Bitcoin compound inflation of 7% since 2020 canceled out by 900% gains while USD declines 20%

Bitcoin compound inflation of 7% since 2020 canceled out by 900% beneficial properties whereas USD declines 20%

Bitcoin compound inflation of 7% since 2020 canceled out by 900% beneficial properties whereas USD declines 20% Bitcoin compound inflation of 7% since 2020 canceled out by 900% beneficial properties whereas USD declines 20%

Bitcoin offset its meagre inflation with huge amplify whereas US DXY increased by upright 12% with compound inflation hitting 20%.

Quilt art work/illustration by CryptoSlate. Image entails mixed verbalize material that could perhaps perhaps additionally simply encompass AI-generated verbalize material.

Whereas Bitcoin is in total even handed a hedge in opposition to inflation, it does own a perfect inflation rate of 0.83%. Bitcoin’s inflation is extraordinarily low when put next to the buck’s peak of 9.1% in 2022. On the synthetic hand, when we study the cumulative inflation rate for both Bitcoin and the US buck, we behold the exact strength of Bitcoin’s position in keeping wealth.

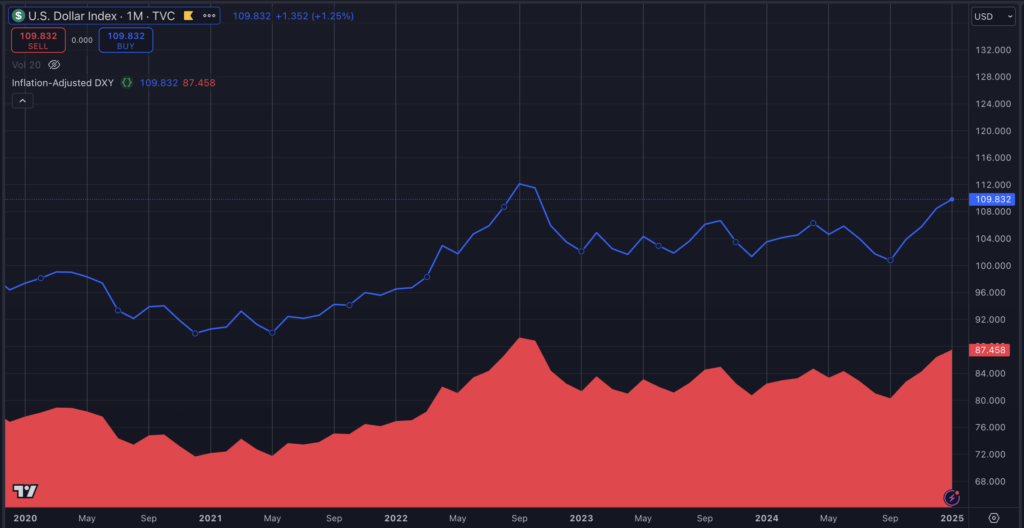

From 2020 to 2025, Bitcoin rose roughly 960%, whereas the US Buck Index (DXY), which measures the US buck in opposition to a basket of a form of currencies, rose upright 12% in nominal terms.

Bitcoin’s inflation-adjusted stamp and the DXY, normalized for inflation, present predominant insights into the real stamp dynamics of both resources. Whereas the nominal DXY reflects relative currency strength, its inflation-adjusted stamp highlights the ongoing erosion of procuring energy.

The nominal DXY on the 2d stands at 109.8, reflecting world inquire of for the buck amid macroeconomic uncertainty. On the synthetic hand, when adjusted for cumulative US inflation since 2020âaveraging over 2% yearly and peaking above 8% in 2022âthe real stamp of the DXY drops to 87.5. This represents a 22.3-level incompatibility, or roughly 20.3% of the nominal stamp, illustrating the buck’s worthy lack of procuring energy over time despite its relative strength in opposition to a form of currencies.

Bitcoin’s nominal stamp, meanwhile, is around $91,000. Adjusted for its low offer inflationâ1.74% yearly from 2020â2024 and 0.83% in 2025âits inflation-adjusted stamp stands at roughly $84,365. The $6,635 incompatibility represents perfect 7.3% of its nominal stamp, stressing Bitcoin’s relative stability and skill to shield procuring energy over time when put next to fiat currencies. This smaller adjustment highlights Bitcoin’s programmed scarcity and low inflation as key factors in its resilience.

The divergence between the inflation-adjusted metrics for the DXY and Bitcoin emphasizes a broader story. Whereas fiat currencies cherish the buck face predominant devaluation because of inflation, Bitcoin’s managed offer forces jam it as a hedge in opposition to currency debasement. The extra pronounced inflationary affect on the DXY emphasizes the danger of putting forward procuring energy in a fiat machine, particularly in the course of periods of high inflation.

The incompatibility between nominal and inflation-adjusted metrics is predominant for evaluating the long-timeframe stamp of resources. The DXY’s nominal strength masks the elementary erosion of the buck’s procuring energy, whereas Bitcoin’s inflation-adjusted stamp reflects its ability to place stamp over time. These insights toughen the importance of inflation-adjusted analyses in creating efficient strategies for navigating the macroeconomic panorama.

Extra, the inflation of comparability currencies worn to connect the DXY could perhaps perhaps additionally simply aloof even be even handed to title the right divergence. On the synthetic hand, the above figures give a ballpark assessment of Bitcoin’s elevated strength in opposition to the buck previous nominal terms.

Merely build, if you invested $100 in Bitcoin in 2020 and $100 in DXY this present day, your BTC would own a looking out for energy of $927, whereas your DXY could perhaps perhaps be the same to $91 in real terms.

Source credit : cryptoslate.com

CryptoQuant

CryptoQuant  Kaiko

Kaiko