Bitcoin ETFs show ‘staying power,’ now landing in Thailand

Bitcoin ETFs show disguise ‘staying strength,’ now touchdown in Thailand

Bitcoin ETFs show disguise ‘staying strength,’ now touchdown in Thailand Bitcoin ETFs show disguise ‘staying strength,’ now touchdown in Thailand

US-primarily based Bitcoin ETFs are for the time being on a 15-day influx lunge.

Hide art work/illustration through CryptoSlate. Image involves blended squawk material that would possibly well encompass AI-generated squawk material.

Plight Bitcoin trade-traded funds (ETFs) are gaining traction globally, as evidenced by a most modern regulatory resolution in Thailand.

After the US Securities and Change Rate (SEC) approved these merchandise in January, they've viewed massive inflows after a most modern dip in volumes.

Bitcoin ETF lands in Thailand

Thailand’s Securities and Change Rate (SEC) has reportedly approved ONE Bitcoin ETF Fund by One Asset Administration (ONEAM), marking the country’s first Bitcoin ETF.

The ETF is phase of ONEAM’s Unhedged fund, typically unavailable to retail traders. The fund would put money into 11 high global funds primarily based in Hong Kong and the US to boost liquidity and security. Furthermore, it would possibly maybe actually maybe well make sure its coin storage protection aligns with global standards.

ONEAM CEO Pote Harinasuta praised the approval, calling the product an true different to other monetary assets. He properly-known that it permits traders to diversify their assets and arrange funding dangers.

Meanwhile, this approval marks Thailand’s entry because the 2nd Asian country to endorse a affirm Bitcoin ETF. In April, Hong Kong authorities approved several Bitcoin and Ethereum ETFs. Even though these merchandise beget struggled with volume, other Asian regulators dwell in launching linked merchandise for their residents.

‘Staying strength’

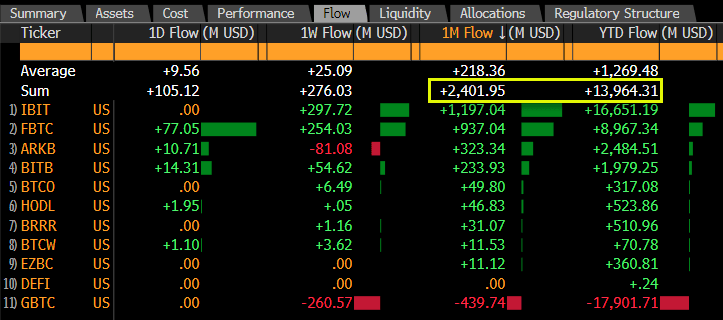

Bloomberg senior ETF analyst Eric Balchunas, citing knowledge from Bloomberg Intelligence, reported that US-primarily based affirm Bitcoin ETFs recorded 15 consecutive days of receive inflows.

These ETFs attracted $2.4 billion in inflows over the previous month, trailing easiest the SPDR S&P 500 ETF Believe and Main edge S&P 500 ETF. This brings the 365 days-to-date total for Bitcoin ETFs to approximately $14 billion.

Despite occasional days of zero flows and outflows only in the near previous, Balchunas properly-known that the modern lunge demonstrates the “staying strength” of Bitcoin ETFs. Particularly, the 15-day lunge marks the 2nd-longest certain breeze resulting from the ETFs started trading in January when they saw 17 consecutive inflows.

Mentioned in this text

Source credit : cryptoslate.com