Bitcoin short-term holder realized price growth hits a speed bump

Bitcoin temporary holder realized rate growth hits a tempo bump

Bitcoin temporary holder realized rate growth hits a tempo bump Bitcoin temporary holder realized rate growth hits a tempo bump

Realized rate metric shows well-known funding at peak bitcoin costs

Cowl art work/illustration by technique of CryptoSlate. Image comprises mixed screech which would possibly well well consist of AI-generated screech.

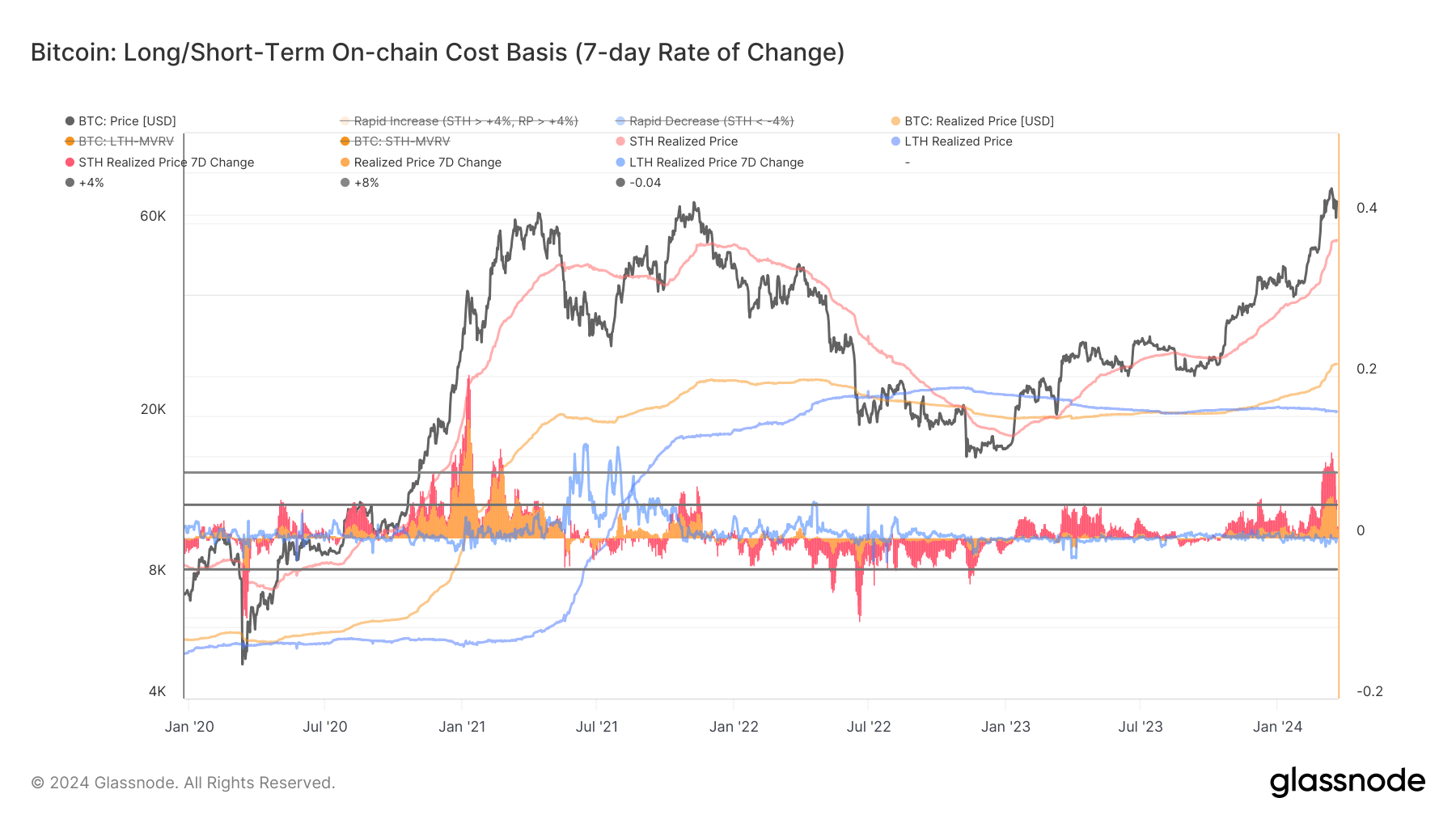

The realized Bitcoin rate represents the everyday on-chain acquisition rate. It’s a at hand metric because it perfectly gauges the market’s valuation baseline at any given level. When dissected by map of the lens of temporary and long-term holders, it offers insights into the cohorts’ funding horizons and their acute attain on Bitcoin’s rate.

