Bitcoin tumbles under $39,000 triggering $115M liquidation in 1 hour

Bitcoin’s (BTC) dip beneath the $39,000 label resulted in important liquidations totaling approximately $115 million all around the cryptocurrency market all around the previous hour.

Crimson market

Within the final 24 hours, BTC skilled a 4% decline, procuring and selling at $38,915 as of press time, in step with records from CryptoSlate. This downturn reduced its market capitalization by around $40 billion, settling at $767 billion.

BitMEX co-founder Arthur Hayes rapid that Bitcoin’s latest designate pattern would per chance also persist till the raze of the month, influenced by the US Treasury’s quarterly refunding announcement.

Simultaneously, Ethereum (ETH) witnessed a 6% fall, reaching $2,230. The decline in ETH’s designate would per chance also be attributed to very broad selling tension from its Basis and fund movements connected to the distressed crypto entity Celsius.

Celsius transferred around 13,000 ETH (approximately $30.87 million) to Coinbase and 2,200 ETH (roughly $5.12 million) to FalconX, whereas the Ethereum Basis sold $1.6 million of the digital asset.

Long merchants nervous

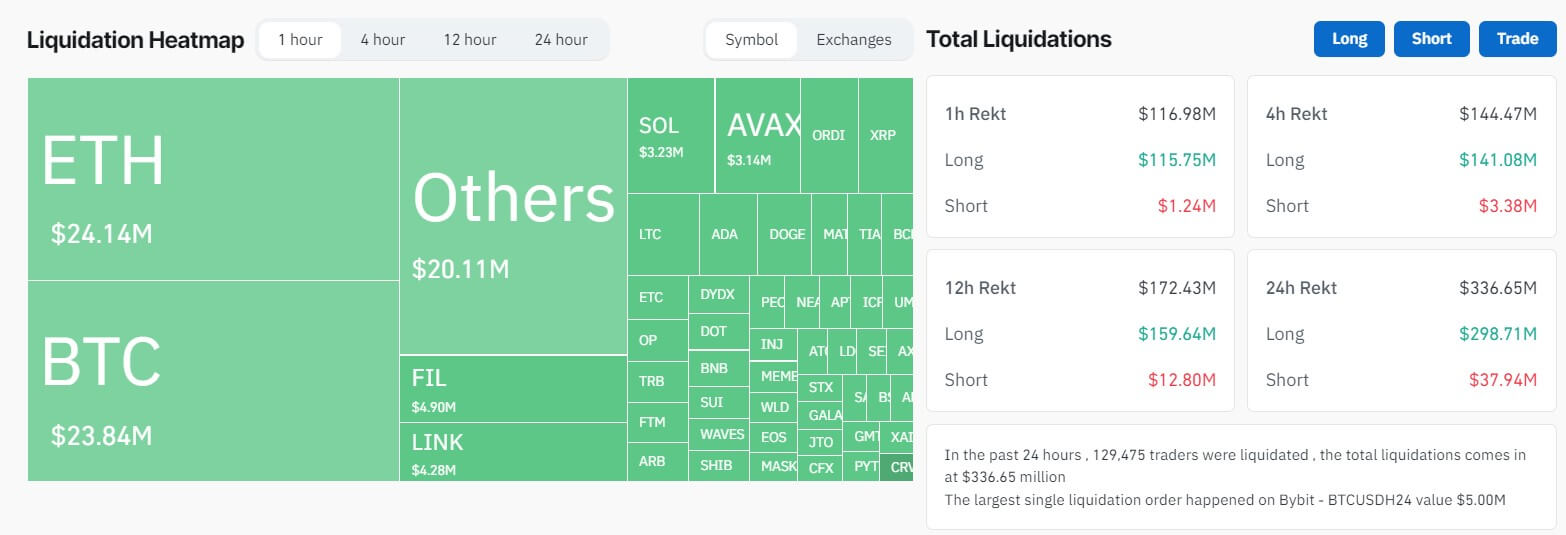

Files from Coinglass shows big losses for merchants waiting for further market designate will increase. For context, lengthy merchants misplaced $115 million all around the previous hour by myself.

When the timeframe is extended to 24 hours, lengthy merchants’ losses quantity to virtually $300 million, whereas those with bearish market positions incurred a more modest $38 million in losses all over this reporting duration.

Bitcoin merchants bore the brunt of the downturn, shedding better than $80 million, with better than 60% of those losses attributed to lengthy positions. Primarily the most important person liquidation turned into a $5 million wager on BTC’s designate lengthen on Bybit.

Equally, Ethereum speculators confronted total liquidations of around $70 million, with the huge majority of losses—approximately $60 million—stemming from merchants making a bet on ETH designate will increase.

Traders holding positions in quite loads of valuable digital currencies also skilled big losses, with Solana, XRP, Dogecoin, and Ordinal seeing liquidations of $16 million, $4 million, $5 million, and $6 million, respectively.

Examining exchanges, Binance, the largest cryptocurrency exchange by procuring and selling volume, saw merchants collectively lose $98 million, whereas OKX reported liquidations totaling $71 million. Other crypto platforms, at the side of ByBit and HTX, witnessed a combined loss of $63.52 million amongst their merchants.

Source credit : cryptoslate.com