Bitcoin could hit $200,000 without dollar collapse – Bitwise CIO

Bitcoin may perchance moreover hit $200,000 without dollar collapse â Bitwise CIO

Bitcoin may perchance moreover hit $200,000 without dollar collapse â Bitwise CIO Bitcoin may perchance moreover hit $200,000 without dollar collapse â Bitwise CIO

Bitwise CIO Matt Hougan believes that Bitcoin's doable rise to $200,000 hinges on twin forces, now now not a dollar collapse.

Conceal artwork/illustration by technique of CryptoSlate. Image involves blended lisp which may perchance moreover comprise AI-generated lisp.

Bitcoin’s (BTC) trace may perchance moreover surge to $200,000 without the need for a collapse of the US dollar, in step with Bitwise CIO Matt Hougan.

In his newest investor memo, Hougain urged that Bitcoin’s cost rests on two objective forces: its characteristic as a digital retailer of cost and inflationary pressures on fiat currencies.

Key forces driving Bitcoin

Hougan said that many analysts fail to see Bitcoin’s broader doable, customarily assuming its growth depends on a weakening dollar. In accordance with the Bitwise CIO:

“You fetch a considerably better look of Bitcoin. Even as you happen to separate these arguments.”

Hougan argued that the key driver is Bitcoin’s accumulate 22 situation as a digital equal to gold. Despite representing handiest 7% of gold’s estimated $18 trillion market, BTC’s market cap has the skill to grow greatly because it positive components acceptance among investors.

He celebrated:

“Bitcoin’s trace may perchance moreover rise despite the fact that it captured correct 25% of goldâs market pushing it successfully past $200,000.”

The 2nd pressure stems from the likely debasement of fiat currencies, particularly the dollar, which may perchance moreover pressure extra investors toward assets fancy Bitcoin as a hedge. With US federal debt at $36 trillion, Hougan sees increasing fiscal pressures prompting a important growth in the retailer-of-cost market, benefiting Bitcoin.

Beyond retailer of cost

Hougan emphasised that Bitcoin may perchance moreover expand in cost despite the fact that handiest one among these forces materializes. May perchance simply aloof Bitcoin’s fragment of the retailer-of-cost market grow, it may perchance perchance perchance moreover reach $214,000, objective of inflationary pressures.

Conversely, an expanded marketplace for replacement assets, driven by fiat concerns, may perchance moreover moreover push Bitcoin’s trace better. However, the splendid upside would happen if each forces converge.

Additionally, Hougan urged that Bitcoin’s utility may perchance moreover ultimately lengthen beyond its characteristic as a retailer of cost, doubtlessly becoming an global settlement layer. He believes broader applications may perchance moreover additional give a steal to Bitcoin’s cost, positioning it as a key player in the global financial ecosystem.

Hougan also cautioned investors referring to the hazards of procuring and selling in Bitcoin, emphasizing the volatility and regulatory concerns that require careful consideration.

Within the ruin, Hougan sees Bitcoin’s route to $200,000 as achievable if it continues to grow interior these twin drivers â without requiring a collapse of the US dollar.

Bitcoin Market Knowledge

On the time of press 6:26 pm UTC on Oct. 29, 2024, Bitcoin is ranked #1 by market cap and the cost is up 5.47% over the last 24 hours. Bitcoin has a market capitalization of $1.44 trillion with a 24-hour procuring and selling quantity of $55.82 billion. Learn extra about Bitcoin ›

Crypto Market Summary

On the time of press 6:26 pm UTC on Oct. 29, 2024, the total crypto market is valued at at $2.forty five trillion with a 24-hour quantity of $111.94 billion. Bitcoin dominance is presently at 58.86%. Learn extra referring to the crypto market ›

Mentioned in this article

Source credit : cryptoslate.com

Farside Investors

Farside Investors

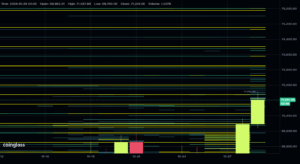

CoinGlass

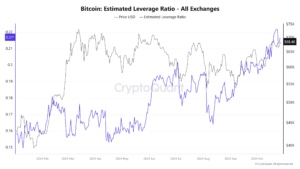

CoinGlass  CryptoQuant

CryptoQuant