Bitcoin ETF outflows hit $200 million ahead of FOMC meeting

Bitcoin ETF outflows hit $200 million sooner than FOMC meeting

Bitcoin ETF outflows hit $200 million sooner than FOMC meeting Bitcoin ETF outflows hit $200 million sooner than FOMC meeting

The most modern uncertainty out there might be being fueled by the impending Federal Birth Market Committee's (FOMC) resolution on cutting ardour charges.

Cowl art work/illustration by project of CryptoSlate. Characterize entails blended negate material that could consist of AI-generated negate material.

US characteristic Bitcoin substitute-traded funds (ETFs) skilled a second straight day of outflows for the second day this week after ending their 19-day influx budge on June 10.

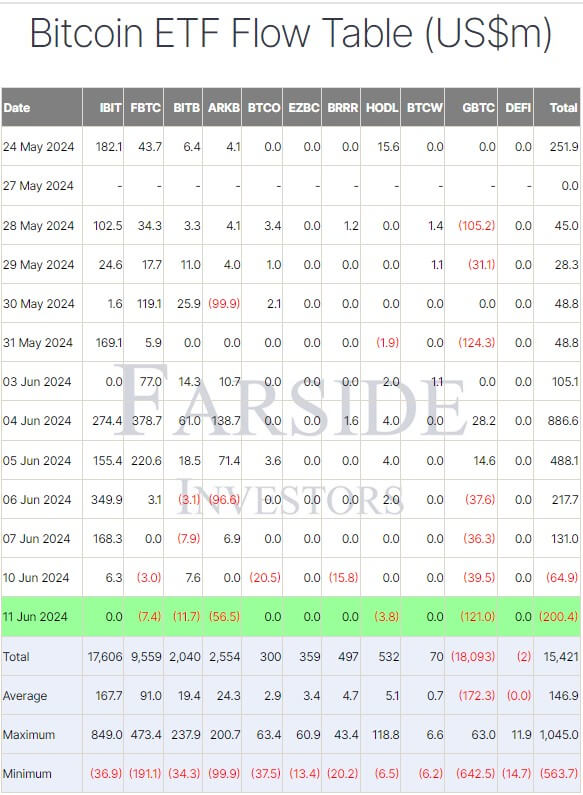

Data from Farside exhibits that on June 11, Bitcoin ETFs had cumulative outflows of $200 million, with withdrawals pushed by 5 issuers.

ETF outflows

Grayscale’s GBTC led the outflows with $121 million, elevating its total outflows to $18.03 billion. Ark Invest’s ARKB adopted with virtually about $57 million in glean outflows. Bitwise’s BITB reported approximately $12 million in outflows, while Fidelity and VanEck seen smaller glean outflows of $7.4 million and $3.8 million, respectively.

Despite these famous outflows, the funds comprise accumulated a total glean influx of $15.42 billion since their originate in January.

These mountainous outflows contributed to Bitcoin’s label descend to as low as $66,207 prior to now 24 hours. Crypto analyst Patrick Scott commented:

“Bitcoin ETFs are adding a brand original reflexive component to payment, where off-hours dumps translate to outflows on the next trading day.”

Bitcoin has since recovered to $67,449 as of press time.

FOMC forward

Market consultants imagine that BTC’s most contemporary label efficiency and the ETF outflows demonstrate customers’ caution sooner than the predominant Federal Birth Market Committee (FOMC) meeting.

Notably, three US lawmakersâSenators Elizabeth Warren, Jacky Rosen, and John Hickenlooperâcomprise urged the Federal Reserve to lower the federal funds payment from its two-decade excessive of 5.5%. They argued:

“This sustained interval of excessive ardour charges is already slowing the financial system and is failing to address the closing key drivers of inflation.”

Despite this, the market expects no substitute in ardour charges. Per the CME FedWatch Software program, 99.4% of customers predict the payment will cease at the most modern level of 525-550 bps.

Mentioned listed right here

Source credit : cryptoslate.com