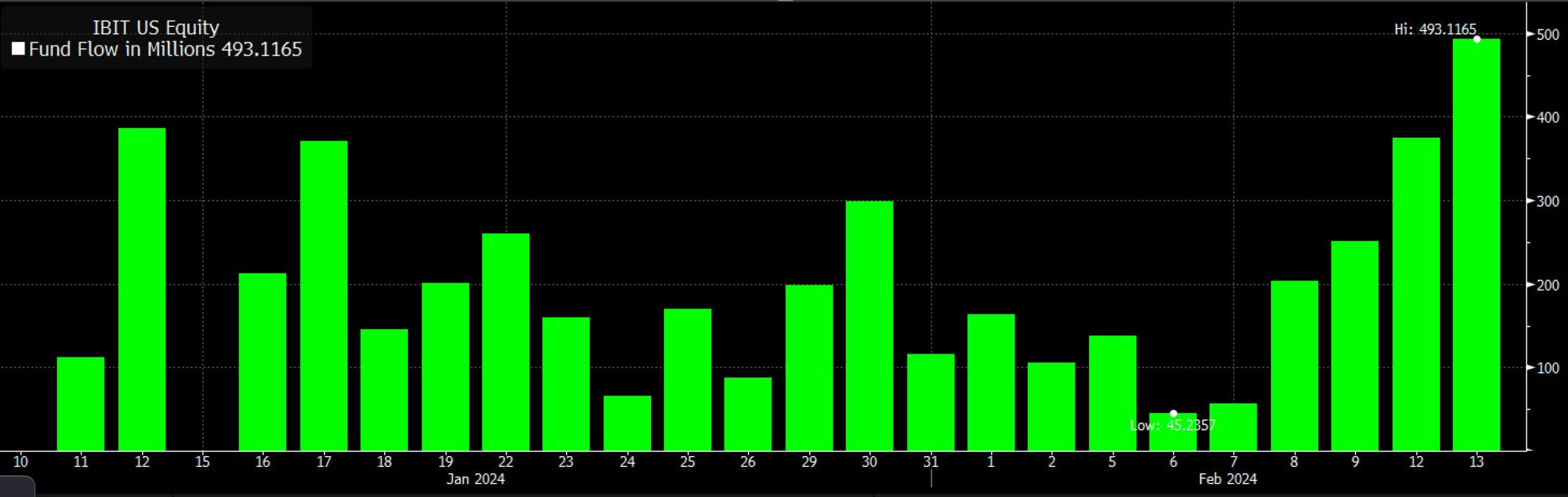

IBIT reached $493 million in each day volume on Feb. 13, with the entirety being inflows, per Farside Investors’ recordsdata, which reveals that IBIT’s volume has been rising constantly after hitting a document low on Feb. 6.

Comparatively, Grayscale Bitcoin Belief (GBTC) recorded $72.8 million in outflows on Feb. 13, indicating a critical slowdown in promote rigidity when compared with final month. The fund’s outflows comprise remained beneath the $100 million level for basically the most segment over the past week.

At 9:27 pm UTC on Feb. 14, Coinglass showed that GBTC used to be reporting $681 million in volume, while the Constancy Wise Starting effect Bitcoin Fund (FBTC) used to be at $455 million. The market’s seven various location Bitcoin ETFs had lower than $200 million in volume every.

BlackRock’s total inflows are location to surpass $5 billion once shopping and selling closes for the day, bringing its Bitcoin hoard to a small of over 96,669 BTC.

Meanwhile, FBTC is finish on its heels with total inflows of smartly suited beneath $4 billion.

High 7%

BlackRock’s IBIT is also the second biggest location Bitcoin ETF when ranked by market cap and is competing with about a of the largest prone funds in each day volume.

Grayscale’s GBTC, which existed as a non-alternate traded fund before it used to be converted to an ETF in January, has a vastly greater market cap of $24 billion but additionally has more critical outflows.

When ranked among all non-cryptocurrency ETFs, IBIT’s most novel market cap locations it among the many 250 biggest funds per rankings from 8marketcap.

Balchunas smartly-known:

“[$5 billion AUM] locations it in High 7% of all ETFs by dimension in smartly suited 23 shopping and selling days. “

Roughly 3,100 ETFs exist within the US at most novel.

Source credit : cryptoslate.com