Bitcoin ETFs see 14% growth in institutional interest during Q2 despite downturn

Bitcoin ETFs ogle 14% impart in institutional pastime at some stage in Q2 no matter downturn

Bitcoin ETFs ogle 14% impart in institutional pastime at some stage in Q2 no matter downturn Bitcoin ETFs ogle 14% impart in institutional pastime at some stage in Q2 no matter downturn

Bitwise CIO Matt Hougan said that institutional merchants pastime in Bitcoin would magnify over the years.

Mask art/illustration by CryptoSlate. Describe comprises combined relate that can even merely consist of AI-generated relate.

Bitwise CIO Matt Hougan highlighted a vital magnify in institutional investments in Bitcoin replace-traded funds (ETFs) at some stage in the 2d quarter no matter BTC price declining 12% over the three months.

Hougan highlighted the increased pastime in his latest Aug. 20 repeat to merchants, the put he said:

“Bitcoinâs tag fell 12% in Q2 2024 and numerous wondered if that would spook establishments out of the market. The acknowledge change into a resounding ‘no.'”

Historic adoption price

Hougan emphasised that institutional adoption of Bitcoin ETFs is occurring at an unprecedented bound.

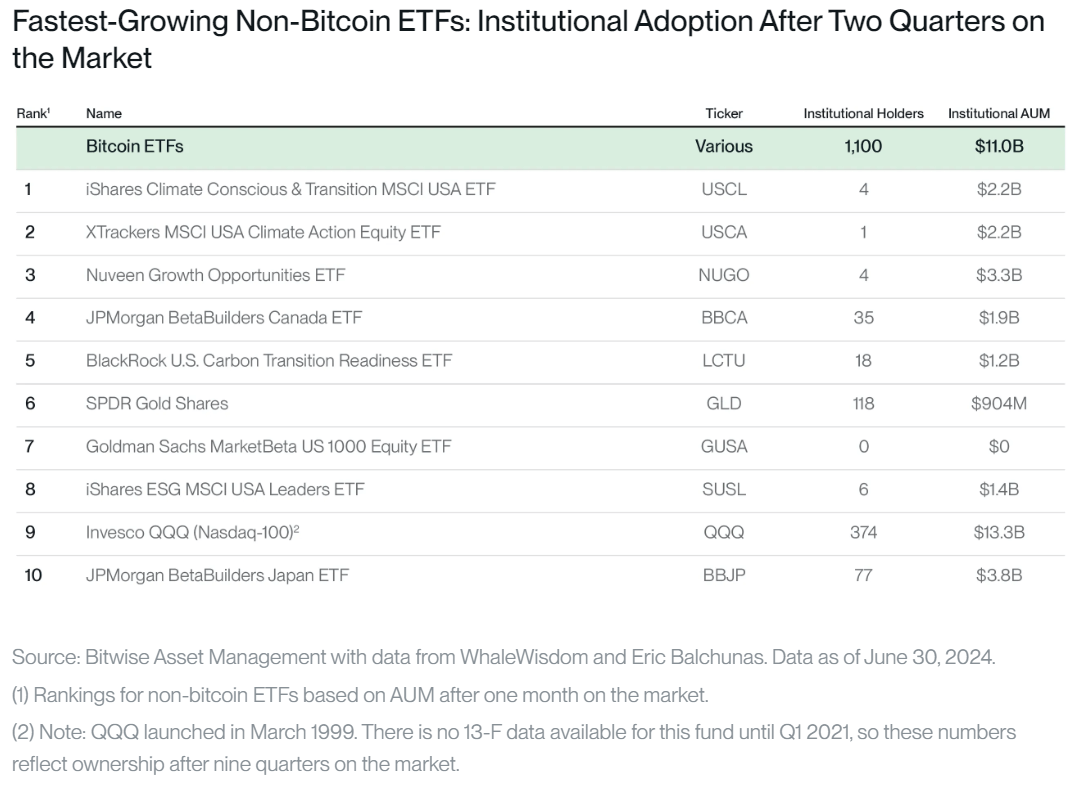

Constant with him, the option of institutional merchants holding Bitcoin ETFs grew by 14% quarter-over-quarter, rising to 1,100 from 965. These merchants now put a watch on 21.15% of the total resources below administration (AUM) in Bitcoin ETFs, up from 18.74%. By the quit of Q2, institutional holdings in Bitcoin ETFs totaled $11 billion.

Despite 112 merchants exiting their Bitcoin ETF positions at some stage in Q2, 247 unique companies entered the market, resulting in a receive addition of 135 institutional merchants.

Hougan infamous that the stage of adoption of Bitcoin ETFs is equivalent to the early impart of Invesco’s QQQ ETF, which launched in March 1999. Severely, the BTC ETFs have attracted 3x as many institutional customers inside factual two quarters.

Hougan addressed issues about evaluating Bitcoin ETFs as a crew to individual ETFs, declaring that individual Bitcoin ETFs nonetheless dominate. As an instance, Bitwise’s Bitcoin ETF â ranked fourth by AUM on the quit of June â had more institutional holders (139) than SPDR’s GLD ETF (118) on the identical stage in its pattern.

Pondering these numbers, Hougan concluded:

“We shouldnât let the historical adoption of Bitcoin ETFs by retail merchants obscure the truth that they are additionally gaining institutional traction sooner than any other ETF in history.”

Portfolio expansion

The Bitwise CIO predicted that institutional exposure to the flagship digital asset would magnify over the years.

Constant with him, while the median institutional investor in the in the meantime allocates only 0.47% of their portfolio to Bitcoin, this establish might exceed 1% inside a year. He defined that decent merchants are inclined to step by step magnify their crypto exposure, continuously beginning with 1% or much less nonetheless sooner or later elevating it to 2.5% and even 5% over time.

Hougan added:

“one year 1 is typically a problem, nonetheless momentum tends to create into Years 2, 3, 4, and 5. I search knowledge from the identical element to happen right here.”

Talked about listed right here

Source credit : cryptoslate.com