Bitcoin trades at discount in Korea destroying historical ‘Kimchi Premium’

Bitcoin trades at discount in Korea destroying historical âKimchi Premiumâ

Bitcoin trades at discount in Korea destroying historical âKimchi Premiumâ Bitcoin trades at discount in Korea destroying historical âKimchi Premiumâ

Home and worldwide pressures reshape South Koreaâs Bitcoin market, favoring different sources.

Quilt artwork/illustration by plan of CryptoSlate. Image involves blended allege which could well embrace AI-generated allege.

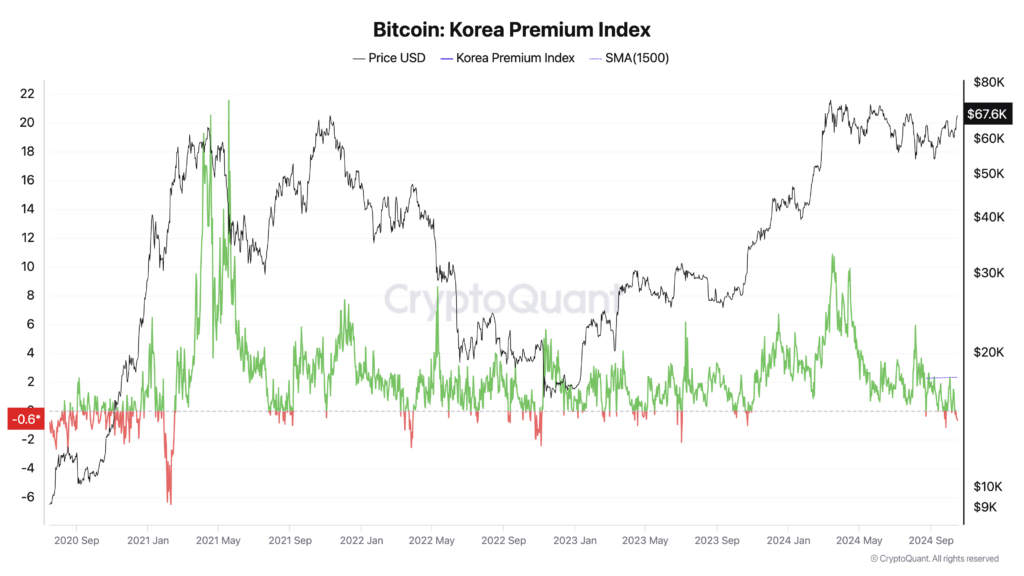

Bitcoin is trading at a discount on South Korean exchanges, reversing the veteran “kimchi top charge” that has historically signaled bullish market sentiment.

Per The Korea Instances, the cryptocurrency is priced roughly 700,000 obtained ($511.73) lower domestically when in contrast to world exchanges, leading to a detrimental top charge (discount) of -0.74% as of Thursday afternoon.

This shift appears to counsel a bearish outlook amongst South Korean merchants. In overall, a elevated kimchi top charge signifies stable local demand and sure sentiment, on the total leading to Bitcoin prices exceeding world rates. In distinction, a lower or detrimental top charge displays weakened enthusiasm and lowered procuring for stress, doubtlessly signaling a market correction or alignment with world valuations.

Analysts attribute this weird and wonderful discrepancy to subdued investor sentiment in South Korea and elevated demand for digital sources on international platforms. KP Jang, head of Xangle Research, advised the Korea Instances that restrictions prevent international and institutional merchants from gaining access to domestic exchanges, amplifying the impact of declining retail investor demand.

A shift in dealer preferences toward altcoins is also influencing the market. As Bitcoin surged globally, Korean merchants started amassing undervalued different cryptocurrencies, looking ahead to a stable fourth-quarter rally, as reported by Substitute Insider. These altcoins, including Tao, Sei Network, Aptos, Sui, NEAR Protocol, and The Graph, are perceived as offering elevated returns, doubtlessly diverting attention far from Bitcoin.

Declan Kim, a study analyst at DeSpread, also advised the Korea Instances that the altcoin market, which comprises a serious fraction of domestic trading, continues to battle amid transitional phases of most fashionable rules. The implementation of the Digital Asset User Protection Act is affecting market forces. Many altcoins remain unlisted on domestic exchanges when in contrast to international ones, and the ban on market-making makes securing liquidity robust.

The kimchi top charge has historically been an indicator of South Korea’s crypto market. When Bitcoin surpassed the 100 million obtained designate domestically in March, the highest charge temporarily spiked to as much as 10%. A elevated top charge on the total signifies stable local demand and bullish sentiment, on the total coinciding with or previous Bitcoin designate rallies. Conversely, a lower or detrimental top charge suggests bearish sentiment and lowered procuring for stress.

Files signifies a principal decline in Bitcoin-Korean obtained (BTC/KRW) trading volume over the final 40 days, reflecting a shift in investor heart of attention.

Analysts query the reverse kimchi top charge to be transient. Jang anticipates that the discrepancy will unravel quickly, as such premiums personal incessantly persisted for long sessions. He mentioned that ongoing discussions about regulations to allow company investments in digital sources could well make stronger liquidity on domestic exchanges and gradually lower the designate gap with international markets.

Perchance the most fashionable trading conditions mirror a posh interplay of domestic rules, investor behaviors, and world market trends, signaling important shifts interior South Korea’s crypto panorama. The detrimental kimchi top charge, though weird and wonderful, could well in the consequence in a extra balanced and dilapidated market as it aligns extra closely with world digital asset valuations.

The final time the Kimchi Top charge fell detrimental used to be in Oct. 2023, correct sooner than Bitcoin’s ETF-fueled bull speed.

Source credit : cryptoslate.com