Bitcoin tumbles to lowest price since mid-May under $64k

Bitcoin tumbles to lowest designate since mid-Would possibly presumably presumably below $64k

Bitcoin tumbles to lowest designate since mid-Would possibly presumably presumably below $64k Bitcoin tumbles to lowest designate since mid-Would possibly presumably presumably below $64k

The payment performance wiped $20 million from crypto traders internal 1 hour.

Duvet art/illustration by strategy of CryptoSlate. Image involves blended utter that would encompass AI-generated utter.

Bitcoin has plummeted to below $64,000, its lowest level since mid-Would possibly presumably presumably, pushed by heightened promoting stress available within the market.

BTC has basically traded downwards or sideways after exceeding the $70,000 word before the total lot up of the month. Since then, the flagship asset has shed greater than 10% of its reach all the contrivance in which by this period.

Why is BTC falling?

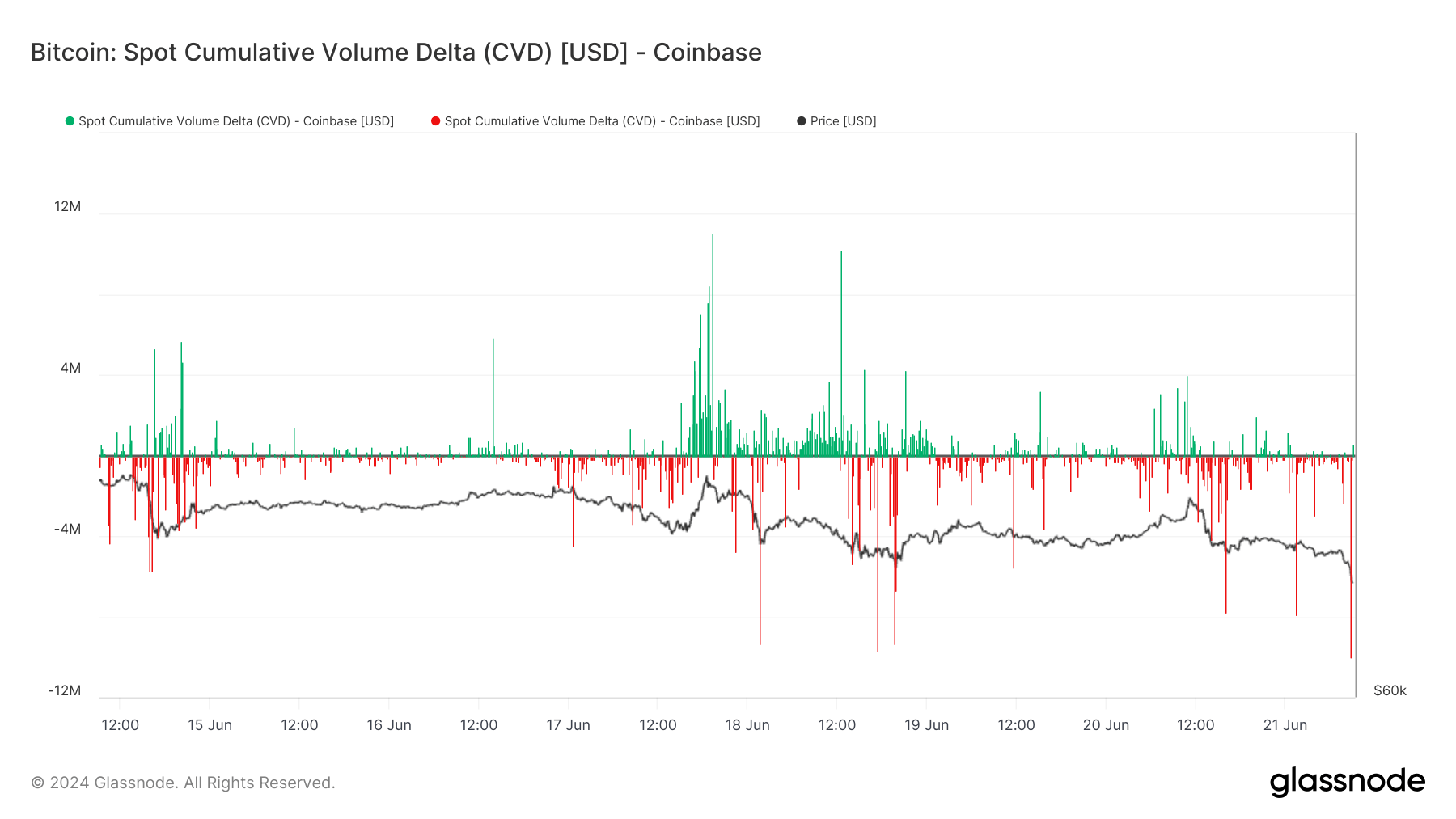

On-chain records finds that some recent promoting stress originated from Coinbase, the ideal US-primarily based fully crypto exchange. Glassnode records shows that the platform skilled $10 million in situation-promoting deliver, marking the most life like amount internal a 10-minute window in a week.

Particularly, the German authorities is also contributing to the most modern promoting stress, shifting $600 million in BTC on June 19, with $195 million despatched to four exchange addresses, in conjunction with Kraken, Bitstamp, and Coinbase.

Market consultants be pleased attributed BTC’s most modern designate weakness to increased outflows from the US-primarily based fully situation Bitcoin exchange-traded funds (ETFs). While curiosity in these ETFs surged after their approval in January, leading to over $fifty three billion inflow, the past week has seen obtain outflows exceeding $900 million.

Furthermore, BTC miners were offloading their holdings as a result of financial stress launched by the recent halving tournament. Bitcoin analyst Willy Woo acknowledged BTC’s designate would entirely enhance “when aged miners die and hash payment recovers.”

$20 million liquidation in 1 hour

Coinglass records finds that the market downturn liquidated round $20 million in crypto positions all the contrivance in which by the past hour, totaling $150 million within the most effective 24 hours.

A closer uncover on the liquidations indicates that prolonged traders who guess on designate will increase confronted the most important losses, shedding $106 million. In disagreement, short traders, retaining a more bearish outlook, were liquidated for $44 million.

Bitcoin traders skilled the most life like losses, totaling $42 millionâ$26 million from prolonged positions and $16 million from short positions. Ethereum traders followed carefully, with liquidations reaching approximately $28 million.

The most important single liquidation came about on Bybit, attractive a BTCUSD transaction valued at $8.09 million.

Talked about listed here

Source credit : cryptoslate.com