Bitcoin’s price drop created $441 million buying frenzy for crypto investment products

Bitcoinâs label drop created $441 million shopping frenzy for crypto investment merchandise

Bitcoinâs label drop created $441 million shopping frenzy for crypto investment merchandise Bitcoinâs label drop created $441 million shopping frenzy for crypto investment merchandise

CoinShares seen that patrons diverse their funds within the route of various digital sources previous Bitcoin final week.

Duvet art/illustration through CryptoSlate. Image contains mixed shriek material that will consist of AI-generated shriek material.

Bitcoin’s newest label struggles presented patrons with “shopping alternatives,” resulting within the influx of $441 million into crypto-linked investment merchandise, in accordance to CoinShares‘ newest yarn.

James Butterfill, the head of compare at CoinShares, explained that digital sources experienced heavy volatility final week because of the promoting pressures from the German government and recordsdata of defunct Mt. Gox’s repayments.

These elements prompted Bitcoin’s label to drop greatly, hitting a five-month low under $55,000. It additionally recorded one of basically the predominant market liquidations since the FTX crumple in 2022.

Butterfill pointed out that the “label weak point” presented a “shopping opportunity” for patrons having a mark to set up exposure to the emerging industry.

This influx marks a turnaround after three consecutive weeks of outflows. Nevertheless, Alternate-Traded Product (ETP) volumes remained low at $7.9 billion.

Butterfill added:

“Volumes in Alternate Traded Merchandise (ETPs) remained moderately low at $7.9 billion for the week, reflecting the same outdated seasonal pattern of decrease volumes within the summertime months. This represents a 17% decrease participation price as in contrast with the full market for trusted exchanges.”

Traders spread tentacles

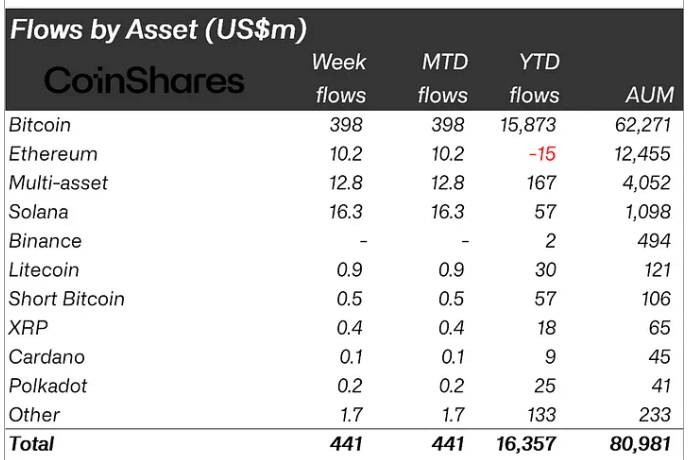

CoinShares notorious that patrons were prepared to spread their funds within the route of various digital sources, which reduced Bitcoin’s usual dominance to 90% of the full inflows. In step with the agency, the flagship digital asset seen inflows totaling $398 million, bringing its 365 days-to-date depart alongside with the circulation to $15.8 billion.

In the meantime, high altcoins admire Solana additionally seen principal inflows, reflecting patrons’ diversification programs. Remaining week, investment merchandise linked to Solana purchased $16 million in inflows, bringing their 365 days-to-date flows to $57 million.

In the same vogue, Ethereum seen a particular shift with $10 million in inflows. Nevertheless, it stays basically the most productive ETP with a get outflow of $15 million 365 days-to-date.

A form of altcoins, comparable to Polkadot, XRP, Litecoin, and Cardano, seen cumulative inflows of larger than $1 million.

Mentioned on this text

Source credit : cryptoslate.com