Bitcoin power law model suggests $30K floor, $1M potential this cycle

Bitcoin energy legislation model suggests $30K floor, $1M doable this cycle

Bitcoin energy legislation model suggests $30K floor, $1M doable this cycle Bitcoin energy legislation model suggests $30K floor, $1M doable this cycle

Giovanni Santostasi's Bitcoin Vitality Legislation model predicts a 'floor' of $30,000, never to be breached all over again.

Quilt art work/illustration through CryptoSlate. Image entails blended advise material that may presumably presumably contain AI-generated advise material.

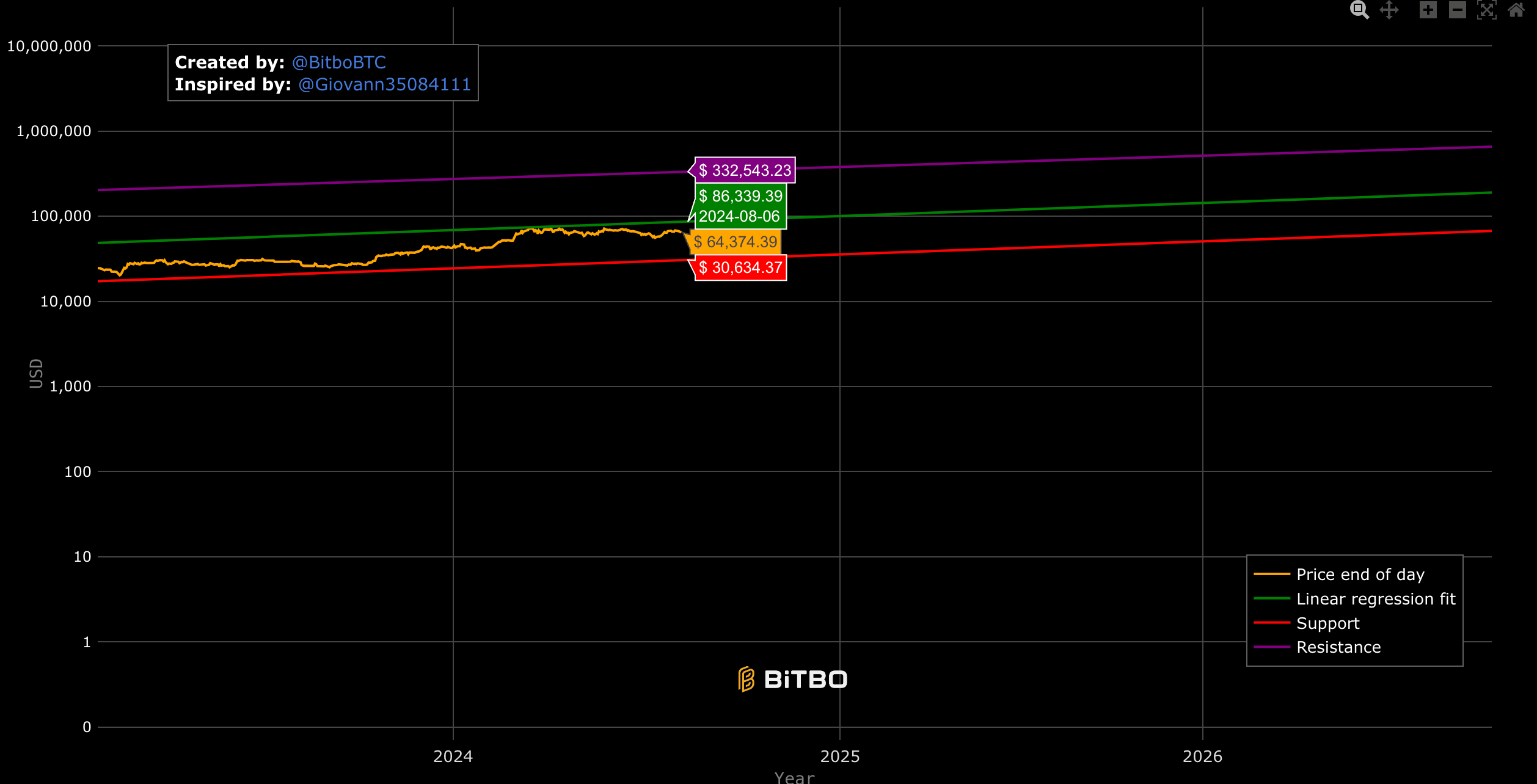

Giovanni Santostasi’s Bitcoin Vitality Legislation model suggests Bitcoin’s value will no longer fall below $30,000 all over again, indicating a floor for future valuations. The model reveals Bitcoin’s value trajectory will proceed to upward push, with its unusual ‘comely value’ at $86,339 and doable ceiling at $332,543.

