US Bitcoin ETFs see record outflows as Hong Kong counterparts thrive

US Bitcoin ETFs sight sage outflows as Hong Kong counterparts thrive

US Bitcoin ETFs sight sage outflows as Hong Kong counterparts thrive US Bitcoin ETFs sight sage outflows as Hong Kong counterparts thrive

Hong Kong build Bitcoin and Ethereum ETFs recorded essential inflows of better than $300 million final week.

Quilt artwork/illustration thru CryptoSlate. Portray entails combined divulge material which may maybe maybe even just embrace AI-generated divulge material.

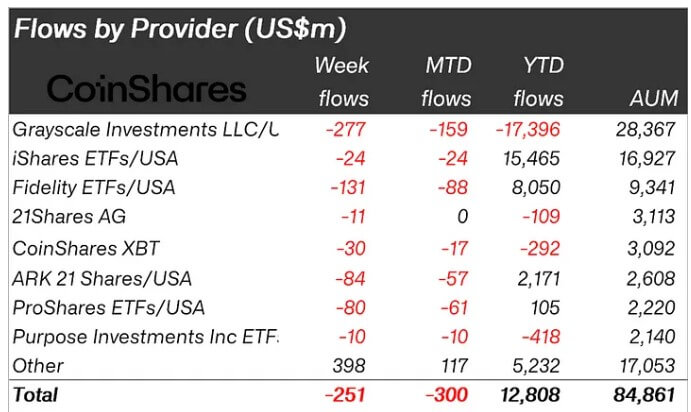

CoinShares’ most in model weekly file revealed that crypto-associated funding merchandise saw their fourth consecutive week of antagonistic flows, dominated by the “measurable outflows from the newly issued ETFs in the US.”

Primarily based completely totally on the file, the market saw an outflow totaling $251 million, with the New child 9 build Bitcoin ETFs accounting for over 60%, or $156 million, of these flows.

James Butterfill, CoinShares head of research, acknowledged:

“We estimate the frequent aquire designate of these ETFs since launch to be $62,200 per bitcoin, because the designate fell 10% below that degree, it'll also just enjoy precipitated automatic sell orders.”

A breakdown of the flows confirmed that Constancy’s FBTC saw the highest outflow amount, with $131 million exiting the fund, followed by Ark 21 Shares’ ARKB, which saw outflows amounting to $84 million.

Within the period in-between, BlackRock’s IBIT saw a modest antagonistic circulation of $24 million, while Grayscale’s Bitcoin ETF continued its outflow pattern, with $277 million withdrawn for the length of the length.

The efficiency of these ETFs pushed outflows from the US to $504 million. Particularly, Canada, Switzerland, and Germany also saw outflows totaling $9.6 million, $9.8 million, and $7.3 million, respectively.

Nonetheless, in spite of the efficiency of US-basically basically based build Bitcoin ETFs, the newly launched build-basically basically based Bitcoin and Ethereum ETFs in Hong Kong saw $307 million in inflows for the length of the first week of their trading.

Ethereum and Polkadot plan inflows

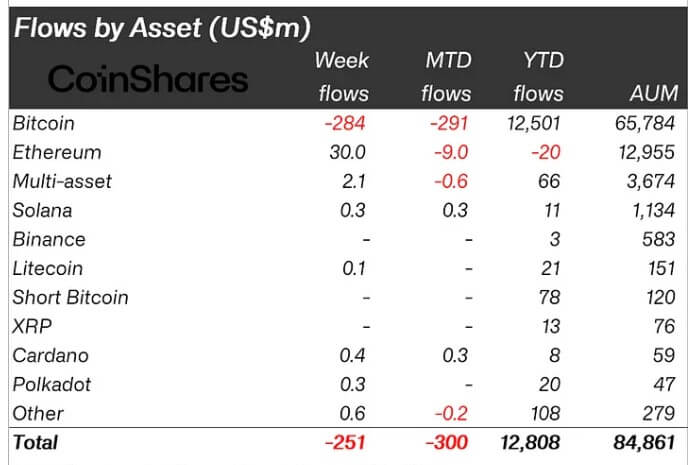

All over resources, Bitcoin saw outflows totaling $284 million, propelling its month-to-date outflow to $291 million.

CryptoSlate’s old stories found out that crypto investors increasingly extra sought publicity to altcoins while reducing their publicity to flagship digital currencies look after Bitcoin.

This pattern continued this week as altcoins look after Avalanche, Cardano, and Polkadot saw modest inflows of roughly $0.5 million, $0.4 million, and $0.3 million, respectively.

Particularly, Ethereum broke its 7-week spell of antagonistic flows, seeing $30 million of inflows final week. This has diminished ETH’s year-to-date outflow to a antagonistic of $20 million.

Mentioned on this text

Source credit : cryptoslate.com