Bitcoin network congestion eases as mempool clears in February

Bitcoin’s mempool is a keeping living for transactions broadcast to the community but no longer but included in a block. Inspecting the mempool presents insight into community congestion, transaction request, and price trends, providing a odd vantage level on the suppose of the Bitcoin ecosystem.

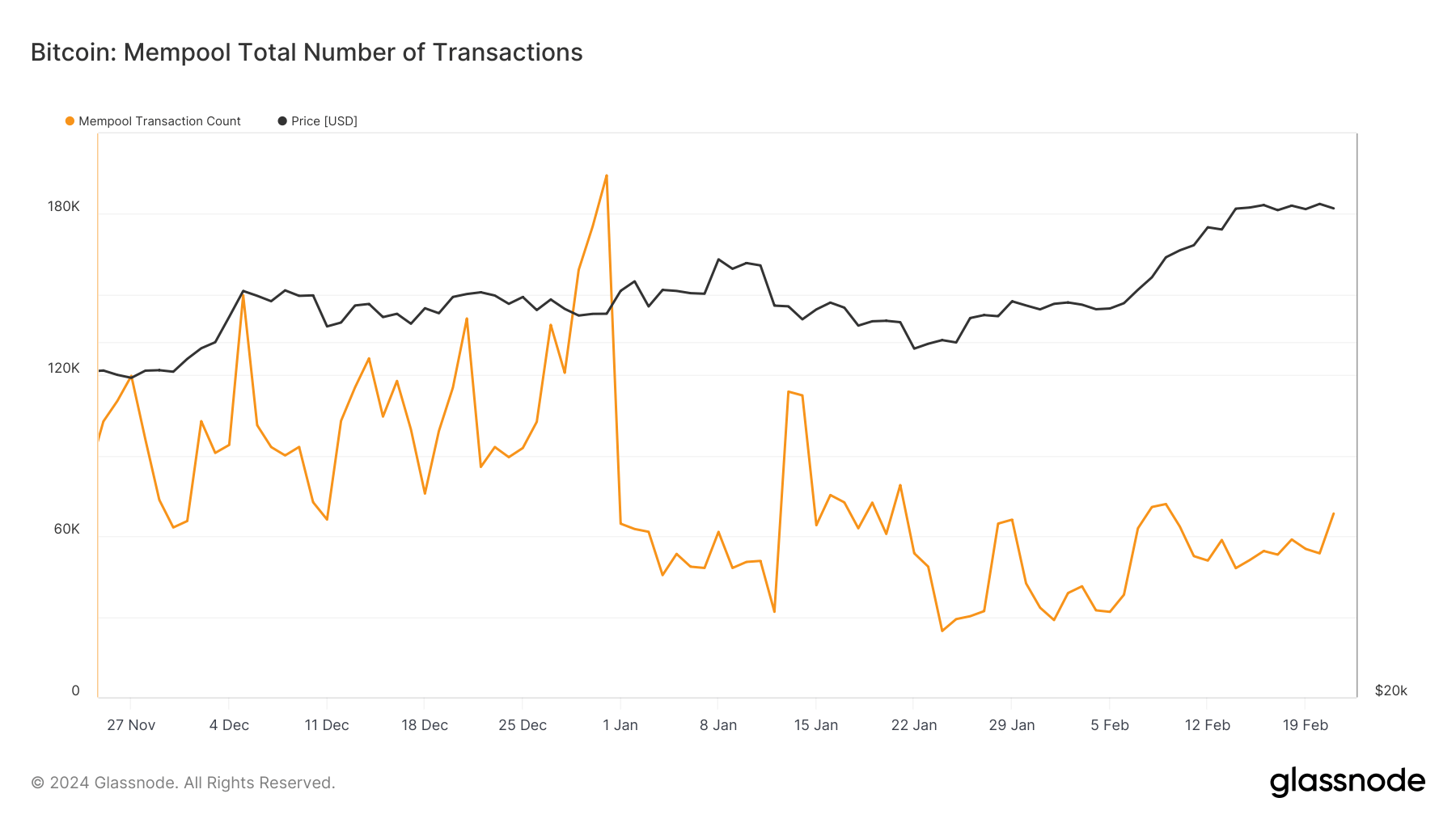

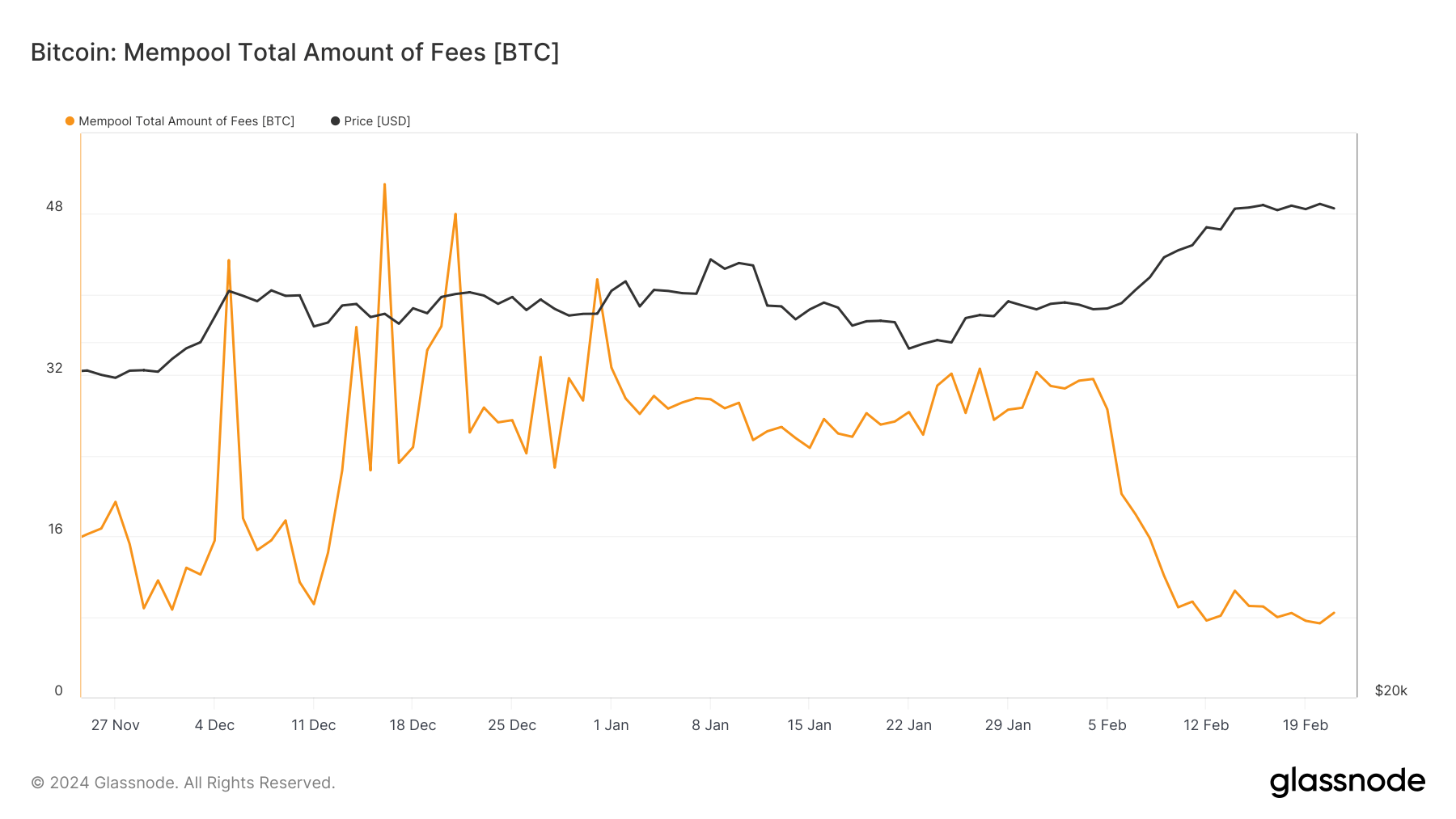

At some level of the final months of 2023 and the early weeks of 2024, the Bitcoin community experienced well-known congestion, as evidenced by the swelling size of the mempool. In mid-December, the mempool contained 117,813 transactions ready to be processed, and transaction prices totaling 50.9 BTC.

This congestion signaled a excessive request for block home and highlighted the community’s challenges in accommodating surging transaction volumes. By the tip of December, the anxiety intensified, with the mempool size escalating to 194,374 transactions, indicating a top in community exercise and user engagement.

This congestion had exiguous influence on Bitcoin’s price, which traded at around $42,000 for the easier segment of December. The persistence of excessive transaction counts and charges into early January, with the mempool harboring 64,664 transactions and 32.7 BTC in prices on the main day of the year, underscored the community’s stress below the burden of unprocessed transactions.

The whole size of transactions waiting for affirmation in the mempool additional ballooned to 106.369 million bytes, peaking at 139.457 million by unhurried January, reflecting a backlog of transactions and an amplify in the complexity or size of the transactions.

The turning level for the prolonged duration of congestion got right here in February. By Feb. 21, the mempool cleared considerably, with the whole transaction prices dropping to 8.3 BTC and the assortment of ready transactions reduced to 68,433. The whole size of transactions in the mempool moreover lowered to 90.439 million bytes, indicating a well-known alleviation of community congestion.

This era of reduced congestion adopted Bitcoin’s bullish rally, which saw it climb over $52,000 after which find stability at the $51,800 stage.

The clearing of the mempool congestion in February, regardless of Bitcoin’s rising price, signifies an enchancment in the community’s skill to route of transactions, presumably via miners prioritizing transactions with better prices or the adoption of efficiency-making improvements to measures by users, such as transaction batching or the utilization of off-chain choices.

2nd, the low cost in congestion and charges doubtless contributed to a clear shift in investor sentiment, viewing the improved community efficiency as a bullish indicator of Bitcoin’s usability and scalability.

Source credit : cryptoslate.com