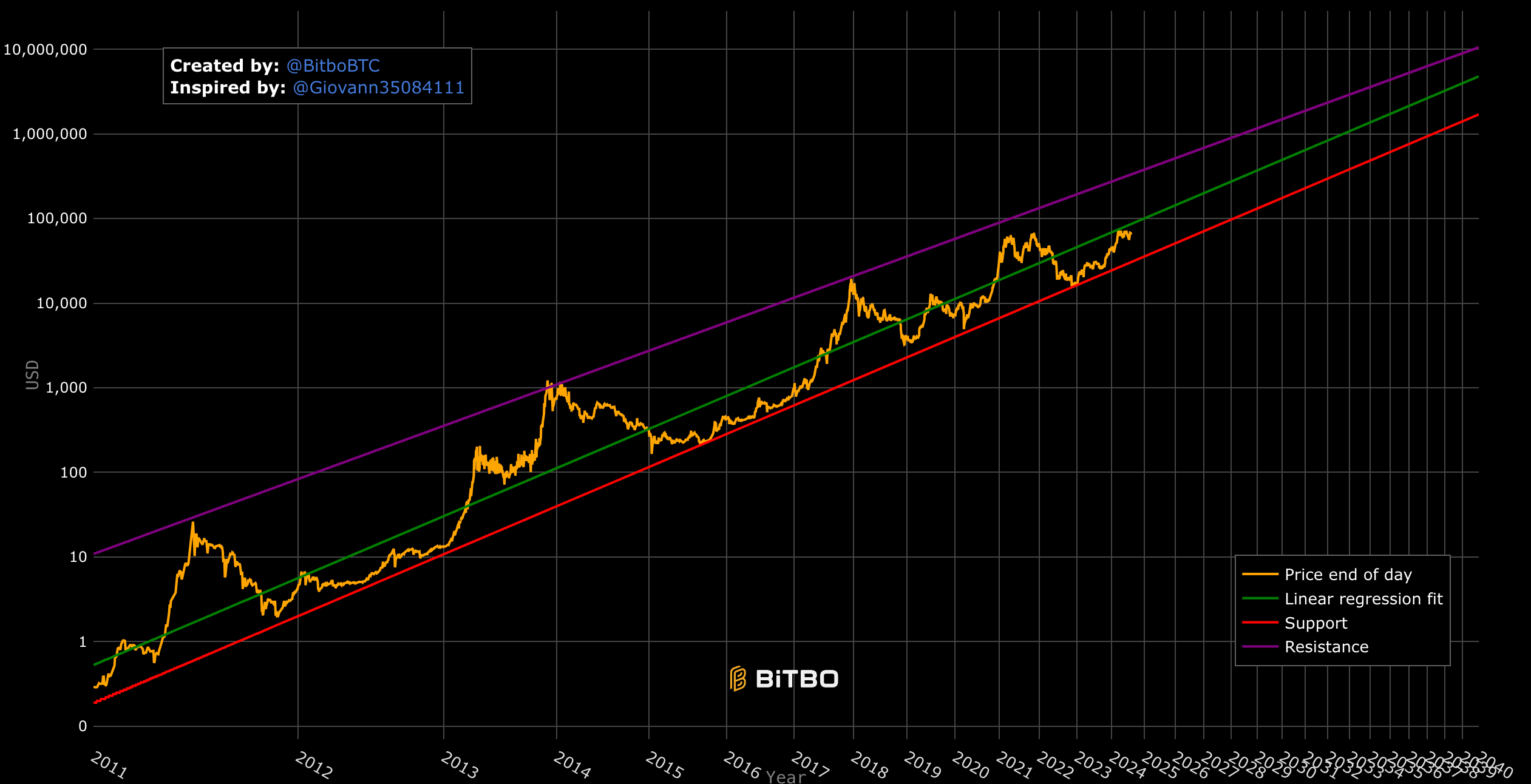

As depicted in the charts from Bitbo, the model makes expend of linear regression to study succor and resistance bands, which comprise historically contained Bitcoin’s value actions. The succor band, derived from previous value records, suggests a decrease boundary that Bitcoin’s value may presumably presumably tranquil no longer breach, whereas the resistance band signifies an upper boundary.

The model predicts that Bitcoin may presumably presumably tranquil attain $100,000 per coin forward of 2028 and will no longer fall below this value after 2028. Furthermore, it forecasts that Bitcoin may presumably presumably hit $1,000,000 between 2028 and 2037 and protect this stage thereafter.

The model’s foundation lies in the energy legislation distribution, a statistical relationship the set up one quantity varies as the facility of 1 other. This distribution has been noticed in varied natural phenomena and monetary markets, providing a tough framework for long-timeframe value predictions. The power-legislation model’s utility to Bitcoin suggests a consistent upward pattern, aligning with the asset’s historical performance despite its volatility.

Critics of the model argue that it relies carefully on historical records, that may presumably presumably no longer story for future market forces or unforeseen events. They warning that whereas the model gives a structured manner to understanding Bitcoin’s value actions, it would possibly most likely presumably presumably tranquil no longer be taken as an absolute predictor of future costs. Nonetheless, the Vitality Legislation model gives a compelling perspective on Bitcoin’s doable increase, reinforcing the conclusion among some analysts that Bitcoin’s value will proceed to upward push over the very long timeframe.

Unlike the Stock-to-Float model, the Vitality Legislation has never been invalidated. If this continues, the comely value at the next halving has to be round $290,000 in 2028.

Mentioned listed here

Source credit : cryptoslate.com