Bitcoin ETFs get fresh strategies from Bitwise and $475 million in inflows

Bitcoin ETFs obtain recent concepts from Bitwise and $475 million in inflows

Bitcoin ETFs obtain recent concepts from Bitwise and $475 million in inflows Bitcoin ETFs obtain recent concepts from Bitwise and $475 million in inflows

Bitwise's recent Bitcoin Normal ETF will observe companies with indispensable Bitcoin reserves and high financial strength.

Conceal art/illustration by capacity of CryptoSlate. Image entails mixed impart material that will consist of AI-generated impart material.

Situation Bitcoin ETFs skilled a solid restoration on Dec. 26, breaking a four-day depart of outflows.

Knowledge from Farside Investors confirmed that ETFs reported mixed win inflows of $475.2 million, indicating renewed investor curiosity after a interval of indispensable outflows of upper than $1.5 billion.

In step with the data, Fidelity’s Wise Origin Bitcoin Fund led the restoration by attracting $254.4 million in recent capital. The ARK 21Shares Bitcoin ETF followed with $186.9 million in inflows.

BlackRock’s iShares Bitcoin Have faith ETF (IBIT) secured $56.5 million, while Grayscale’s mini Bitcoin ETF and VanEck’s ETF saw smaller contributions of $7.2 million and $2.7 million, respectively.

Meanwhile, Bitwise’s BITB and Grayscale’s Bitcoin Have faith saw outflows of $8.3 million and $24.2 million respectively.

Bitcoin Normal ETF

This considerable influx comes as Bitwise Asset Management has filed an application with the US Securities and Alternate Commission (SEC) to starting up a recent ETF tailored to companies adopting the “Bitcoin Normal.”

This means the proposed fund would observe companies integrating Bitcoin as a core treasury asset.

Joe Burnett, Director of Market Analysis at Unchained, described the fund as a most up-to-date different to feeble stock indices, stating that lengthy-term success hinges on a company’s ability to generate definite Bitcoin returns and comprise holdings.

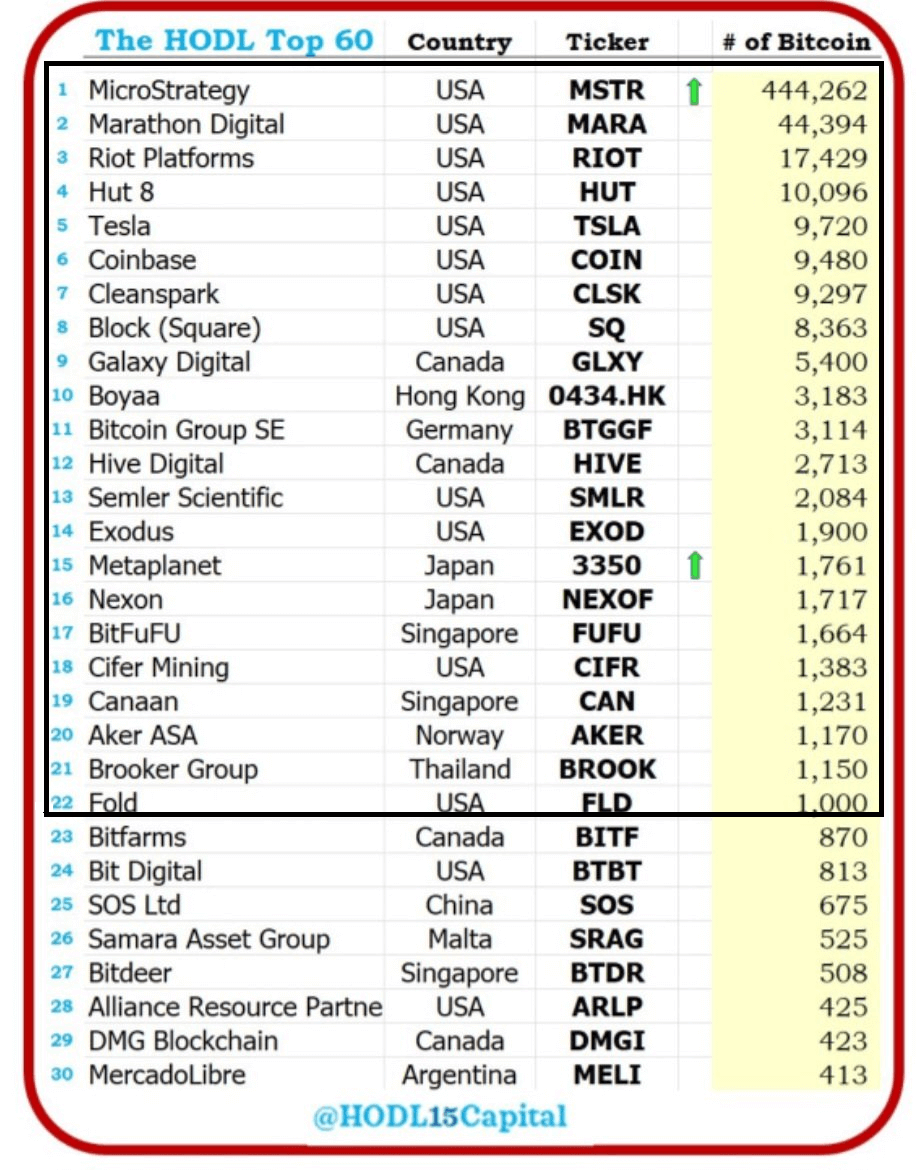

Companies must protect now not lower than 1,000 BTC in reserves to qualify for inclusion and meet strict financial benchmarks. Eligible companies will deserve to have a market capitalization exceeding $100 million, daily shopping and selling liquidity of now not lower than $1 million, and a public trek of now not lower than 10%.

The ETF plans to allocate now not lower than 80% of its win property to those Bitcoin-focused companies, weighting picks in accordance with their Bitcoin holdings. To make certain diversification, no single safety would symbolize higher than 25% of the fund’s complete allocation.

Knowledge compiled by crypto analyst HODL15Capital suggested 22 seemingly companies for the fund. This list entails well-known companies love MicroStrategy, Metaplanet and famed Bitcoin miners equivalent to Marathon Digital.Â

Mentioned listed right here

Bitcoin

Bitcoin  Bitwise

Bitwise  BlackRock

BlackRock  MicroStrategy

MicroStrategy  Metaplanet

Metaplanet  Marathon Digital

Marathon Digital  Fidelity Investments

Fidelity Investments  Fidelity Wise Origin Bitcoin Have faith

Fidelity Wise Origin Bitcoin Have faith  ARK 21Shares Bitcoin ETF

ARK 21Shares Bitcoin ETF  Bitwise Bitcoin ETF

Bitwise Bitcoin ETF  iShares Bitcoin Have faith

iShares Bitcoin Have faith  Grayscale Bitcoin Have faith

Grayscale Bitcoin Have faith  VanEck Bitcoin Have faith

VanEck Bitcoin Have faith

Source credit : cryptoslate.com

CryptoQuant

CryptoQuant