Bitcoin leverage above $66k wiped out creating new floor for higher price discovery

Bitcoin leverage above $66k worn out atmosphere up unique ground for higher value discovery

Bitcoin leverage above $66k worn out atmosphere up unique ground for higher value discovery Bitcoin leverage above $66k worn out atmosphere up unique ground for higher value discovery

Contemporary Bitcoin market sweep sets stage for organic value discovery above $50k with $27B leverage relief.

Quilt art/illustration by strategy of CryptoSlate. Image involves blended relate material that can just embody AI-generated relate material.

Contemporary recordsdata on Bitcoin liquidations and leverage stages signifies outlandish value discovery exercise as longs and shorts maintain been swept from the market. Grand of the leveraged positions were shaken out final week as Bitcoin saw volatile value actions around the US market originate.

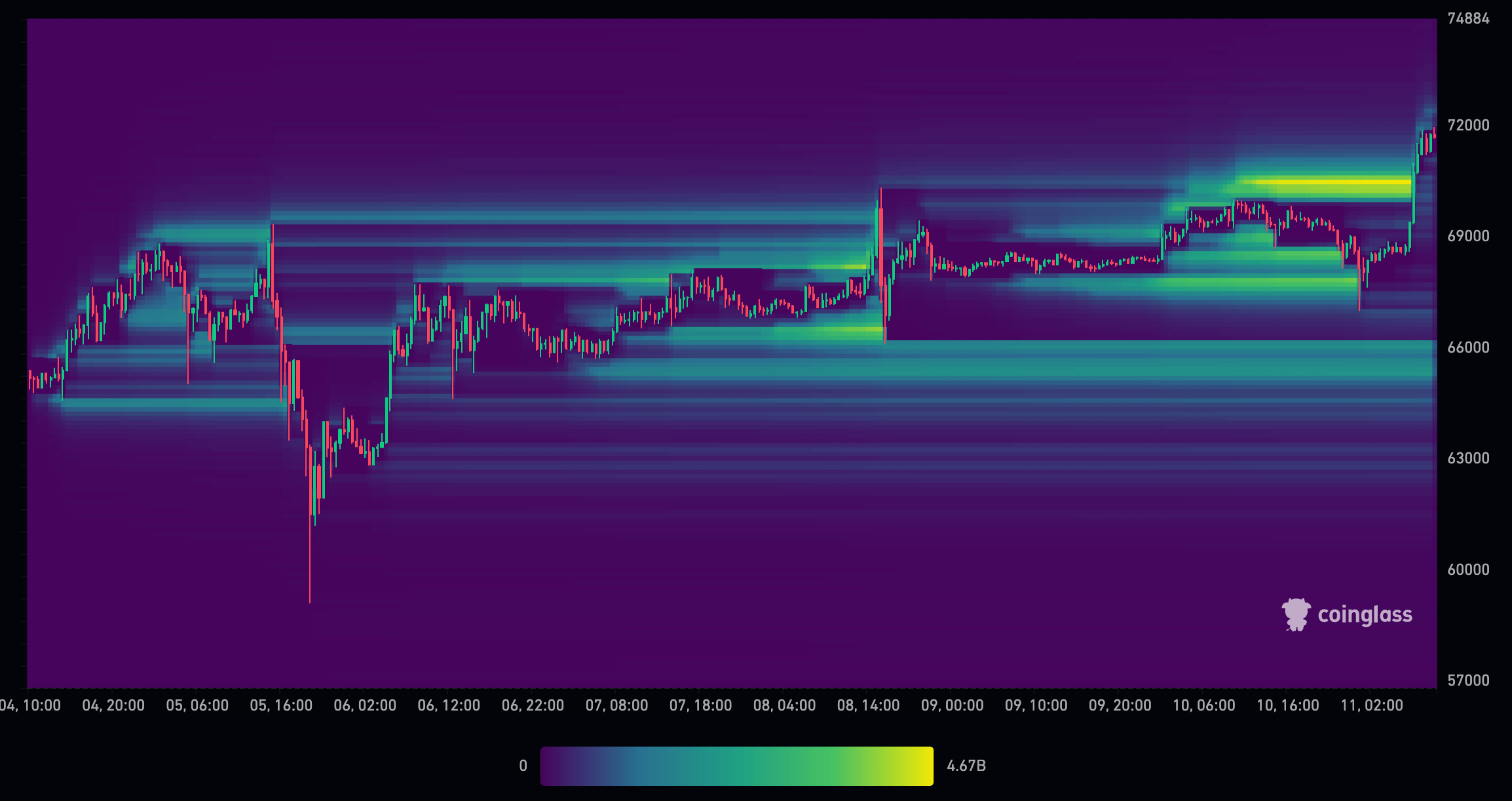

The liquidation chart from CoinGlass under highlights how trading exercise on March 5 and eight around 2.30 pm GMT (US market originate) led to heavy liquidations of every prolonged and fast positions. A roughly 2% carry out bigger modified into once followed by a decrease of over 10% on March 5, which swept the present books and flushed out all leverage appropriate down to $60,000.

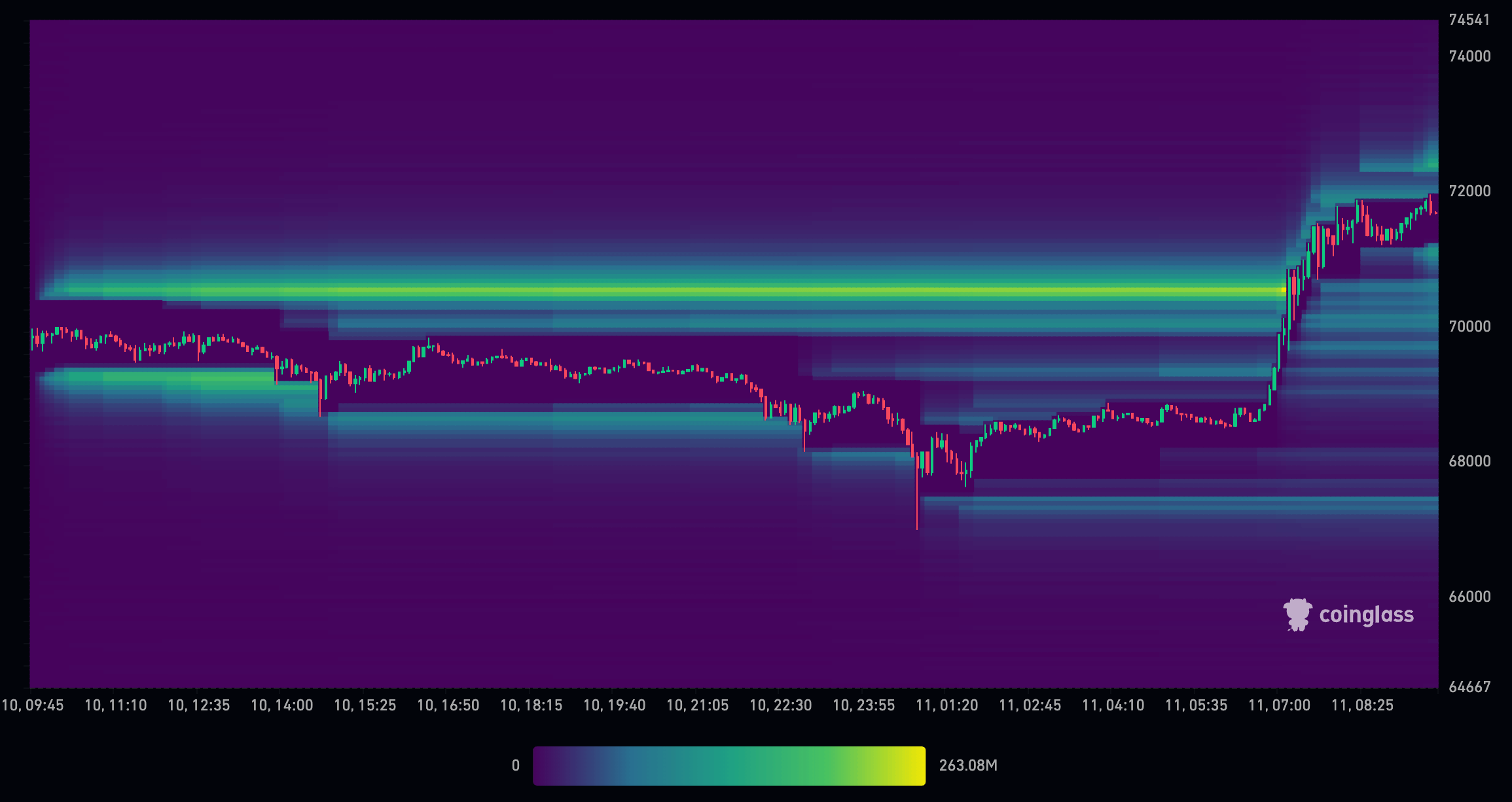

The next hasty V-formed recovery saw extra leverage positions created around $70,000 and $66,000. The market originate on March 8 shook these out, leaving minute to no leverage above $66,000.

