Bitcoin channel predictions align with market movements over 6 months

Bitcoin channel predictions align with market movements over 6 months

Bitcoin channel predictions align with market movements over 6 months Bitcoin channel predictions align with market movements over 6 months

Analyzing Bitcoin's enhance at $49k and resistance at $61k the utilization of easy buying and selling channels.

Quilt artwork/illustration by strategy of CryptoSlate. Portray entails blended explain that could perhaps consist of AI-generated explain.

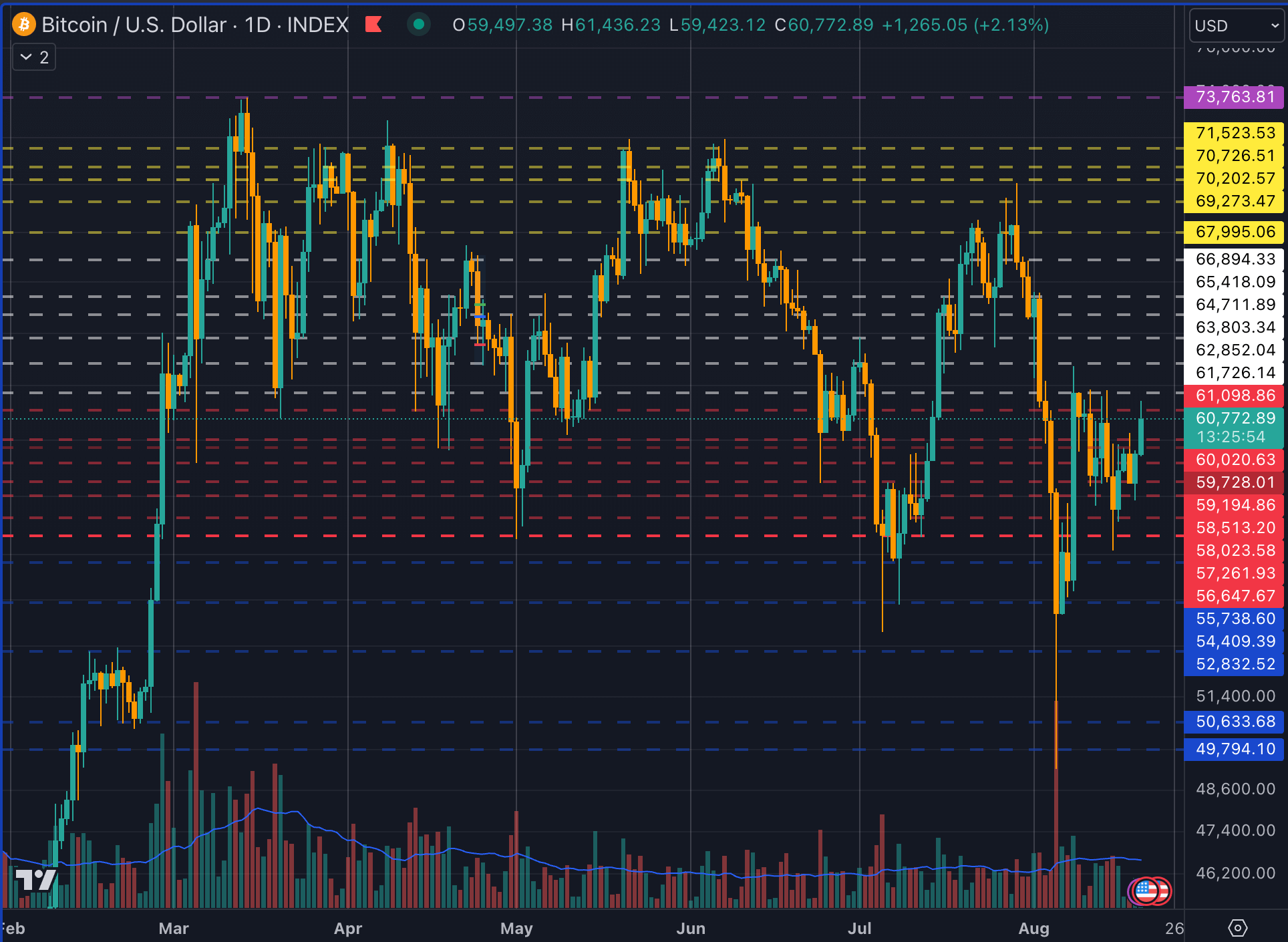

By intention of prognosis of Bitcoin futures leverage, space market picture books, and psychological buying and selling ranges, I created a converse of channels that hold proved surprisingly resilient correct through the last six months.

I’ve not day traded crypto since 2021, focusing instead on greenback rate averaging into Bitcoin daily. The elimination of the emotional side of buying and selling allowed me to condominium the details with out projecting my non-public emotions into trades and prognosis.

Taking a watch fully on the 30-minute rate chart for Bitcoin, I drew horizontal lines per repeating shut costs to establish the put merchants could perhaps well be searching for to pickle pause-losses. I then when put next these ranges to Coinglass’s liquidation ranges to be conscious which aligned with excessive leverage. Finally, I reviewed the Binance space market picture e book to study the put gargantuan aquire and sell orders had been positioned exterior the recent mid-rate.

Based on this seemingly simple prognosis, I created four channels correct through February and March to not predict the market but to establish the put lets question enhance and resistance. Over the previous six months, these channels hold matched local backside and tops a entire lot of conditions.

