Bitcoin halving cuts production, sinks revenues for top miners

Bitcoin halving cuts manufacturing, sinks revenues for high miners

Bitcoin halving cuts manufacturing, sinks revenues for high miners Bitcoin halving cuts manufacturing, sinks revenues for high miners

Stronghold Digital Mining reported a 47.1% decline in month-to-month Bitcoin mining output in Would per chance per chance well also neutral, attributing it to the put up-halving.

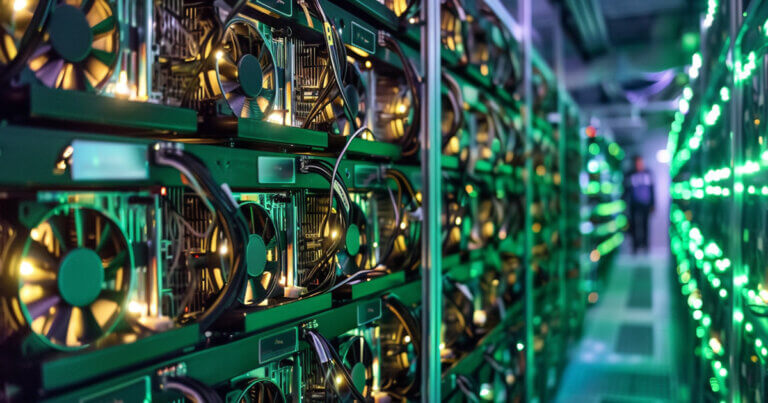

Duvet artwork/illustration via CryptoSlate. Image involves mixed whine material that may maybe well per chance moreover neutral consist of AI-generated whine material.

Stronghold Digital Mining reported a 47.1% decline in its month-to-month Bitcoin mining output in Would per chance per chance well also neutral.

The company mined 82 BTC at some level of the principal plump month following the halving, when put next with 155 BTC in April.

Within the period in-between, revenues for the month came in at $5.2 million, a 46% tumble from the earlier month.

Stronghold explicitly attributed the tumble to the halving. The company talked about:

“The most principal driver of the decline turned into as a result of principal plump month of put up-halving operations.”

The company moreover reported a median hash mark of $0.052 per TH/s in Would per chance per chance well also neutral, down from 0.095 in April. It attributed the switch to the halving and diminished block rewards, a 0.8% decline in Bitcoin’s mark, and transaction bills falling to 7.4% in Would per chance per chance well also neutral from 25.3% in April.

It seen a community hash price of 1.2%, in part offsetting the pattern.

Decline in manufacturing all the arrangement via the board

Within the same arrangement, Cipher Mining reported that it mined 166 BTC in Would per chance per chance well also neutral versus 296 BTC in April, representing a 43.9% month-over-month tumble.

The company acknowledged the impact of Bitcoin’s halving nonetheless emphasised that it maintained optimistic cash flows and expanded its inventory and operation web sites.

Marathon Digital fared a puny better, reporting that it produced 616 BTC in Would per chance per chance well also neutral, down 27.5% from 850 BTC in April. The company talked about it mitigated the reduction by rising the selection of mining blocks it won in Would per chance per chance well also simply to 170 â up from 129 blocks in April.

Marathon talked about it held 17,857 BTC at the discontinue of Would per chance per chance well also neutral and sold 390 BTC over Would per chance per chance well also neutral. It reported an energized hash price of 29.3 EH/s and an put in hash price of 30.6 EH/s.

SCleanspark, Insurrection Platforms, and Bitfarms moreover reported an analogous declines in their BTC output fell

The Bitcoin halving came about on April 20, 2024, lowering block rewards from 6.250 to a few of.125. The event has moreover impacted miner mission.

Talked about on this article

Source credit : cryptoslate.com