Bitcoin sees $621 million outflow as investors react to Fed’s cautious stance

Bitcoin sees $621 million outflow as investors react to Fed’s cautious stance

Bitcoin sees $621 million outflow as investors react to Fed’s cautious stance Bitcoin sees $621 million outflow as investors react to Fed’s cautious stance

Ethereum defies construction with $13 million inflows amid tall crypto outflows.

Masks art/illustration by skill of CryptoSlate. Image consists of mixed verbalize material which could also consist of AI-generated verbalize material.

CoinShares’ most contemporary weekly document highlighted a essential shift in crypto funding products, with the sphere experiencing its significant outflows in three months.

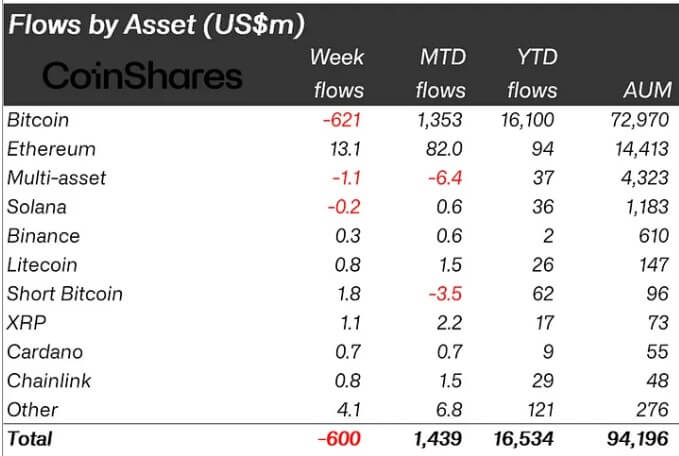

Final week, investors pulled $600 million from the market, with Bitcoin products bearing the brunt, facing $621 million in outflows.

In the intervening time, quick-Bitcoin products noticed almost $2 million in inflows, reflecting the bearish sentiment.

James Butterfill, CoinShares’ head of be taught, attributed these transferring sentiments to a “more hawkish-than-anticipated FOMC assembly.” Final week, the Federal Originate Market Committee of the US Federal Reserve made up our minds to defend the composed ardour rate, which many experts instructed supposed there could well presumably be most fascinating one who you should well imagine rate sever this twelve months.

Butterfill explained that this pass has forced investors to lower their exposure to fixed-provide resources adore Bitcoin. He added:

“These outflows and recent impress sell-off noticed total resources under management (AuM) drop from above $100 billion to $94 billion over the week.”

In the intervening time, the bearish construction in the US perceived to grasp impacted other countries. Canada, Switzerland, and Sweden noticed outflows of $15 million, $24 million, and $15 million, respectively. However, Australia, Brazil, and Germany noticed modest inflows of $1.7 million, $700,000, and $17.4 million, respectively.

Moreover, the trading volume for crypto ETPs modified into as soon as $11 billion last week, drastically lower than the $22 billion weekly common. Despite this, these products accounted for 31% of all trading volumes on significant exchanges.

Inflows proceed in altcoin.

Despite the bearish construction for Bitcoin, most altcoins had a definite week, attracting significant funds.

Ethereum persevered its upward trajectory with an further $13.1 million in inflows, bringing its month-to-date total to $82 million. Its turnaround could well presumably be attributed to the highly anticipated delivery of advise Ethereum substitute-traded fund (ETF) products in the US, which experts mediate would enhance market accessibility for the emerging substitute.

In the intervening time, other altcoins adore Cardano and Lido attracted greater than $1 million, whereas other resources adore Litecoin, Chainlink, and others noticed modest flows.

Talked about on this article

Source credit : cryptoslate.com