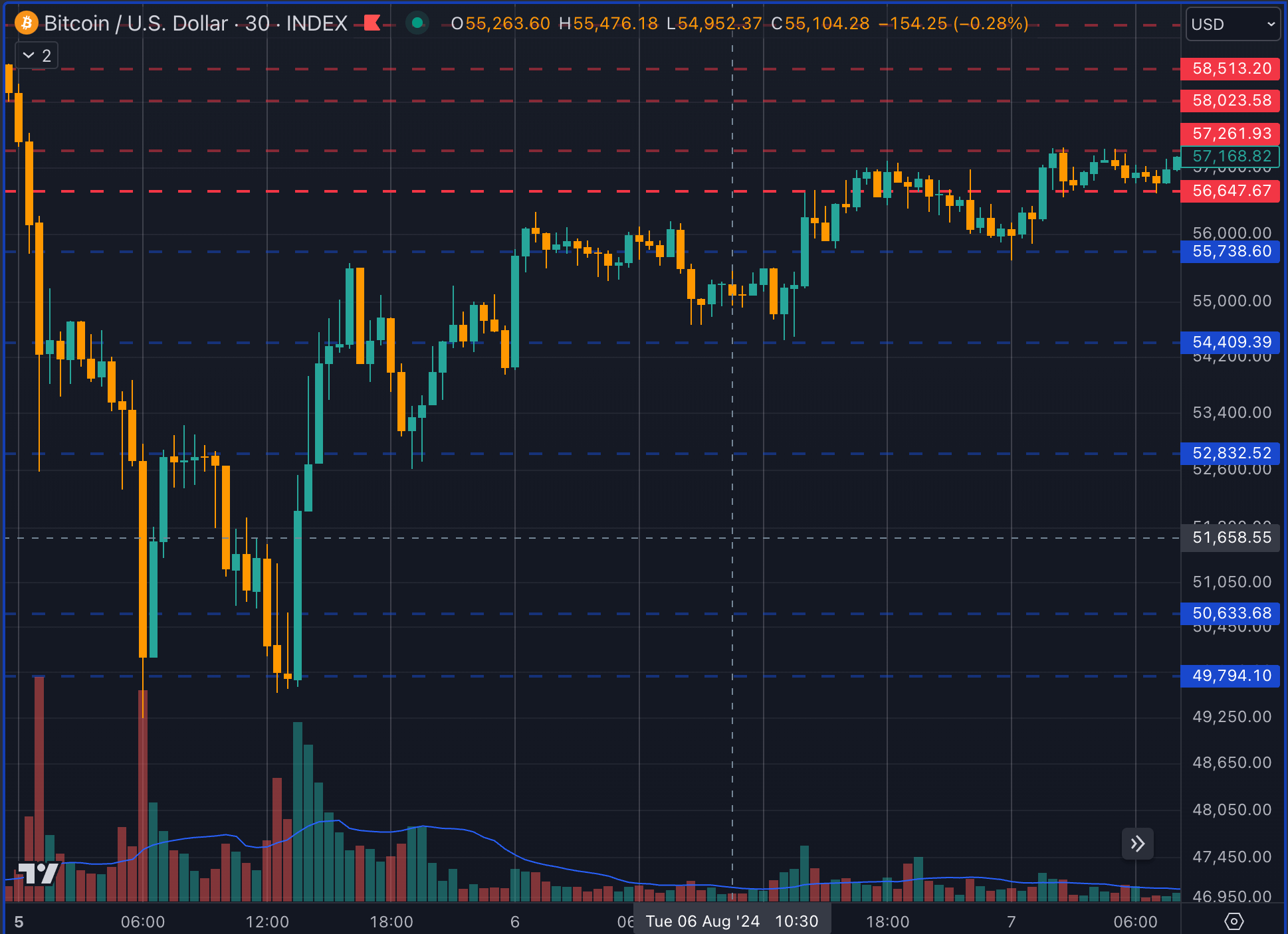

Further, Bitcoin’s drop to $49,000 lined up completely with the perfect line of my backside channel. I postulated that a fall below this rate would originate up recent decrease rate discovery, opening up the opportunity of recent decrease costs. However, Bitcoin bounced off the backside channel sooner than hitting resistance on the tip of the channel.

