Bitcoin miners to soar in 2025 amid AI hosting and BTC yield strategies – Clear Street

Bitcoin miners to flit in 2025 amid AI hosting and BTC yield suggestions – Sure Avenue

Bitcoin miners to flit in 2025 amid AI hosting and BTC yield suggestions – Sure Avenue Bitcoin miners to flit in 2025 amid AI hosting and BTC yield suggestions – Sure Avenue

Sure Avenue outlines earnings skills for Bitcoin miners by plan of AI records center repurposing and regulatory-pleasant initiatives.

Duvet art work/illustration through CryptoSlate. Image involves mixed insist material which could encompass AI-generated insist material.

Constant with a recent Sure Avenue yarn, Bitcoin miners are pursuing yield suggestions for their BTC holdings and diversifying into AI compute.

The yarn, titled ‘BTC Mining: 2025’s Key Themes Emerge,‘ outlines three issues for 2025: generating earnings on bitcoin reserves, leveraging existing infrastructure for HPC initiatives, and making the most of a shift in US regulatory leadership.

Bitcoin yield and space ETF upgrades

Sure Avenue’s authors point out that several miner administration teams are investigating techniques to raze earnings from stored BTC, with securities lending described as a potentially viable skill pending regulatory adjustments. The yarn states that a recent SEC stance could allow in-kind introduction of BTC replace-traded fund shares, allowing miners to replace bitcoin at as soon as for ETF devices and therefore companion with high brokers on portion lending earnings. Low-to-mid single-digit yields are renowned for customary collateral securities, while elevated charges could practice if ETF shares change into extra difficult to borrow.

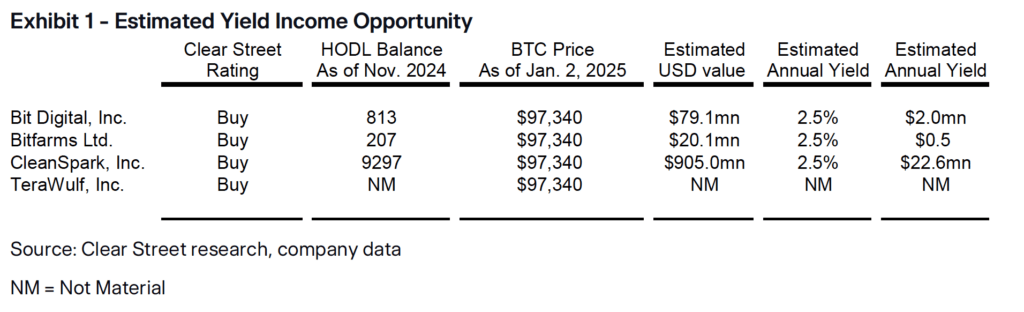

Sure Avenue adds that factual adjustments would insist BTC securities lending on par with broader lending practices, prompting sector contributors to specialise in operational info. Per the diagnosis, CleanSpark holds a necessary HODL balance and could create thousands and thousands of bucks in annual passion as soon as suggestions scale. Bit Digital, Bitfarms, and TeraWulf are cited with varied holdings or approaches, including staking capabilities or no longer preserving Bitcoin at all, reckoning on corporate policy. Sure Avenue projects that such yield mechanisms could unlock extra earnings streams and support miners optimize big-scale operations that could probably in any other case be idle.

HPC compute and AI diversification

The yarn additionally highlights a rising pivot against HPC compute, with miners repurposing records centers, energy sources, and developed equipment to support AI-driven workloads. The authors look a route for companies to diversify earnings beyond mining. Bit Digital is alleged to be transitioning into an files center enterprise through acquisitions in Montreal, aiming to host HPC clients for real charges and doable upside. TeraWulf is renowned for a recent HPC settlement that could amplify to over 100 MW of skill, focusing on seek files from for advanced AI research wants. Sure Avenue’s figures point out that HPC services and products can generate appealing per-megawatt revenues, with margin ranges reckoning on records center configuration and contract size.

Constant with the yarn, political shifts could additionally bolster the industry’s outlook. President Trump’s administration is portrayed as friendlier to Bitcoin interests as a consequence of doable adjustments at the SEC and Department of Energy and extra originate views on BTC products. Trump’s nominee for SEC chair, Paul Atkins, has previous involvement in digital asset initiatives, and the proposed Treasury Secretary, Scott Bessent, is considered as extra receptive to crypto than previous leadership.

Alternatively, the research warns that cuts in federal spending or energy policy adjustments could introduce uncertainties, namely if renewable energy credit ranking are modified. Sure Avenue additionally notes the likelihood that diminished authorities outlays could probably slash support inflationary pressures some traders look as functional for Bitcoin.

The diagnosis highlights several companies as high picks in accordance with valuations, growth doable, and most novel HPC roadmaps.

Sure Avenue suggestions for Bitcoin miners

Bit Digital (BTBT) is labeled a Purchase as a consequence of its shift from an asset-light mining model against HPC earnings, with administration citing a pipeline of doable records center tenants. CleanSpark (CLSK) is presented as a celebrated pure-play miner, supported by most productive-in-class energy suggestions and a pipeline for growth by plan of 2027. TeraWulf (WULF) has a bigger extra than one relative to others however goals to define it with contemporary HPC affords and improved mining metrics. Bitfarms (BITF), even handed as a BTC mining specialist, reportedly has real energy contracts and is poised for a doable HPC foray in slack 2025 or early 2026.

Per Sure Avenue, these projections relaxation on every firm’s skill to scale records center operations, stable or renew energy agreements, and navigate remaining regulatory steps for securities lending. The authors emphasize that readability from the SEC on in-kind BTC ETF portion introduction will seemingly be pivotal for unlocking yield on HODL balances.

Their projections point out stronger earnings for taking half miners as contemporary practices outmoded and capital inflows amplify from institutional partners looking out for extra publicity to digital assets. Bitfarms, Bit Digital, CleanSpark, and TeraWulf live in focus in accordance with Sure Avenue’s most novel forecasts.

Talked about listed right here

Source credit : cryptoslate.com

CryptoQuant

CryptoQuant