Bitcoin nears all-time high with stable metrics, signaling strength for further upside – K33 Research

Bitcoin nears all-time excessive with actual metrics, signaling energy for added upside â K33 Research

Bitcoin nears all-time excessive with actual metrics, signaling energy for added upside â K33 Research Bitcoin nears all-time excessive with actual metrics, signaling energy for added upside â K33 Research

The recent upward circulate is devoid of euphoria, painting Bitcoin as a maturing asset with energy to create a persevered rally.

Hide art work/illustration by the exhaust of CryptoSlate. Image entails combined screech which would possibly contain AI-generated screech.

Bitcoin (BTC) is no longer exhibiting indicators of frenzy, no longer like March, which signifies room for added progress in designate, in line with K33 Research document printed on Oct. 29.

As of press time, BTC was once shopping and selling at $73,500, roughly $300 some distance from surroundings a brand original all-time excessive.

Despite the spectacular over 8% create all the strategy in which thru the final week, Bitcoin’s shopping and selling volumes live subdued. On a typical foundation alternate volume averages $2.6 billion, nearly about half of the stages seen in the year’s first quarter. The barely gentle market exercise suggests a wholesome, late buildup as a exchange of fear-pushed shopping.

Furthermore, Ethereum (ETH) lags in the again of, with the ETH/BTC shopping and selling pair reaching multi-year lows, reflecting a shifting point of curiosity in the crypto dwelling in direction of Bitcoin.

Consistent with the document, Bitcoin’s most up-to-date rally to all-time highs has been devoid of the frequent euphoria. This paints Bitcoin as a maturing asset poised for sustained momentum amid favorable market conditions and upcoming election influences.

Increased institutional ask of

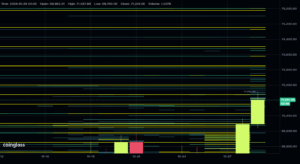

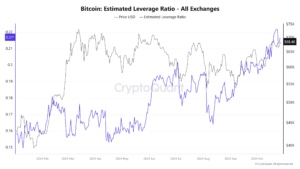

Present market conditions in futures contracts existing a more balanced and less leveraged ambiance in contrast with March and April when speculative shopping and selling was once rampant.Â

Bitcoin’s annualized funding charges now average 10.83%, vastly decrease than the excessive 32.17% price viewed for the length of the first quarter. This implies a cooler, more measured map amongst traders.Â

CME futures also replicate this steadiness, as their premiums live closer to funding price averages than the first quarter’s starkly divergent figures.

The document added that alternate-traded fund (ETF) flows signal strong institutional pastime, and this ask of helps the expectation of persevered beneficial properties, in particular as retail traders exhibit some distance less urgency in the recent rally.

Furthermore, the most up-to-date notional flows reached larger averages than the first quarter height, reinforcing the institutional pastime thesis.

Elections loom

Aligned with totally different analysts’ expectations, K33 Research predicts doable beneficial properties for the crypto market if ragged US president Donald Trump wins the elope.Â

With favorable odds and several campaign promises tailored in direction of a supportive regulatory stance on digital assets, the document identified that Trumpâs victory would possibly spark a surge across the crypto market.Â

Conversely, Vice President Kamala Harris’ procure would possibly temper this momentum, even if it'll also additionally be less opposed to the crypto alternate in the US. Thus, a Harris timeframe would possibly seize away some uncertainty from the market, favoring Bitcoin and the crypto market.

Bitcoin Market Files

On the time of press 7:11 pm UTC on Oct. 29, 2024, Bitcoin is ranked #1 by market cap and the worth is up 5.67% all the strategy in which thru the final 24 hours. Bitcoin has a market capitalization of $1.Forty five trillion with a 24-hour shopping and selling volume of $57.1 billion. Learn more about Bitcoin ›

Crypto Market Summary

On the time of press 7:11 pm UTC on Oct. 29, 2024, the total crypto market is valued at at $2.46 trillion with a 24-hour volume of $113.42 billion. Bitcoin dominance is for the time being at 58.94%. Learn more about the crypto market ›

Mentioned listed here

Source credit : cryptoslate.com

Farside Patrons

Farside Patrons

CoinGlass

CoinGlass  CryptoQuant

CryptoQuant