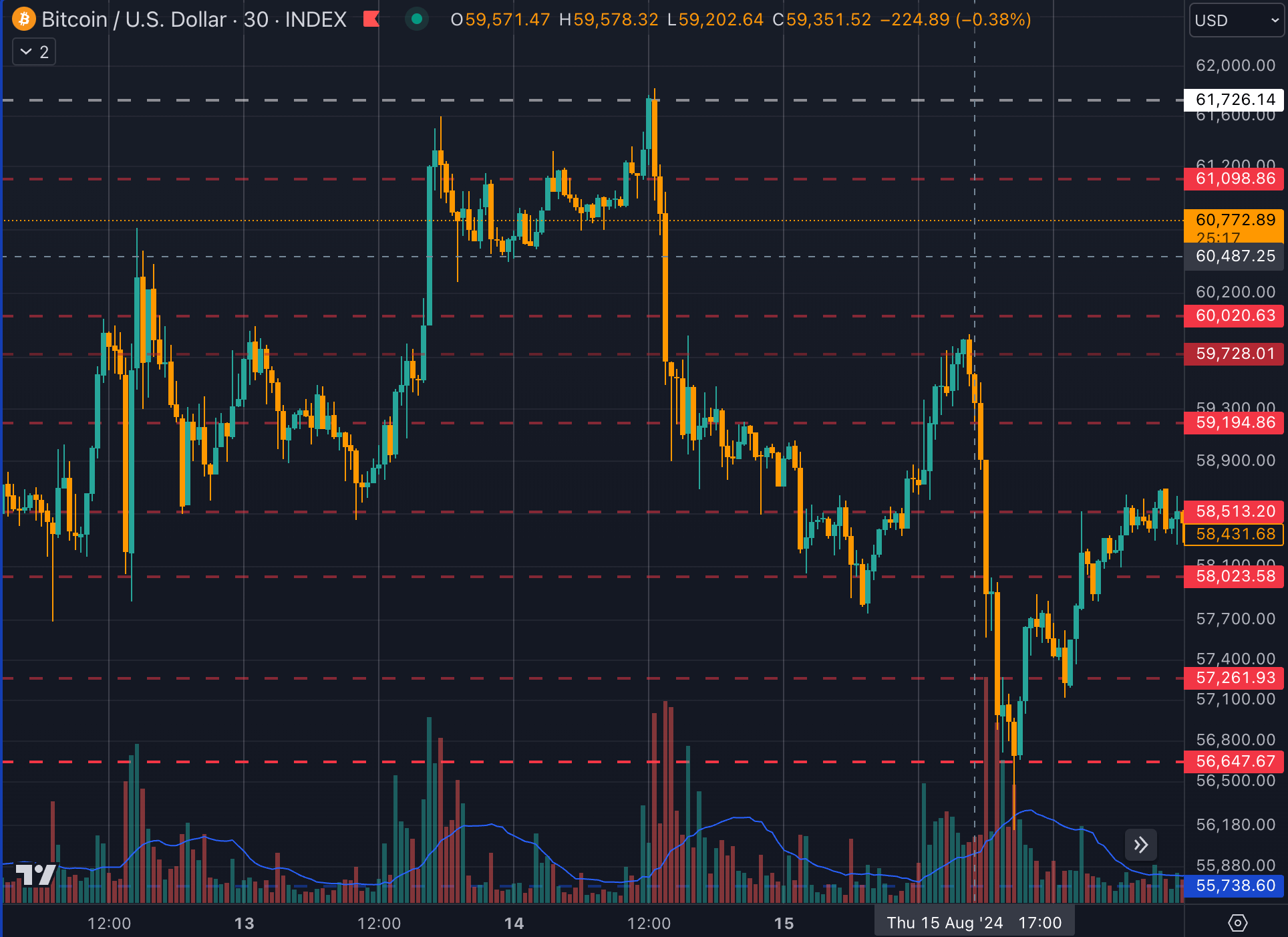

Between Aug. 12 and Aug. 16, Bitcoin bounced off the backside of the white channel sooner than falling to the backside of the crimson channel, the put it again stumbled on enhance.

