US Bitcoin ETFs see $903 million inflow as 2024 confirmed $44.2 billion gain globally

US Bitcoin ETFs peep $903 million inflow as 2024 confirmed $44.2 billion attain globally

US Bitcoin ETFs peep $903 million inflow as 2024 confirmed $44.2 billion attain globally US Bitcoin ETFs peep $903 million inflow as 2024 confirmed $44.2 billion attain globally

Bitcoin products kicked off the yr with $666 million bag inflow as merchants remain bullish.

Duvet art/illustration by strategy of CryptoSlate. Image contains blended suppose material that could perhaps encompass AI-generated suppose material.

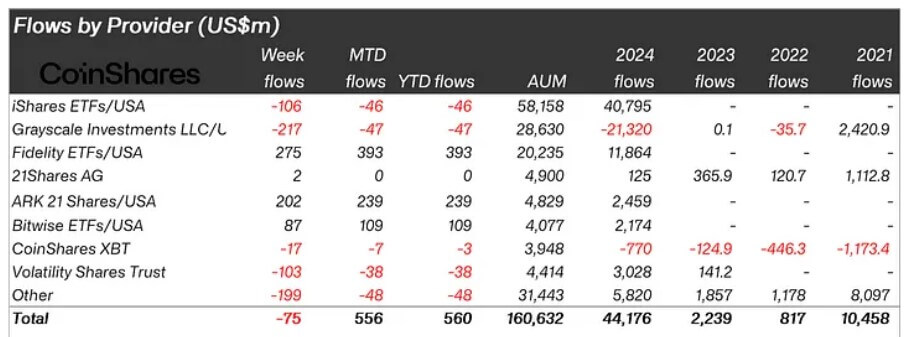

Crypto-connected products recorded a excellent $44.2 billion in inflows closing yearânearly four events better than the old all-time excessive of $10.5 billion verbalize in 2021.

Primarily based completely on CoinShares’ most modern file, this file-breaking efficiency is attributed to the introduction of US verbalize-essentially essentially based completely alternate-traded funds (ETFs), which vastly influenced international investments.

Bitcoin ETFs dominate

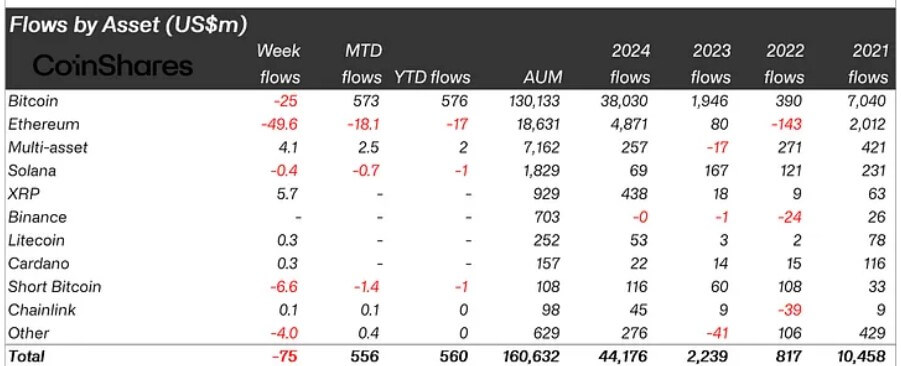

Bitcoin dominated the scene, drawing $38 billion in inflows and accounting for 29% of the total resources below management (AuM).

This predominant inflow also resulted in a significant magnify in Bitcoin ETFs’ holdings, which surpassed a million BTC in much less than a yr of their beginning.

Main products love BlackRock’s IBIT and Constancy’s FBTC attracted the most ardour. Notably, IBIT change into the most a hit ETF beginning within the past decade by outperforming with reference to 3,000 other ETFs.

On the opposite hand, Grayscale’s GBTC noticed the most outflows closing yr as merchants withdrew bigger than $21 billion from the fund for cheaper choices.

However, the ETF products’ determined flows resulted within the US leading international inflows, because it attracted nearly the overall $44.4 billion, adopted by Switzerland with $630 million.

On the opposite hand, predominant outflows from Canada and Swedenâtotaling $707 million and $682 million, respectivelyâpartly offset these positive components.

James Butterfill, CoinShares head of be taught, pointed out that the outflows suggest a shift in investments from these regions to US-essentially essentially based completely products, underscoring the rising attraction of the American crypto market.

He also infamous that Bitcoin climb to a fresh all-time excessive of larger than $100,000 closing yr resulted briefly BTC products seeing inflows of $116 million.

Ethereum resurgence

Ethereum also stood out for its efficiency, especially for its resurgence within the latter portion of the yr.

The digital asset secured $4.8 billion in inflows as its ETH verbalize-essentially essentially based completely ETFs ended the yr strongly. This inflow represented 26% of its AuM, which is 2.4 events better than its 2021 complete and vastly exceeds its 2023 efficiency.

In the period in-between, Ethereum’s positive components outpaced its everlasting rival Solana, which managed $69 million in inflows, representing relevant 4% of its AuM.

Other orderly-cap different coins, equivalent to Polkadot, Cardano, XRP, and others, collectively attracted $813 million, accounting for 18% of their AuM.

2025 flows

In the period in-between, this yr has started on a determined tag for Bitcoin investment products within the US, with inflows reaching $666 million within the first two buying and selling days.

On the opposite hand, in step with Farside files, Jan. 3 noticed a $908 million inflow in a single day, with Constancy leading at $357 million, relevant sooner than BlackRock and Ark Invest at $253 million and $222 million, respectively.

Talked about on this text

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Cardano

Cardano  Polkadot

Polkadot  CoinShares

CoinShares  BlackRock

BlackRock  Constancy Investments

Constancy Investments  Grayscale Investments

Grayscale Investments  Constancy Wise Foundation Bitcoin Belief

Constancy Wise Foundation Bitcoin Belief  iShares Bitcoin Belief

iShares Bitcoin Belief  Grayscale Bitcoin Belief

Grayscale Bitcoin Belief

Source credit : cryptoslate.com

CoinGlass

CoinGlass