BlackRock warned SEC lack of in-kind orders for Bitcoin ETF shares could hurt investors

A novel a part of the novel space Bitcoin ETFs, to boot-liked by the SEC, is the money-introduction mechanism for issuing and redeeming shares. The ETFs are thought of as commodity-shares ETFs, but, as BlackRock beneficial properties out in its iShares Bitcoin ETF (IBIT) prospectus, “all space-market commodities diversified than bitcoin, equivalent to gold and silver, employ in-form creations and redemptions with the underlying asset.”

In its filings, BlackRock strongly advocated for in-form orders for shares, but the SEC guided candidates toward a money-introduction model on account of the nature of particular regulatory processes. People allowed to aquire and sell shares of the belief (Authorized Participants) get to be registered dealer-dealers, which suggests they’re officially identified and must apply definite monetary suggestions. Steady now, it’s not determined how these dealer-dealers can apply these suggestions in the occasion that they’re coping with Bitcoin directly.

Attributable to this uncertainty, it’s unstable for these dealer-dealers to make teach of Bitcoin to aquire or sell shares of the belief. The SEC doubtlessly set apart not want allowed a product love this on the stock commerce if it’s unclear how the suggestions apply. Therefore, your whole ETF beneficial properties were updated from in-form to money-creates in December sooner than approval.

If the “NASDAQ receives the in-form regulatory approval” to permit procuring and promoting shares with Bitcoin directly in the cease, the ETFs will likely inquire of a commerce to permit in-form orders. On the other hand, we don’t know when this can happen or if this can happen in any recognize.

BlackRock’s peep on the money introduction model for Bitcoin ETFs

This facts has been accessible to merchants for the reason that Dec. 19 change to BlackRock’s S1 filing. On the other hand, following the a success open of the New child 9 ETFs and billions of bucks in volume, revisiting the arena’s greatest asset manager’s warning to the SEC relating to money-creates appears recommended. It’s significant to display that BlackRock is required to remark any discipline cloth dangers in its prospectus, so the inclusion of a capability remark of affairs skill it’s possible, not possible.

That stated, BlackRock does not mediate the money-introduction skill is efficient, pointing out that the belief’s present apply of procuring and promoting shares with money as a change of the utilization of Bitcoin directly may cause complications in keeping part prices aligned with Bitcoin’s proper worth.

It cautions that this mismatch may happen on story of cash transactions are extra advanced and take longer than notify Bitcoin transactions. It continues to title that delays in these transactions may imply that the prices passe to calculate the worth of the belief’s shares (NAV) may not precisely mirror the precise-time label of Bitcoin.

Extra, beneath a portion entitled ‘Chance Components Related to the Have faith and the Shares,’ BlackRock additionally warns of reduced arbitrage alternatives for Authorized Participants,

“The teach of cash creations and redemptions, as in opposition to in-form creations and redemptions, may adversely get an affect on the arbitrage transactions by Authorized Participants supposed to care for the worth of the Shares intently linked to the worth of bitcoin and, as a result, the worth of the Shares may tumble or otherwise diverge from NAV.”

In the cease, BlackRock warned that there is a probability that Authorized Participants may not get to proceed facilitating the belief in the occasion that they issue these delays and extra steps get turn into too unstable or costly. This reluctance may additionally originate it extra difficult to care for the belief’s part prices cease to the categorical worth of Bitcoin. If this methodology doesn’t work well, merchants may aquire shares for extra than they’re worth or sell them for much less. This is in a position to well cause losses for the shareholders.

BlackRock is a extra well-known imply for in-form orders than the model well-liked by the SEC. The prospectus says in-form part introduction and redemption is “mainly extra efficient, and on account of this truth much less costly, for space commodity commerce-traded merchandise.”

Bitcoin ETF NAV correlation with money introduction model.

Most apparently, BlackRock identifies money-introduction commodity-shares ETFs as “a novel product that has not been examined and may also be impacted by any ensuing operational inefficiencies.” Particularly, BlackRock highlights instances of “market volatility or turmoil” where money-creates may materially get an affect on the ETF’s capability to interchange.

“To boot as, the Have faith’s incapacity to facilitate in-form creations and redemptions, and ensuing reliance on money creations and redemptions, may cause the Sponsor to discontinue or suspend the introduction or redemption of Shares for the interval of instances of market volatility or turmoil, amongst diversified penalties.”

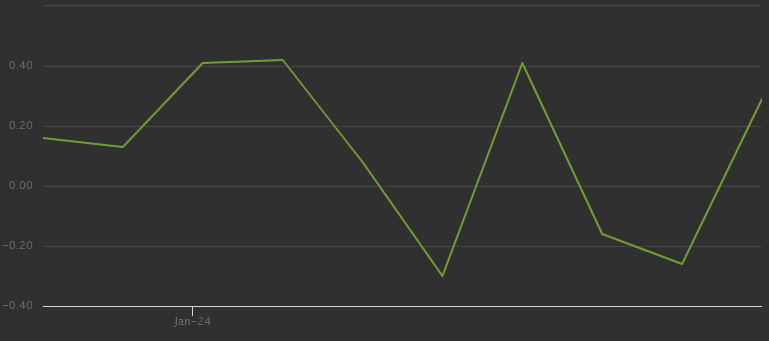

Since open, the NAV top class to lessen label spread has been not as much as 100bps, starting from +40bps to -30bps over ten trading days. By comparison, BlackRock’s iShares Core S&P 500 ETF (IVV) has not deviated extra previous +5bps and -11bps over the previous twelve months.

In a extra notify comparison, nonetheless, the iShares Gold Have faith (IAUM) has seen a selection of around +300bps over the previous twelve months. Its very best top class to gold used to be over +200bps, and the lowest carve again label used to be around -140bps.

On condition that IAUM can teach in-form orders for gold and BlackRock believes money-creates may make a extra unstable carve again label or top class for IBIT, merchants may wonder if lets mild inquire of it to eye deviations from the NAV previous 3% in the cease. Alternatively, per chance BlackRock’s resolve for in-form orders used to be a foretelling of the exodus from Grayscale, which, if dealt with in-form, may get merely seen Bitcoin leaving one ETF and flowing directly into one more as a change of being resold quite loads of instances.

The subsequent filing to eye out for regarding capability in-form Bitcoin ETF orders is whether or not the Nasdaq requests that Bitcoin be thought of as a viable asset for getting and promoting shares. Till then, the money introduction of shares will proceed.

Source credit : cryptoslate.com