Bitcoin’s halving fails to stem $206 million outflows as investors shift to altcoins like Polkadot

Bitcoin’s halving fails to stem $206 million outflows as investors shift to altcoins indulge in Polkadot

Bitcoin’s halving fails to stem $206 million outflows as investors shift to altcoins indulge in Polkadot Bitcoin’s halving fails to stem $206 million outflows as investors shift to altcoins indulge in Polkadot

Analysts outlined that the fresh outflow vogue used to be being influenced by the high curiosity fee fears.

Quilt art/illustration via CryptoSlate. Image entails combined voice that might perhaps well well encompass AI-generated voice.

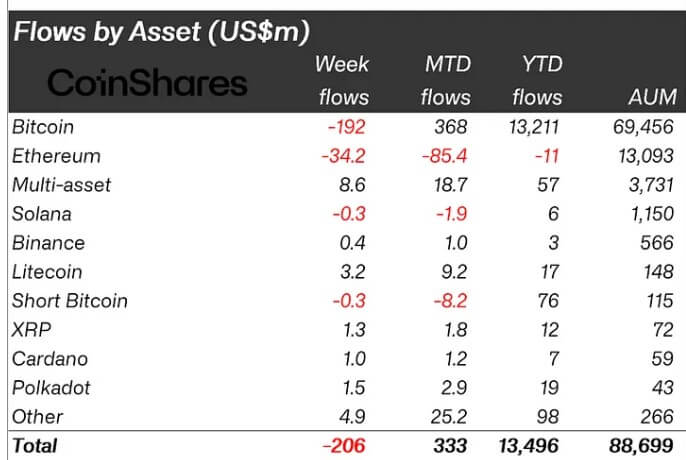

Crypto-linked investment merchandise saw their second consecutive week of outflows in April, with roughly $206 million leaving the market, per CoinShares‘ most up-to-date weekly memoir.

No topic Bitcoin’s most up-to-date halving, which in total generates excitement in the market, investor curiosity in the leading digital asset remained subdued, evidenced by outflows totaling $192 million.

Conversely, non permanent investors seized the numerous equipped by the halving event to enhance their positions, injecting $300,000 into the market.

What is fuelling the outflows?

One day of the previous week, CryptoSlate reported that US-based fully Bitcoin (BTC) swap-traded funds (ETFs) skilled five consecutive days of outflows. These outflows were basically pushed by Grayscale’s GBTC, ProShares BITO, and Ark 21 Shares’ ARKB.

James Butterfill, the Head of Compare at CoinShares, elucidated that these outflows signify a dwindling curiosity among ETP/ETF investors. The vogue stems from speculations that the Federal Reserve might perhaps well perhaps opt to delay fee cuts further.

Additionally, Butterfill pointed out a parallel decline in trading volumes of ETPs, which clocked in at $18 billion closing week. He emphasized that these volumes now symbolize a lesser fragment of complete BTC volumes, marking a shift from 55% a month previously to twenty-eight%.

Altcoins map curiosity

Merchants are an increasing selection of favoring lesser-known altcoins over most main cryptocurrencies indulge in Solana and Ethereum.

Primarily based fully on the memoir, altcoins equivalent to Chainlink, Polkadot, Litecoin, Cardano, and XRP collectively attracted over $7 million in inflows closing week.

Meanwhile, Ethereum has persisted its downward vogue, with closing week marking the sixth consecutive week of outflows totaling $34 million. Its month-to-date drift remains destructive at $85 million, with a year-to-date drift also in destructive territory, amounting to $11 million.

Solana skilled extra modest outflows of $300,000, whereas blockchain equities recorded their 11th consecutive week of outflows, reaching $9 million.

Butterfill attributed the outflows from blockchain equities to investor considerations referring to the affect of mining halving on mining companies.

Mentioned listed right here

Source credit : cryptoslate.com