Bitcoin sees $543 million in inflows after Powell’s dovish remarks

Bitcoin sees $543 million in inflows after Powell’s dovish remarks

Bitcoin sees $543 million in inflows after Powell’s dovish remarks Bitcoin sees $543 million in inflows after Powell’s dovish remarks

The mountainous $543 million Bitcoin inflows is the excellent in the closing 5 weeks.

Quilt art work/illustration through CryptoSlate. Image entails blended tell which can also encompass AI-generated tell.

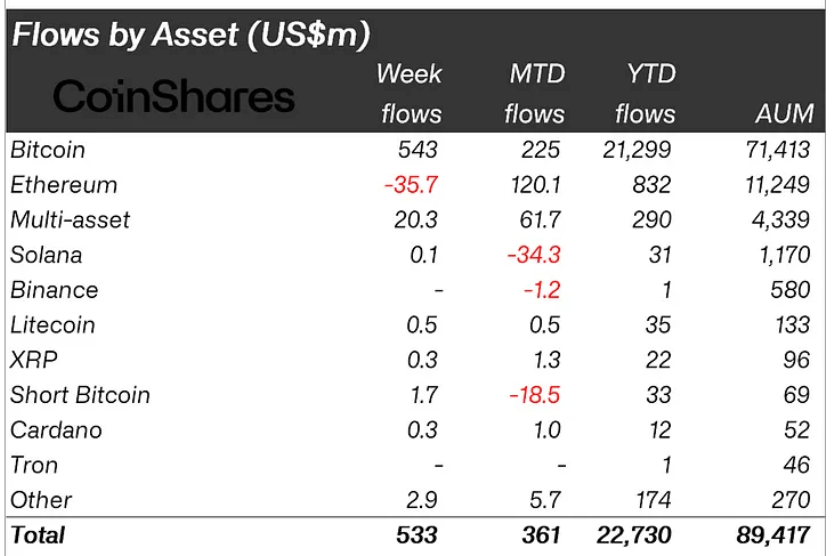

In accordance to CoinShares’ latest weekly fund shuffle alongside with the stream sage, crypto investment products noticed their finest inflows in 5 weeks, with $533 million pouring into the field.

James Butterfill, head of analysis at CoinShares, defined that these inflows adopted remarks by US Federal Reserve Chair Jerome Powell at the Jackson Gap Symposium closing week.

At the event, Powell hinted that the market would possibly maybe well ask curiosity fee cuts in September, which many market observers suggested were bullish for Bitcoin and diverse crypto.

This assertion also perceived to believe boosted trading volumes, with closing week’s volume reaching $9 billion, significantly better than in old weeks.

Bitcoin, US lead

Bitcoin dominated the inflows, with $543 million, most of which came about on Friday after Powell’s dovish feedback. Butterfill said that this additional indicated Bitcoin’s sensitivity to curiosity fee expectations.

Curiously, the bullish sentiment also attracted fast trades, with $1.7 million flowing into Brief BTC products.

Conversely, Ethereum confronted outflows totaling $36 million closing week. This would possibly maybe well be due to the continuing investors’ exit from Grayscale’s Ethereum Belief. Butterfill wrote:

“Though unusual issuers proceed to peep inflows with the Grayscale Ethereum believe offsetting this with $118 million outflows.”

No subject this, the newly launched Ethereum ETFs in the US believe accumulated $3.1 billion in inflows, which partially offsets the $2.5 billion outflow from the Grayscale Belief.

Within the intervening time, blockchain equities recorded inflows for the third consecutive week, totaling $4.8 million. Varied digital resources fancy Solana, XRP, and Litecoin noticed blended inflows of around $1 million.

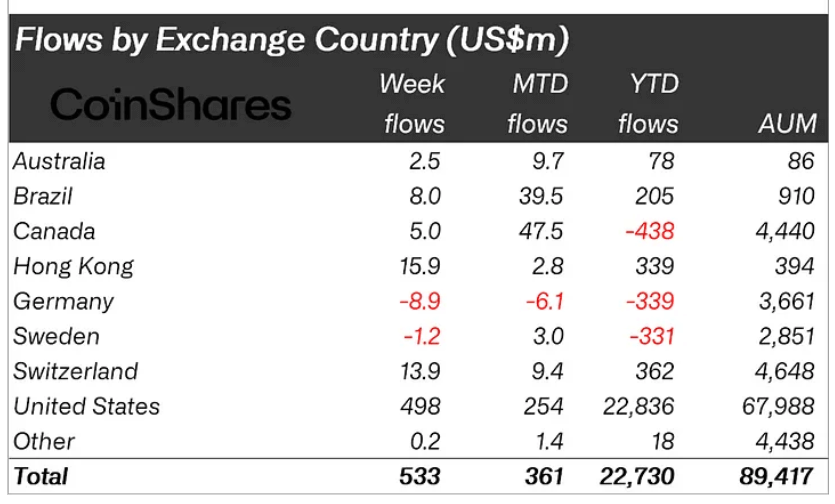

Across regions, the US unsurprisingly accounted for nearly the total total inflows, with $498 million. Hong Kong and Switzerland also noticed valuable inflows, reaching $16 million and $14 million, respectively.

In distinction, Germany skilled minor outflows totaling $9 million, making it one of the few countries with a 300 and sixty five days-to-date web outflow.

Talked about in this article

Source credit : cryptoslate.com