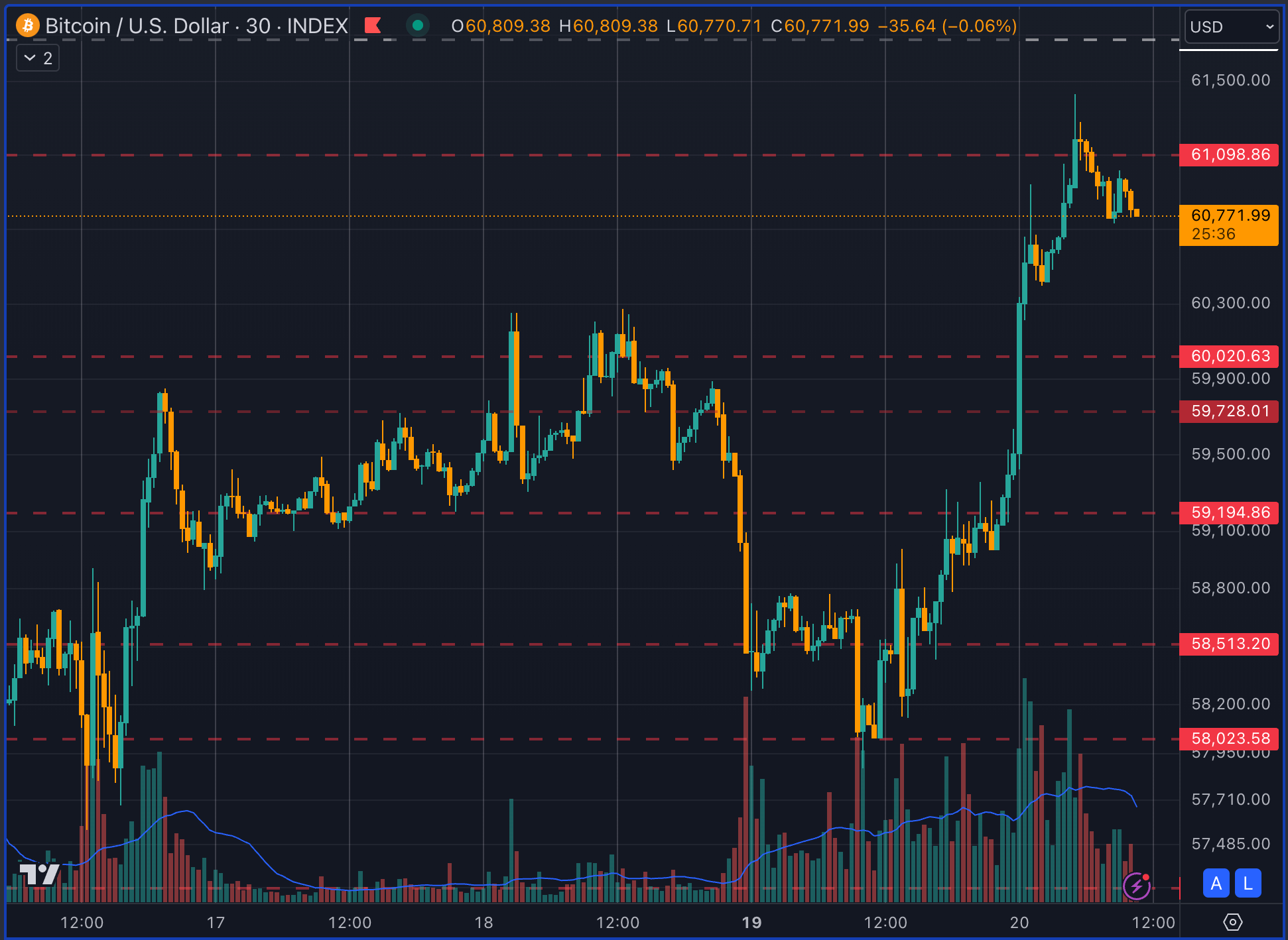

Currently, Bitcoin has confirmed strength, rebounding to the tip of the crimson pickle, which is the 2nd backside channel within the prognosis. Bitcoin unpleasant above the crimson, threatening to enter the white sooner than failing a retest of the tip of the channel at $61k, doubtlessly returning to the following stage at $60k.

Whereas I build not have faith in buying and selling the utilization of technical prognosis, many others build. Which means, I peep the rate in figuring out areas whereby other merchants will pickle orders to estimate the put to impeach market reversals. Finally, charting is barely a minor ingredient in determining Bitcoin rate alongside legislation, geopolitical events, the financial climate, social sentiment, and on-chain transactions.

I build not converse with a concept to foretell Bitcoin costs daily. However, these channels hold been highly influential in determining how mighty power Bitcoin desires to pass sure rate ranges, both up or down.

As an illustration, currently, sizeable Bitcoin FUD triggered by institutions transferring gargantuan amounts of Bitcoin on-chain will want appreciable social sentiment power to pull Bitcoin below $56.6k. Likewise, bullish sentiment triggered by cutting rates or increasing market liquidity would hold to be worthy to push through $66.8k to break into the tip yellow channel.

I post about this prognosis on the on-chain social media platform Lens Protocol, along with recent SlateCast episodes, on the official CryptoSlate tale. None of this prognosis ought to be regarded as non-public financial advice; as mentioned earlier, I build not trade off these ranges myself. I have faith in buying for Bitcoin frequently and repeatedly at regardless of rate it is on that day.

Bitcoin Market Recordsdata

At the time of press 12:21 pm UTC on Aug. 20, 2024, Bitcoin is ranked #1 by market cap and the rate is up 4.26% correct through the last 24 hours. Bitcoin has a market capitalization of $1.2 trillion with a 24-hour buying and selling volume of $27.95 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 12:21 pm UTC on Aug. 20, 2024, the total crypto market is valued at at $2.14 trillion with a 24-hour volume of $62.22 billion. Bitcoin dominance is currently at 56.02%. Learn more about the crypto market ›

Talked about on this article

Source credit : cryptoslate.com