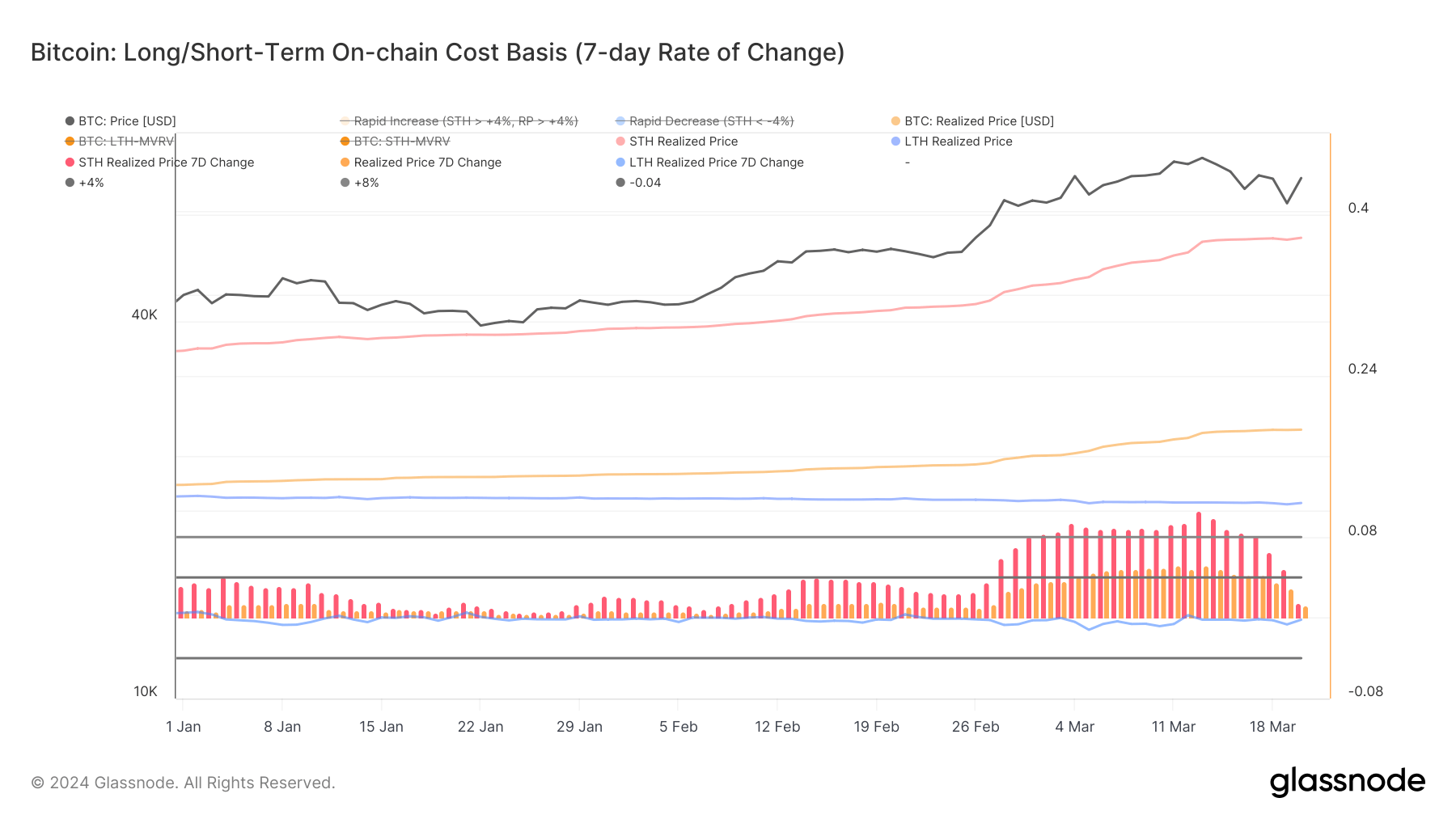

These cohorts’ 7-day commerce in realized rate offers a great better metric visualization. The 7-day commerce in realized rate for temporary holders reached its three-year excessive on Mar. 13, at 10.62%. The 7-day commerce in realized rate for long-term holders the identical day stood at -0.183%, representing a minute lower from the old weeks.

This divergence between STH and LTH realized costs suggests a essential influx of temporary speculative hobby into the market. New market participants maintain been entering at bigger rate phases than long-term holders between Mar. 6 and Mar. 13, riding the cohort’s realized rate up. The upward thrust in STH realized rate culminating on Mar. 13, when Bitcoin’s rate peaked at above $73,100, implies that well-known investments maintain been made at or come peak costs.

Monitoring changes in realized costs for every LTHs and STHs is key thanks to their capacity to explain shifts in market sentiment and capacity rigidity factors. As an illustration, a rising STH realized rate, namely with Bitcoin’s rate make bigger, can signal increasing optimism or speculative query as newer entrants are involving to make investments at bigger rate phases. The quite real or reducing LTH realized rate commerce suggests a retain sentiment amongst long-term investors, who would possibly well well not switch their holdings despite rate fluctuations, thus anchoring the market’s foundational notion of rate.

The knowledge from Glassnode confirmed a market at a capacity inflection level. The dramatic make bigger in STH realized rate commerce, alongside a serious make bigger in Bitcoin’s rate, indicated a transient bullish sentiment driven by speculative trading and new entrants attracted by the momentum. Alternatively, spikes as arresting as the one seen on Mar. 13 now and again final longer than a couple of weeks before experiencing a serious correction, which is precisely what took place prior to now week.

