Bitcoin ETFs in the US drive higher crypto allocations among institutional investors

Bitcoin ETFs in the US pressure greater crypto allocations among institutional traders

Bitcoin ETFs in the US pressure greater crypto allocations among institutional traders Bitcoin ETFs in the US pressure greater crypto allocations among institutional traders

Institutional traders cite regulatory points and votality as main barriers to entry to the asset class.

Quilt art/illustration by job of CryptoSlate. Image entails mixed train that might presumably consist of AI-generated train.

Institutional traders increasingly more sought exposure to crypto at some stage in the first quarter of the year following the beginning of diverse US-based mostly field Bitcoin alternate-traded funds (ETFs) in January.

The CoinShares Digital Fund Manager survey published that these institutional traders procure vastly elevated their digital asset allocations, reaching 3% in their portfolios. This marks the wonderful level since the survey’s inception in 2021.

Many of these traders attributed their elevated exposure to digital asset investments to dispensed ledger technology.

Furthermore, they now check out digital sources as offering supreme cost and an elevated query for investing in BTC as a diversifier.

Bitcoin reveals the most compelling yell outlook.

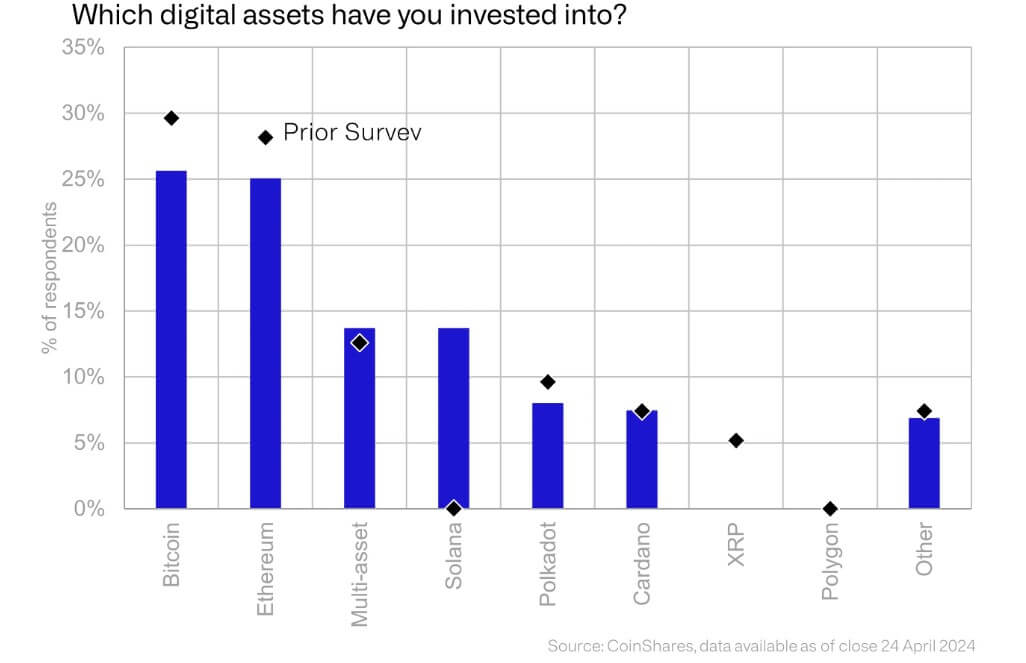

Institutional traders’ portfolios predominantly characteristic Bitcoin, the premier digital asset in query among this cohort. In keeping with James Butterfill, head of analysis at CoinShares, over a quarter of these respondents talked about their portfolios had exposure to BTC by job of the sector ETFs.

Following Bitcoin, Ethereum holds the second situation, though investor ardour has declined since the outdated survey.

In keeping with traders, BTC and ETH reside the digital sources with the most compelling yell outlook.

On the other hand, Solana has seen a surge in investor enthusiasm, evidenced by an uptick in its allocation to 14%. This amplify is primarily pushed by a select out community of noteworthy traders expanding their holdings in the rapid-rising blockchain community, which has loved at the moment yell in impress and adoption all around the last year.

While other replacement digital sources procure struggled, XRP stands out for its appreciable decline. None of the surveyed traders talked about maintaining it.

Funding barriers

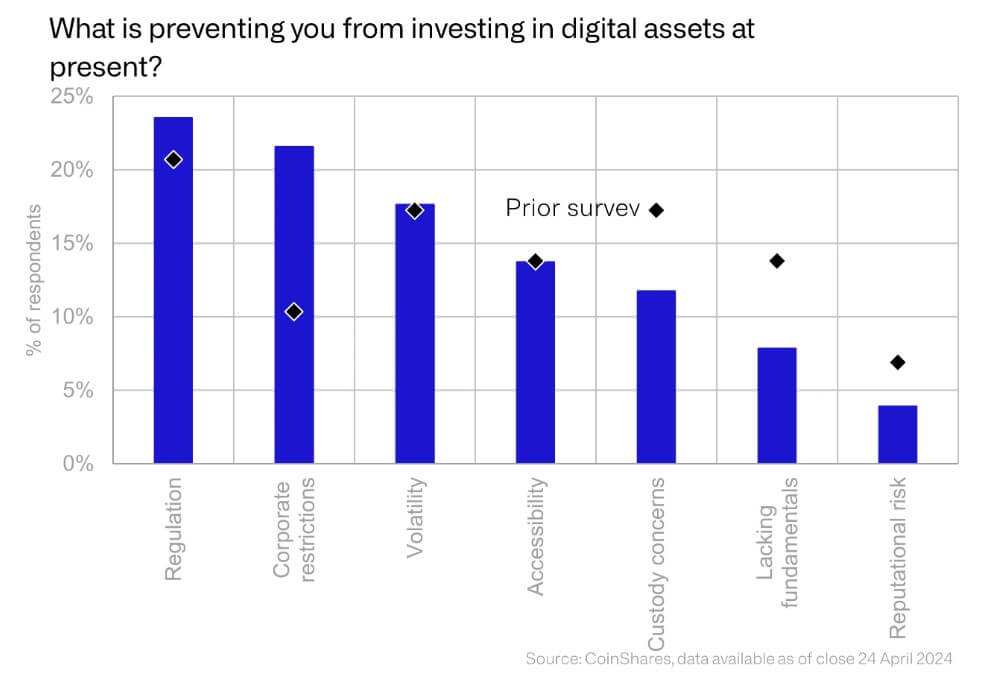

No topic the growing exposure to digital sources and the introduction of Bitcoin ETFs, many traders quiet fight to receive admission to this asset class.

The CoinShares survey confirmed that regulatory issues reside the major barrier for most traders. The rising alternate faces regulatory scrutiny, particularly in the US, where monetary regulators fancy the SEC procure filed diverse ethical actions against major avid gamers fancy Binance and Coinbase.

Within the period in-between, the inherent volatility of the rising sector remains to be a serious problem for some traders. However, custody points, reputation menace, and the absence of a conventional investment case are changing into much less problematic.

Mentioned listed right here

Source credit : cryptoslate.com