Bitcoin leads $321 million inflows into crypto as Fed rate cuts spur growth

Bitcoin leads $321 million inflows into crypto as Fed payment cuts spur roar

Bitcoin leads $321 million inflows into crypto as Fed payment cuts spur roar Bitcoin leads $321 million inflows into crypto as Fed payment cuts spur roar

Ethereum outflows difference broader market rebound following dovish Fed stance.

Quilt art work/illustration by the usage of CryptoSlate. Portray involves mixed utter material that may maybe furthermore encompass AI-generated utter material.

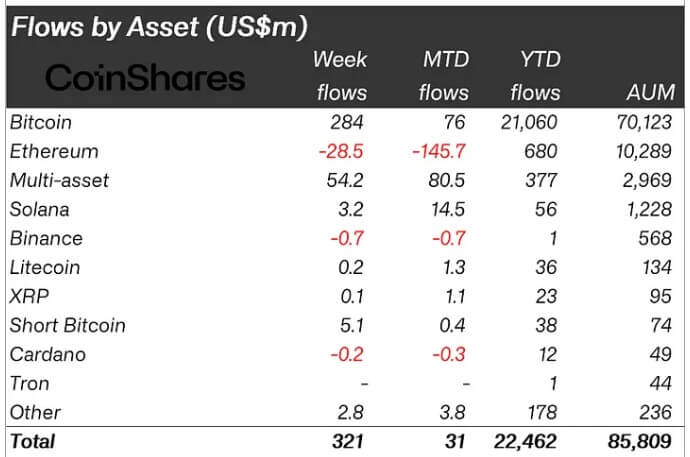

Digital asset investment products saw inflows for the 2d consecutive week this month, with investors pouring $321 million into the alternate, in step with CoinShares‘ most up-to-date weekly list.

This influx boosted the total sources below administration (AuM) for crypto alternate-traded products (ETPs) by 9%, bringing the total to $85.8 billion. The total investment product quantity furthermore increased to approximately $9.5 billion.

James Butterfill, head of research at CoinShares, linked this sure constructing to the Federal Reserve’s recent decision to diminish hobby rates by 50 basis points. He explained:

“This surge used to be likely pushed by the Federal Open Market Committee (FOMC) feedback closing Wednesday, which took a extra dovish stance than anticipated, alongside side a 50 basis level hobby payment decrease.”

Bitcoin, US dominate flows

A breakdown of the flows confirmed that Bitcoin-basically based investment products led the inflows, producing $284 million in rep features globally closing week. Particularly, major crypto funds from companies love BlackRock, Bitwise, Constancy, ProShares, and 21Shares contributed to this rebound, collectively alongside side $321 million in rep inflows.

The sure mark momentum for Bitcoin furthermore attracted investors with bearish sentiment, who allotted $5.1 million to quick-Bitcoin funds.

Ethereum confronted its fifth consecutive week of outflows, totaling $29 million. This constructing stems from ongoing withdrawals from Grayscale’s ETHE product and declining hobby in original offerings.

In line with Farside records, ETHE experienced outflows between $13 million and $18 million for 3 straight days closing week, overshadowing minor inflows from other products, alongside side Grayscale’s Mini-Believe.

Within the intervening time, Solana maintained its present sure constructing, alongside side $3.2 million in inflows closing week. This waft can furthermore be linked to the announcements of several old financial institutions announcing plans to birth financial products and companies on the network all the plan in which during the most modern Solana Breakpoint match in Singapore.

Other massive-cap altcoins, alongside side XRP and Litecoin, saw mixed inflows of $300,000.

Across areas, the US unsurprisingly emerged as the leading contributor to closing week’s influx, accounting for $277 million, adopted by Switzerland with $63 million.

In difference, Germany, Sweden, and Canada experienced outflows of $9.5 million, $7.8 million, and $2.3 million, respectively.

Talked about listed right here

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Solana

Solana  Litecoin

Litecoin  BlackRock

BlackRock  Bitwise

Bitwise  21shares

21shares  CoinShares

CoinShares  Constancy Investments

Constancy Investments  Grayscale Investments

Grayscale Investments  Grayscale Ethereum Believe

Grayscale Ethereum Believe

Source credit : cryptoslate.com