The 7-day commerce in temporary holder realized rate dropped by 1.469% by Mar. 20, following Bitcoin’s lower to $61,000 and a subsequent recovery to $68,000. This arresting descend shows that the speculative enthusiasm cooled down, and the market entered a consolidation section. Files means that the shopping momentum and optimism that drove the well-known make bigger in STH realized rate and, by extension, Bitcoin’s rate has tempered, leading to a extra cautious market sentiment.

Several interpretations is also drawn from this data level. In the starting keep, the reduction in the rate of commerce in STH realized rate would possibly well well perchance explain that the influx of contemporary capital at bigger valuation phases has slowed. The simultaneous lower in each the STH realized rate commerce and Bitcoin’s market rate can also suggest a low cost in promote-side rigidity from temporary holders.

Infrequently, a excessive STH realized rate commerce, namely when it devices a file because it did on Mar. 13, would possibly well well perchance explain a heightened probability of promoting converse as temporary holders see to capitalize on gains. Alternatively, as this rigidity subsides, it will stabilize costs, albeit at a stage lower than the new highs, as the market absorbs the outcomes of old speculative trading.

Taking a look forward, this duration of recalibration would possibly well well perchance pave the map in which for resistance to be created at this rate stage, because it lets available in the market to digest contemporary gains. Furthermore, the behavior of long-term holders will continue to be a excessive component to video show, as their steadiness amidst volatility generally serves as an anchor for the market’s steadiness.

Source credit : cryptoslate.com