Bitwise CIO downplays price ‘hiccup’ amid Bitcoin bull trend after FOMC shakes markets

Bitwise CIO downplays designate ‘hiccup’ amid Bitcoin bull pattern after FOMC shakes markets

Bitwise CIO downplays designate ‘hiccup’ amid Bitcoin bull pattern after FOMC shakes markets Bitwise CIO downplays designate ‘hiccup’ amid Bitcoin bull pattern after FOMC shakes markets

Bitwise CIO reassures merchants with optimism rooted in technological development and coverage toughen for Bitcoin.

Veil art/illustration by means of CryptoSlate. Image involves mixed allege that would possibly perhaps contain AI-generated allege.

Bitcoin’s designate skilled a engaging pullback following the US Federal Reserve’s most modern rate lower, but market consultants esteem Bitwise CIO Matt Hougan remain optimistic referring to the asset’s long-timeframe trajectory.

On Dec. 18, the Federal Reserve introduced a 25-basis-level rate lower, scaling abet its outlook for 2024 to 2 cuts in situation of the beforehand expected four.

Additionally, and likely more vastly for Bitcoin, Chair Jerome Powell added that the Fed cannot preserve BTC below most modern regulations whereas responding to inquiries about President-elect Donald Trump’s strategic reserve plans.

This precipitated significant market reactions, with Bitcoin’s designate falling to as microscopic as $98,839 earlier than stabilizing at $101,586 earlier this day. Similarly, other high digital assets esteem Ethereum, XRP, and Solana also recorded losses of spherical 5%, 5.5%, and 3%, respectively.

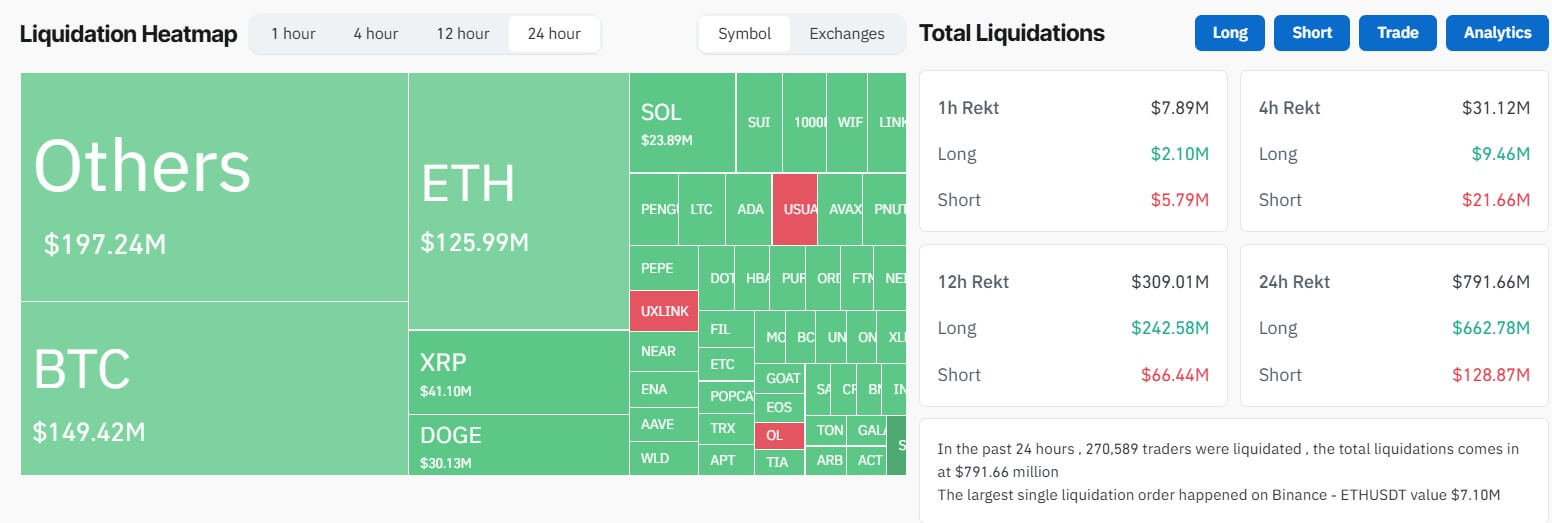

Files from CoinGlass reveals that this purple market efficiency led to spherical $800 million in liquidation, impacting more than 270,000 merchants. Traders speculating on upward designate motion suffered the most losses, losing $662 million all the draw by means of the closing 24 hours.

Previous crypto, mature markets esteem the S&P 500 and the Russell 2000 Index skilled 3% and 4.4% declines, respectively.

Bitcoin’s long-timeframe trajectory

Despite this pullback, Hougan reassured merchants that Bitcoin’s fundamentals remain grand.

The Bitwise CIO outlined that Bitcoin’s most modern resilience stems from interior crypto-particular factors, akin to rising institutional adoption, pro-crypto shifts in US coverage, and authorities and company Bitcoin purchases.

He also highlighted significant blockchain advancements and rising ETF flows as extra drivers of market energy.

Furthermore, Bitcoin’s technical indicators remain favorable, with its 10-day exponential engaging realistic ($102,000) nonetheless above the 20-day exponential engaging realistic ($Ninety nine,000). Hougan views this as a bullish signal, reinforcing his perception that the most modern dip is a momentary fluctuation quite than the terminate of the ongoing bull market.

Despite exterior pressures, Hougan predicted that Bitcoin would proceed its multi-year upward trajectory, buoyed by grand adoption trends and technological advancements within the crypto situation.

He concluded:

“Crypto’s in a multi-year bull market. 50bps of projected rate cuts won’t alternate that.”

Mentioned on this text

Source credit : cryptoslate.com

Farside Investors

Farside Investors