BlackRock’s spot Bitcoin ETF surpasses $10B in AUM, faster than any other to date

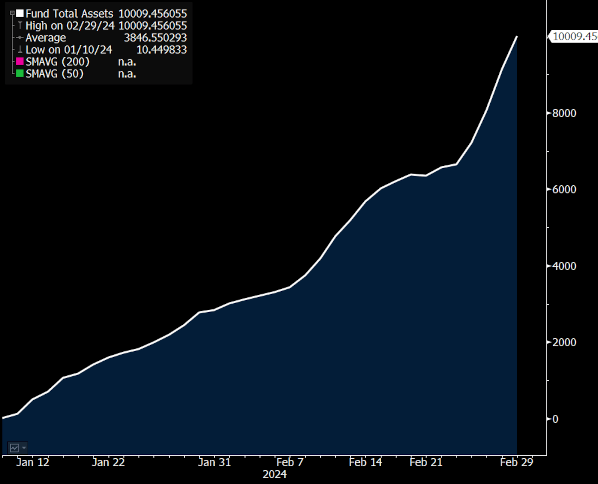

BlackRock’s iShares Bitcoin Belief (IBIT) now has bigger than $10 billion in sources under administration (AUM), in accordance with files from CoinGlass.

Bloomberg ETF analyst Eric Balchunas illustrious that IBIT is one of correct 152 alternate-traded funds (ETFs) that maintain reached the $10 billion mark. Currently, roughly 3,400 ETFs exist in complete.

He observed that IBIT is the quickest to reach $10 billion in AUM. The fund began trading not up to 2 months ago on Jan. 11, which technique that it reached its contemporary stage in not up to 2 months. ETF.com separately illustrious that the principle gold ETF failed to reach $10 billion in AUM for two years.

The competing Grayscale Bitcoin Belief (GBTC) stories a elevated AUM, with $27 billion in sources under administration. Alternatively, GBTC originated as an funding fund in 2013 forward of it became as soon as transformed to an ETF this year, and unlike BlackRock’s IBIT, it failed to launch with zero sources.

The third ideal roar Bitcoin ETF, the Fidelity Sharp Starting put Bitcoin Fund (FBTC), now holds $6.5 billion in sources under administration. All ten existing roar Bitcoin ETFs maintain $forty eight.2 billion in AUM mixed.

Causes for IBIT’s declare

Balchunas implied that IBIT’s rising AUM is which capacity that of inflows. He urged that ETFs in most cases fight to total the principle $10 billion in AUM as a result of that designate must designate from inflows, whereas the 2d $10 billion is more straightforward to total as a result of of market appreciation.

IBIT surpassed the $10 billion mark on March 1. Round that time, the ETF reported $7.7 billion in inflows since launch, including $603 million in inflows on Feb. 29. Basically based on Balchunas, this makes IBIT the ETF with the third-longest chase of inflows.

Rising Bitcoin prices will seemingly be an additional contributor to IBIT’s declare. As of March 4, Bitcoin is worth $67,200. Its designate is up 25.3% over the previous week and up 51.0% over two months.

Furthermore, clear monetary institutions, including Bank of The United States’s Merrill Lynch and Wells Fargo, maintain reportedly begun to present entry to BlackRock’s Bitcoin ETF and competing alternate-traded funds. This declare could well even maintain contributed to most neatly-liked declare.

Source credit : cryptoslate.com