As of March 11, the fall to $67,000, followed by a surge to unique highs around $71,500, has again eradicated most leveraged positions above $66,000, atmosphere a receive ground. The earn of such actions is that Bitcoin now has free reign for pure value discovery above $66,000.

Not just like the bull market of 2021, which modified into once carefully influenced by extremely leveraged positions, the unique cycle appears to be shaking out leverage earlier than it has the likelihood to trigger vital volatility. Extra, key institutional gamers and market makers would possibly per chance well just maintain a hand in clearing the route for Bitcoin’s value discovery through smooth-scale trading activities.

The role of market makers in value discovery

Market makers and, more recently, ETF-authorized individuals carefully affect monetary markets, conducting the trail along with the hunch of buy and promote orders with precision, and are to blame for offering liquidity, which is the lifeblood of any asset’s market. By quoting continuous train and expect costs, they aim to income from the spread, but their role extends some distance previous mere income technology.

All the intention in which through sessions of high volatility, market makers engage in a strategic maneuver recognized as “sweeping” the present e-book. This involves putting many orders at completely different value stages to probe the market’s depth and verify the right balance of supply and demand. This sweeping action is a probe into the market’s demonstrate remark and a catalyst for value discovery, revealing the stages at which market persons are challenging to transact in vital volumes.

The most up-to-date sweep of leverage from the Bitcoin market has profoundly impacted value stipulations. With the elimination of leveraged promote orders, the market has witnessed a low cost in downward stress, bearing in thoughts a more organic value discovery job. That is characterized by a market less influenced by the amplified bets of leveraged traders and more by its participant’s staunch sentiment and valuations.

As the market adjusts to the unique equilibrium free from the weight of leveraged positions, the associated price of Bitcoin is more liable to repeat its right market price. That is now now not to snort that the disappear will seemingly be linear or devoid of volatility; the crypto market is recognized for its hasty value swings. Alternatively, the unique panorama suggests the stipulations are ripe for a more sustained upward fashion.

