Bitcoin sees return of Kimchi Premium in South Korea and CME futures market

Bitcoin’s impress premiums gain resurfaced amidst the most contemporary bullish fervor intelligent the market.

Kimchi top fee

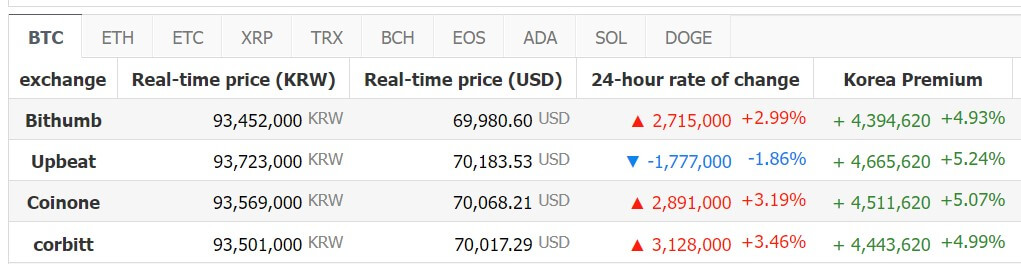

Info unearths BTC trading at a $4,000 top fee in South Korea compared with other markets. As of press time, Bitcoin was priced at $66,893 on Binance, while Korean platforms adore Upbit, Coinone, and Bithumb boasted prices spherical $70,000.

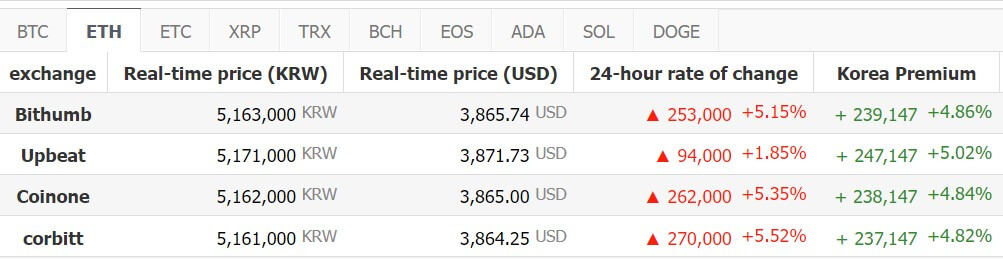

This top fee fashion extends to Ethereum, the second-largest crypto by market cap. ETH commands spherical $3,900 on Korean platforms, whereas it hovers spherical $3,600 on other exchanges.

The Kimchi top fee denotes a instruct the set a digital asset’s impress is notably greater on South Korean exchanges than in US or European markets, opening up arbitrage alternatives for traders with access to each and each markets.

Usually seen as a bullish indicator, the Kimchi top fee suggests elevated buyer narrate within the Korean market. The highest fee is additionally venerable to infer sturdy engagement with digital assets in South Korea.

CryptoQuant’s CEO Ki Young Ju no longer too long within the past highlighted sturdy institutional build aside a query to for BTC in Korea, citing smartly-liked adoption even among older demographics on platforms adore Upbit.

Whereas the most contemporary top fee resurgence isn’t unparalleled, it echoes earlier occurrences, notably in some unspecified time in the future of bullish cycles such as in 2021 when BTC commanded a good deal greater prices on South Korean exchanges than Coinbase and other major platforms.

CME Top class

Similarly, several market observers gain acknowledged BTC trading at a top fee of over $69,000 on the Chicago Mercantile Alternate (CME) futures, a new all-time excessive.

They outlined that this indicates that traders are prepared to pay a top fee for the CME due to they think that the fee of BTC will continue to develop regardless.

On-chain analytical platform CoinGlass knowledge reveals that CME’s BTC birth passion hit a file excessive of virtually $10 billion in some unspecified time in the future of the past day, while the final birth passion on the flagship asset totals a file excessive of $32.36 billion.

Source credit : cryptoslate.com