Leverage low cost and present e-book sweeping since December

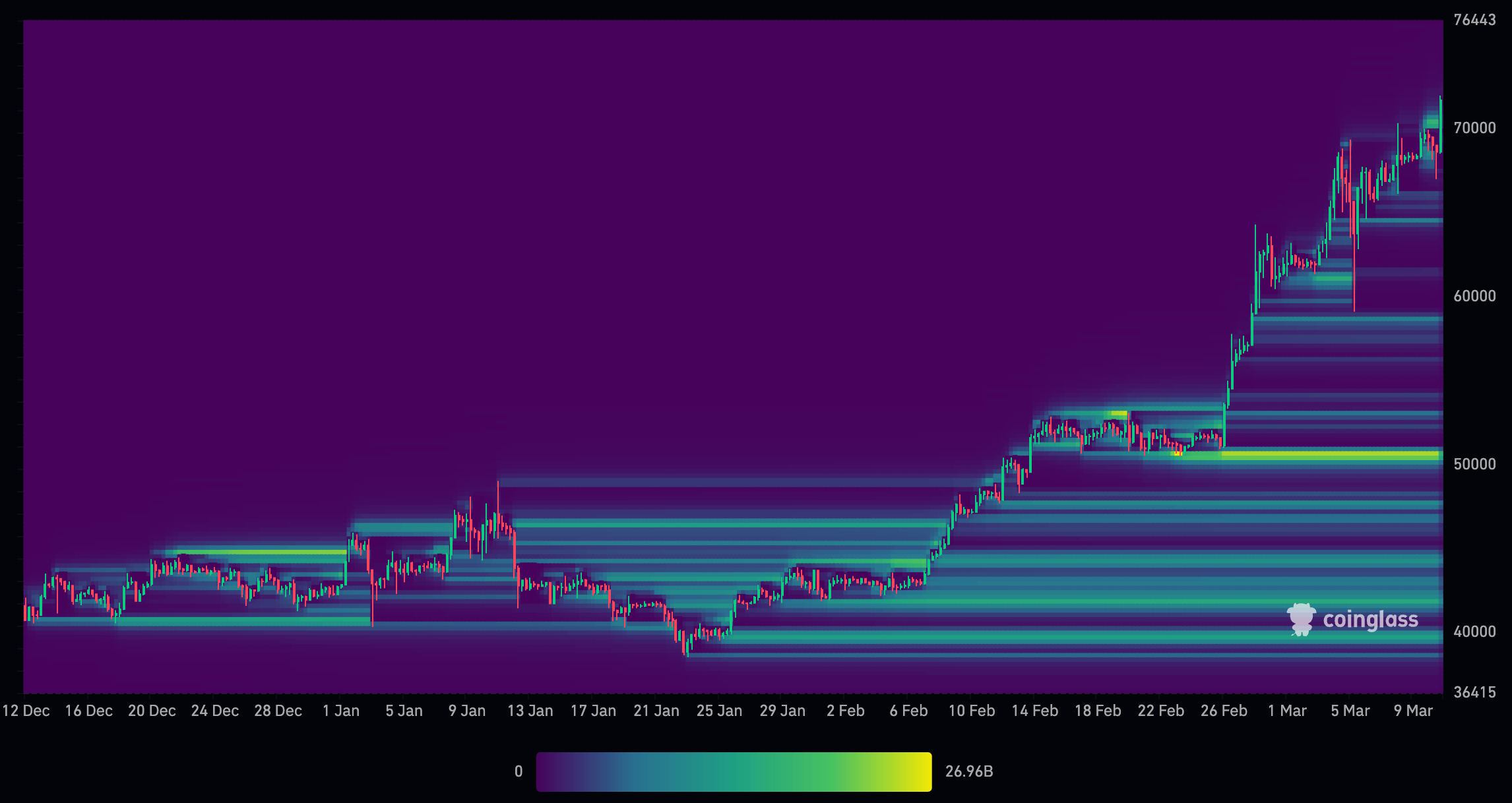

A more in-depth peep on the market forces from December 2022 to March 2023 explains the route for extra value discovery and a novel $50,000 ground.

In December, the market witnessed mighty liquidations of leveraged positions, with many longs liquidated just above the $41,000 stage and shorts liquidated around $45,000. As Bitcoin approached the ETF approval on January 11, many shorts were opened around the $45,000 stage, which persisted because the associated price dropped to around $40,000. Interestingly, there maintain been now now not many longs at this stage, suggesting that the associated price modified into once supported by holders and similar outdated value discovery moderately than leveraged positions.

As Bitcoin rebounded from $40,000 and climbed in direction of $45,000 by early February, rather a lot of shorts were liquidated along the intention in which. As Bitcoin persisted its upward trajectory, longs were positioned from $40,000 to $50,000. By the time Bitcoin reached $50,000, there maintain been mighty leveraged positions, amounting to approximately $27 billion. Alternatively, because the associated price elevated, the quantity of leveraged positions above $50,000 diminished considerably.

The price action first and vital of March saw Bitcoin surge to $70,000 and then plummet to $59,000 within a single candlestick, successfully wiping out nearly all leveraged positions available in the market. Even supposing there modified into once some leverage around $70,000, the bulk of leveraged positions are if fact be told concentrated under $50,000.

The liquidation of leveraged positions has led to a more clear market structure, with a more balanced distribution of longs and shorts. This fashion would possibly per chance per chance pave the intention in which for a more organic value discovery job pushed by staunch market demand moderately than leveraged hypothesis.

The most up-to-date liquidations and low cost of leveraged positions in the Bitcoin market imply a capacity shift in direction of a more fundamentally pushed market. With the bulk of leveraged positions now concentrated at decrease value stages, there would possibly be room for the market to abilities upward stress as staunch demand and adoption drive costs higher.

Eliminating excessive leverage has space the stage for a healthier market dynamic, the establish value discovery is guided by foremost components equivalent to rising mainstream acceptance, regulatory clarity, and technological advancements in the blockchain home.

The most up-to-date liquidations and leverage recordsdata provide a compelling case for a doable upward fashion pushed by organic value discovery.

Source credit : cryptoslate.com